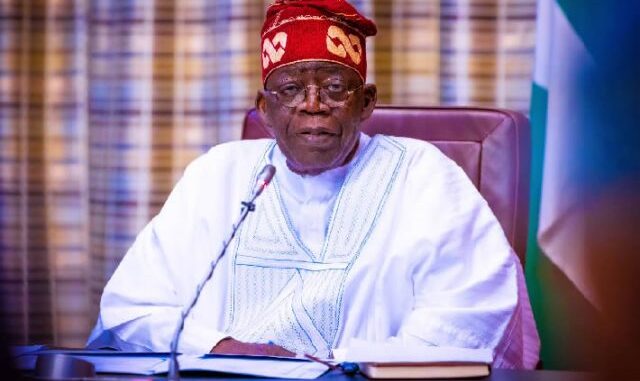

NIGERIANS have endured a month of rising adversity as President Bola Tinubu unleashed a barrage of shock measures. The naira crashed toover N800 to $1 midweek before settling to N775/$1 by weekend. Higher electricity tariffs are imminent; more multinational firms are heading for the exit door; inflation is reaching for the sky, and about 7.1 million more persons are forecast to plunge into extreme poverty. Beyond drastic decisions, Tinubu should adopt thorough planning, preparation, and fallback measures to avoid creating bigger problems than he set out to solve.

For an economy of over 200 million persons, 63.6 percent of whom are living in penury, Africa’s largest, disarticulated, often dysfunctional, driven largely by the informal sector, and built on weak, compromised institutions, drastic policies must be preceded by exhaustive planning. Additionally, there must be simultaneous programmes to raise state capacity, protect the most vulnerable, and manage the inevitable fallout.

Adopting wholesale, the standard prescriptions of the Bretton Woods institutions without poverty-preventing guardrails is imprudent. Rather, Tinubu and his economic team should adapt proven revitalisation programmes to the Nigerian reality and borrow from the ingenuity of the ‘Asian Tigers’ – South Korea, Taiwan, China, and Hong Kong – and from the BRICS – Brazil, Russia, India, China, and South Africa — club that emerged from relative underdevelopment with a mix of market-led, and robust state intervention and institution-building to become major global economic players.

You do not stumble into a productive, export-led economy; you plan and implement sustainable policies. The World Economic Forum says Nigeria can reverse poverty by investing in education, innovation, and technology and in health care. UK-based think tank, Overseas Development Institute, highlights the need to quickly industrialise through targeted infrastructure, skills development, agriculture, effective financial policies, and strong private sector partnership.

Hailed variously as “bold, courageous, and decisive,” by free-market economists, the World Bank/IMF, private sector operators and his supporters, Tinubu within three weeks in office, removed the petrol subsidy a month ahead of plan, floated the naira, proposed VAT on diesel oil, signed a student loans bill that coincided with higher fees in higher institutions, approved a new annual vehicle ownership fee, and endorsed a raise in telecommunications tax.

Superintended over for long by mediocre, uninformed presidents, Nigeria really needs bold measures and leaders that can muster the necessary political will to take tough decisions that can restructure the economy, stamp out pervasive corruption, plug leakages and oil theft, and initiate policies to stimulate production, investment, job-creation, and exports.

In all this, the well-being of Nigerians must be paramount. Policies, even necessary, long canvassed measures require planning against their repercussions. The World Bank that has for decades railed against the subsidy has now forecast the number of poor Nigerians to rise to 101 million soon on the back of the inflationary and poverty-inducing effects of its removal and the naira flotation.

It said an additional four million slid into poverty between January and May this year to join the 89.8 million poor Nigerians, and that another 7.1 million would soon be added to them unless the government compensated them or provided them with palliatives. This further upturns the falsehood promoted by the World Bank/IMF and their reflexive imitators who for years argued that subsidy did not benefit the poor.

Tinubu and his advisers should learn valuable lessons; never adopt policies based on inaccurate diagnosis. Yes, the subsidy regime was driven by industrial-scale fraud; but higher petrol prices affect the poor, driving many more into hunger and penury through inflation. Moreover, the subsidy arose from lack of domestic refining output. No government since 1999 has made any impactful attempt to solve that problem. The perpetrators of the fraud remain untouched. Second, prepare for the aftershocks.

Again, the multiple exchange rate system was grand larceny, facilitating arbitrage on a world record-setting scale and throwing businesses into disarray. In rightly overthrowing it, however, there have been no corresponding measures to strengthen institutional capacity by the weakened and compromised Central Bank of Nigeria and other regulators. The expected moderation of the exchange rate to a favourable rate by the free interplay of supply and demand may therefore prove elusive.The institutional capacity to rein in corruption, malpractices and manipulation is absent.

For an import-dependent country, the result combined with higher energy prices – of fuel, lubricants, and electricity – to fuel inflation, higher cost of doing business and further job losses.

Already, the Bank of America, one of the Big Four United States banks, reported that the naira had moved from being overvalued to being undervalued. Weakened by over 60 percent since its flotation mid-June, BoA said the naira was now 12 percent undervalued.

Within two days of the unification of the rates, the value of Nigeria’s debt also rose by N9 trillion to N81 trillion, said the Debt Management Office, while PwC, a leading consultancy, warns of a corresponding increase in debt servicing, which gulped N1.24 trillion January to March this year.

The Manufacturers Association of Nigeria said more multinationals would leave the country following an even higher electricity tariff announced by distribution companies (though held up by regulators). Its president, Francis Meshioye, said having cost producers N144 billion in 2022 to maintain alternative sources of energy, coupled with the bad roads, insecurity, and multiple taxes, more investors are set to leave.

Tinubu’s enthusiasm for bold decisions should be accompanied by well thought out policies. His “subsidy is gone” shock declaration at his inauguration without prior preparation excites supporters but running governance on such spur of the moment “possession,” as he put it, should not be the norm, especially for policies that have strong systemic impact on the economy and on poverty.

Having stopped subsidies, he should also summon the courage to immediately privatise the four state-owned refineries. Far much realistically, retaining them, their perpetual losses and frequent fraudulent turnaround maintenance enrich a few and impoverish Nigerians. Unlike petrol subsidy, these have no trickle-down benefit to the poor. They lost N1.64 trillion 2014 to 2019, N69.03 billion in 2020, and N104.3 billion February 2020 to February 2021. Losses to oil theft were $46.14 billion, with $10.7 billion lost annually to subsidy for 11 years.

He should also quickly and honestly privatise the Ajaokuta Steel Company and concession the airport and seaport operations to reputable global brands as core investors. The template of initiating policies that harm businesses and deepen poverty and thereafter start scrambling for “palliatives” is a scattershot approach. Successful emerging economies did not rise on palliatives, but through carefully planned and implemented growth-promoting policies.

Tinubu should move on the Nigerian National Petroleum Company Limited, dismantle its management, and drastically reform it if he is serious about revamping the economy beyond swallowing wholesale World Bank/IMF one-size-fits-all prescriptions. Developing countries reemphasised this at the recent climate conference in Paris, France. Heritage Foundation, a conservative US think tank, said their policies had become outdated and ineffective for developing economies, while the Council on Foreign Relations quoted economists who said the group’s ‘free-market fundamentalism’ was hurting rather than helping developing nations.

While competition and free markets remain valuable and desirable, development experts recommend adoption of home-grown adaptations to transform an economy. China achieved mankind’s greatest economic miracle and took 800 million persons out of poverty by adopting a mixture of free market and home-grown creativity. Taiwan and South Korea cherry-picked free market measures and took policies to groom and empower domestic entrepreneurship to transit to industrial and export giants.

Brazil’s Lula Ignacio Da Silva in his first presidential tenure 2003-2011 initiated novel poverty-reduction and rural empowerment programmes alongside the prescribed liberalisation policies and is credited with dragging 20 million Brazilians out of poverty. These successes were the result of deliberate policies, faithfully and honestly implemented, not “shooting from the hip” measures. Tinubu should also take that tested road.

END

Be the first to comment