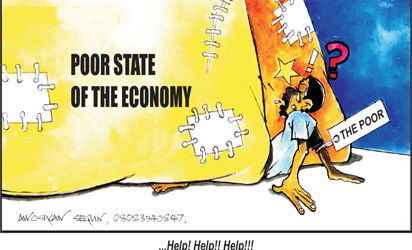

THE announcement last week by the National Bureau of Statistics (NBS) that the economy had slid into recession consequent upon negative growth in two consecutive quarters did not come as a surprise to many Nigerians. The handwriting had been clearly on the wall since last year that the economy was headed in that direction. The Central Bank of Nigeria’s Monetary Policy Committee had warned the nation since last year that unless drastic steps were taken, the economy would go into recession. Apparently, the warning went unheeded, so the CBN’S prophecy has found fulfillment. Recession, a slowdown in economic activities, comes with the attendant pains; contraction of the economy, closure of businesses, loss of jobs and a plunge in the quality of life of the people as a result of decline in revenue. But the current recession is a different one because it is accompanied by galloping inflation. The Consumer Price Index went up from 16.5 per cent in June to 17.1 per cent at the end of July, according to the NBS. The stagflation, as economists love to describe the current case, has pushed more people below the poverty line, increased deprivation in the country, and escalated agony in the land.

We are of the opinion that the Federal Government needs to brace up with a view to stemming the tide of recession so that it does not degenerate into depression. Depression is a sustained downturn in economic activities over a long period. Depression is more severe than recession and would foist more hardship on the people. So, it should not be contemplated at all. But to stave off depression, the government must shake off its lethargy and take decisive steps to bring the economy out of recession. At the root of the galloping inflation is the volatile foreign exchange. The inflation being experienced in the country is a cost-push one. Nigeria is an import-dependent country; therefore, the prices of most items are a reflection of the exchange rate of the local currency to the dollar.

For as long as the naira continues to be worsted by dollar at the foreign exchange market, the prices of imported commodities will continue to soar. The way out of this is for the government to bridge the gap between the interbank and parallel market rates. The over N100 gap between the two rates leaves room for a series of underhand dealings with the propensity for leaving the economy prostrate and the people poorer. However, bridging the gap will take the sail out of the wind of those who make a kill by engaging in round-tripping while buoying the interest of genuine business people in productive activities.

Economists are agreed that government should spend more during recession as an escape route. Doing this will swell the money in circulation and boost economic activities. We acknowledge that in the past few weeks, contractors have been mobilized to site and work has resumed on some projects, but these are just a tip of the iceberg. What is required is a massive release of money into circulation to stop the recession in its tracks. Allied to this is the need to pay outstanding workers’ salaries to enhance the purchasing powers of the populace and buoy manufacturing companies.

Twice this year, the CBN raised the interest rate, first to 12 per cent in March and 14 per cent in July, on the ground that it could not be lower than the inflation rate. Not unexpectedly, this has slowed down the interest of manufacturers in taking bank facilities. Given that the manufacturing sector is critical to the nation’s economic resurgence, the CBN should take a look at this policy. It is an economic fact that high interest rates discourage borrowing and without borrowing, manufacturing activities would suffer a lull.

Every government in the last 30 years has bellowed the need to diversify the economy but not much has been done over the years. This government has also not hidden its interest in the diversification of the economy, and is considering agriculture and mining as the vehicles for this. While some steps have been taken in this direction, what the government is doing is unlikely to deliver the desired result because its focus has been on exporting farm produce and raw minerals. But that is the mistake the country made with petroleum; exporting primary products does not make any country prosperous. So, rather than planning to diversify the economy through the exportation of farm produce and solid minerals, the government should challenge local manufacturing companies to go into processing of these, to create employment opportunities and ensure the inflow of foreign currencies.

The government also needs to cut down on the cost of governance. If the revenue accruing to the states has dwindled, it goes without saying that government expenditure on non-essentials ought to be scaled down. Having a convoy of 15 vehicles accompany a government official is not only a wrong deployment of scarce resources; it is also an unconscionable act capable of pitting the people against the government. Then, the government should communicate more. It is not enough to give assurances without providing data to back same. Keeping the people in the dark would alienate the government from the people. The government needs the cooperation and support of the populace to turn the economic tide, but what would guarantee this is a clear and honest communication about the reality of the situation and what the government is doing to steer the ship of the country out of the troubled waters.

END

Be the first to comment