Nigeria has had a history of “wonder banks” offering clients unbelievable returns on their money, and in the 1980s and 1990s, the government had banned such banks and closed their operations. Is it because MMM are foreigners that they were allowed to operate freely and even to regularly criticise government?

Some smart and fast thinking Nigerians invented 419 to swindle the rest of the world and today some Russian 419 experts have swindled three million Nigerians of billions of naira. Their scheme was devilishly simple; go for the poor, greedy and gullible Nigerians not aware that their company – Mavrodi Mondial Moneybox – MMM has been swindling millions all-over the world for three decades. They looked for and got millions of Nigerians who cannot Google – it takes about 30 seconds on Google to realize MMM is a fraud. According to Mr. Taiwo Kola-Ogunlade, Google’s Communications and Public Affairs Manager for Anglophone West Africa, search for MMM became the biggest traffic on Google following the Tuesday announcement, but by that time, the Ponzi scheme had collapsed in Nigeria, as it did in Zimbabwe and South Africa recently, and will remerge in another poor country soon where millions more would be swindled. Of course MMM has been actively reassuring its naïve believers that what has happened is a one month suspension of payments that will be revived in January but as everyone knows, they have raked in at least a five billion naira loot and most likely have moved on.

Three days ago, I had posted a story on the social media querying the Nigerian government for allowing so many millions of our compatriots to be swindled by a Ponzi scheme. I received a lot of responses criticising me for unfairly blaming the government. Imam Mora, for example, responded saying, “Sir, the Nigerian government through various financial agencies has come out repeatedly to warn Nigerians. I do not blame Govt, blame greed. ” Mma Odi was more colourful: “Na government send them? They warned them, they no hear, they even said that na God send the MMM to help in this recession Abeg make we move to more urgent matters.” Okay, I accept Nigerian authorities warned people to stay away from the racket and many refused to listen. All the same, my concern has been that since the authorities knew the scheme was fraudulent, why was it allowed to flourish all over the country for twelve months, leading to the swindling of three million people? I ask this because pyramid or Ponzi schemes always produce the same outcome of people losing their money without exception.

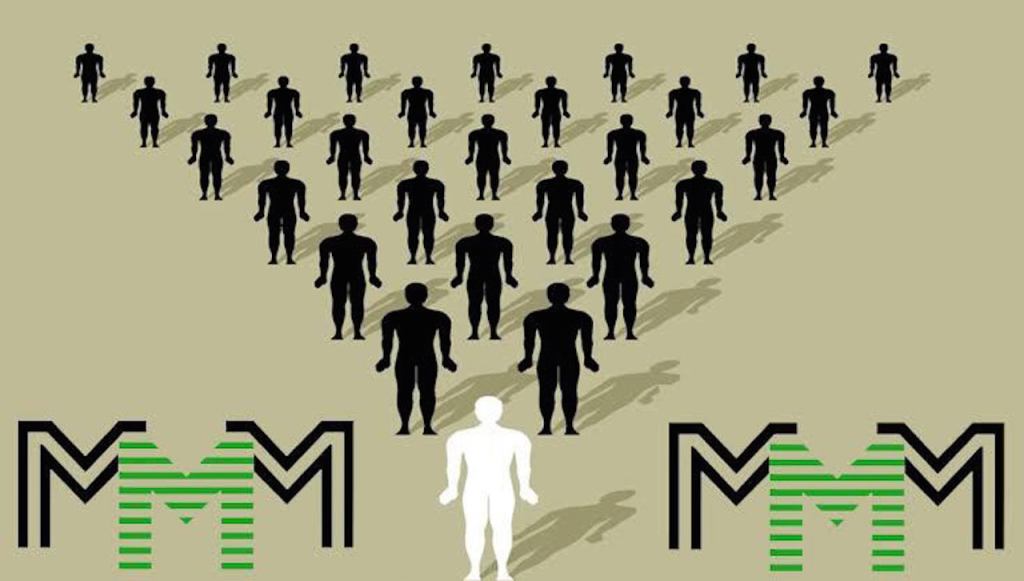

The MMM scheme in Nigeria is based on offering people 30 percent profit after a month of “investing”. They accept that the profit will not be generated by investing the money, the profit comes from the next person to join, so as always happens in such schemes the first persons to enter make their profit, and immediately the number of investors becomes large, the system collapses for the simple reason that the so-called profit is simply money taken up from the next group of persons to come into the system. In other words, it is a system that is guaranteed to fail and the only question is when it will happen.

What really infuriated me about MMM was the warning they issued to the Nigerian government that it would be the fault of their anti-MMM propaganda if the system collapses and millions of Nigerians lose their “investment”.

To camouflage the racket, MMM advertised itself not as a financial system but as “a community of ordinary people selflessly helping each other through mutual aid – you assist with 100 and you will be assisted with 130.” To convince the gullible, they even went on a tirade against bankers on their website: “The modern world is bad. It is inhumane, unfair and unjust. This is the world of money. It is not for people. It is for those who produce this money, for bankers and financiers, government and millionaires. And people are mere “pawns” in this game. They just serve them as attendants. Why do bankers work less and earn a hundred times more?” So although MMM claimed that they were not offering financial services, they very clearly presented themselves as an alternative system to the banks. The Russian multibillionaire even defined himself as part of the ordinary people: “The banker has power over money, and is well-connected. And we are ordinary people, having no power or clout.” It’s 419 at its best.

What really infuriated me about MMM was the warning they issued to the Nigerian government that it would be the fault of their anti-MMM propaganda if the system collapses and millions of Nigerians lose their “investment”. This serves the government right because it appears that the regulatory authorities warned people but did not act against MMM simply because they claimed they were not running a financial service. The government cannot or should not be that naïve. MMM was collecting and paying out money so it was obvious they were running financial services, even if they denied that was what they were doing.

The pain that their money is gone for good is sobering. These three million Nigerians need to demand from their government why no one stopped them from foolishly giving out their hard earned money, borrowed money, money from the sale of their cars and other asset to a gang of thieves.

Nigeria has had a history of “wonder banks” offering clients unbelievable returns on their money, and in the 1980s and 1990s, the government had banned such banks and closed their operations. Is it because MMM are foreigners that they were allowed to operate freely and even to regularly criticise government? In November, after warnings from the Central Bank of Nigeria and the NDIC that Nigerians should stay away from MMM, the response of the Ponzi scheme was interesting. They went to the Gwoza and Bama IDP Camps located in Durumi area and the New Kuchingoro in Abuja offering five million naira worth of relief materials to “distressed Nigerians”. Almost all the media in Nigeria covered the “humanitarian gesture” and the criticisms against the scheme were drowned by stories of how they were helping Nigerians, particularly the poor.

The announcement by the MMM that Nigerians would not get their pay-outs to celebrate the Christmas and New Year festivities is a big blow to many and I sympathise with them. The pain that their money is gone for good is sobering. These three million Nigerians need to demand from their government why no one stopped them from foolishly giving out their hard earned money, borrowed money, money from the sale of their cars and other asset to a gang of thieves.

A professor of Political Science and development consultant/expert, Jibrin Ibrahim is a Senior Fellow of the Centre for Democracy and Development, and Chair of the Editorial Board of PREMIUM TIMES.

END

Be the first to comment