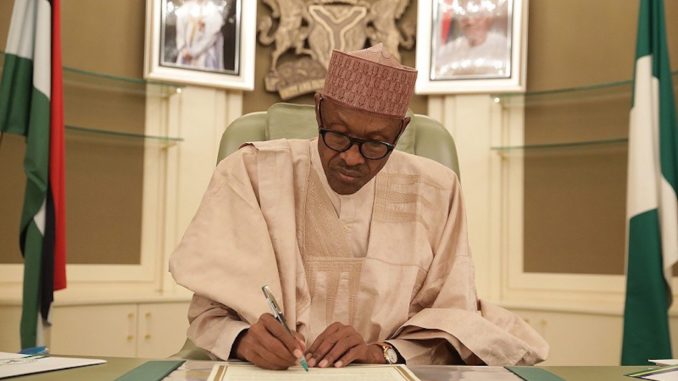

The 2019 Appropriation Bill of N8.83 trillion recently presented to the joint session of the National Assembly by Nigeria’s President Muhammadu Buhari gives various causes for concern and should be urgently adjusted if the country’s economy is to experience resurgence. Indeed, failing to act swiftly by managers of the economy may spell doom in the form of a recession or stagflation.

The first red flag and cause for concern are the benchmarks upon which the budget is predicated namely, oil price, oil production, exchange rate and rate of inflation. The first two, benchmarks, namely oil price and oil production directly affect the revenue projection of the budget. The budget presupposes oil price of $60 per barrel but oil price in the international market has fallen below $50 thus putting the budget immediately at risk. The practice is to fix the benchmark at $10 below the real market price to forestall the now too familiar swings in the oil market. So the realistic budget price, if things stay the way they are, should be $40.

Adding to the dire situation is that the budget is hinged on production of 2.3 million barrels per day. This projection has been punctured by a reduction of Nigeria’s oil quota to 1.6 million barrels by the Organisation of Petroleum Exporting Countries (OPEC). Together, falling oil price and a reduced oil quota indicate that government’s revenue projection is unrealistic, will fall far short of expectations and needs to be reviewed.

The situation will worsen with government’s stance on excise duties. In an attempt to raise revenue, government is going to levy higher excise duties on export goods. This will be counterproductive and lead to less and less of Nigerian manufactured goods been exported. That, once again, means less dollars coming in. It will only widen the balance of payments deficit suffered in the last quarter. It is the most inauspicious time for such a policy; rather government should lighten the burden on exporters and ensure the treasury is lined with enough dollars by their activities. It should rather be working on improving quality control and the business environment.

A challenged revenue situation will have an immediate impact on the forex reserve. It is from the forex reserves that the Central Bank of Nigeria (CBN) defends the naira from speculative bids from investors who think the naira is overvalued. The CBN’s ability to defend the naira will be severely limited if not hampered by slowing, if not deteriorating reserves. This likely dip in reserves and therefore CBN’s fighting power are what calls into question, the benchmark exchange rate of N305 that the CBN has been able to achieve for the greater part of two budget cycles. The success of achieving a stable exchange rate regime was due to favourable oil price and oil production.

The likely lower revenue stream will also impact negatively on government spending including on proposed capital and recurrent expenditures. On the capital expenditure side, government’s planned spending on roads, rail, health, power and housing is likely to be severely limited should the revenues projected not roll in. For example, it is projected that government will put in N80.22 billion Counterpart funding for Railway projects; N280.44 billion for works “for the construction and rehabilitation of roads in every geo-political zone of the country”; over N87 billion for health; and about N56 billion in agriculture among others.

On the recurrent side, government may have problems meeting up with hyped interventions, the biggest of which is minimum wage. Failure to fulfil promises in this regard may heat up the polity with labour already fuming from Government’s dillydally on the issue. Many states have expressed their inability to meet up with an increased wage bill occasioned by the new minimum wage. The situation is likely to be exacerbated with a revenue profile not consistent with government’s projections in 2019.

Once revenue generation is challenged in an economy where government is the biggest spender, it will be impossible for the economy to see the kind of growth projected in the 2019 budget. 3.01 percent is nothing short of ambitious given the tailwinds ahead. An economy described as weak after emerging from a five quarter recession will require something special to accelerate at double its present state of 1.8 percent in a little over four quarters from now. It is all the more unlikely from an economy that will spend heavily on an election that is not only unproductive in economic terms but is likely to lead to push up inflation further from the current 11.8 percent, thus making laughable government’s 9.9 percent expectations.

Our message to government is that it is good to be ambitious but this must be moderated by prevailing conditions and it is on this note that we will advise that the 2019 budget is overly unrealistic and may need to be tinkered further in line with present realities.

END

Be the first to comment