With sanctions lifted, Tehran is entering an already-glutted market as it plans to produce 500,000 barrels per day.

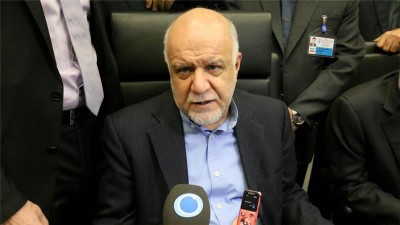

Iran’s Oil Minister Bijan Zangeneh says the country is ready to negotiate with Saudi Arabia and other OPEC members over the current dire conditions in international oil markets.

Tehran recently resumed oil exports after Western sanctions over its nuclear programme were lifted, and announced it plans to produce 500,000 barrels per day. The move will add significant pressure on an already oversupplied market, as OPEC continues to refuse to cut its production.

Inside Story – The cost of Iranian oil

“We support any form of dialogue and cooperation with OPEC member states, including Saudi Arabia,” Zangeneh told reporters.

The Iranian oil minister said in early January that certain countries’ insistence on overproduction was politically motivated.

“If there were a strong political will, the price of oil would have been balanced within one single week,” Islamic Republic News Agency (IRNA) quoted him as saying.

“None of the oil producers is happy with the existing prices, which will harm suppliers in the long term.”

Zangeneh added Iran needs as much as $200bn in investments to revamp its oil industry.

The global oil sector has taken a beating since the summer of 2014, losing about 70 percent of its value. OPEC countries have refused to budge on the flooded market, keeping in place a 30 million barrel per day production ceiling.

Meanwhile, oil prices rebounded on bargain-buying in Asia on Wednesday after the previous day’s plunge, but analysts warned any gains would be limited as the global glut that has hammered markets showed no sign of letting up.

Crude prices have crashed from above $100 per barrel in July 2014 to under $30 after being hit by a perfect storm of overproduction, oversupply, weak demand, and a slowdown in the global economy, particularly key consumer China.

A report by the Kuwait Financial Centre released on Tuesday said the oil-rich states of the Gulf Cooperation Council (GCC) are expected to see their public debts double and their assets decline by one-third by 2020 as they seek to finance budget deficits.

The report noted GCC countries face a combined $159bn deficit in 2016. In contrast, the GCC posted a combined surplus of $220bn in 2012.

END

Be the first to comment