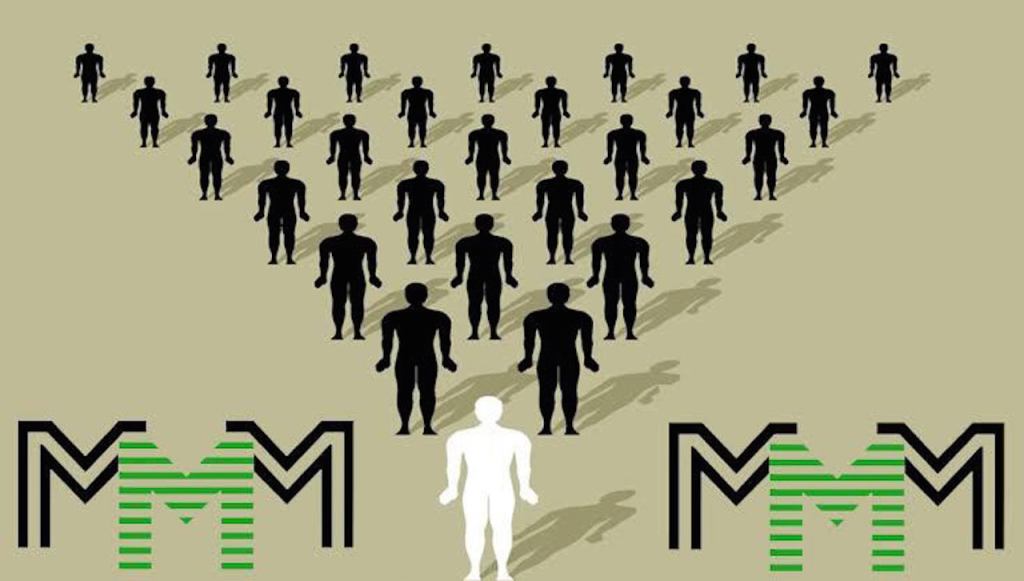

LIKE all things us, the collapse of MMM (a Russian ponzi scheme established in 1989 by Sergei Mavrodi, his brother Vyacheslav Mavrodi, and Olga Melnikova), four years ago, afforded many of us the opportunity to gloat, to remind the “victims” that, “I told you”. The name of the company was taken from the first letters of the three founders’ surnames.

More worrying is that new schemes have overtaken MMM’s. people are falling into the new traps that they set using the social media platforms. Since money transfer can be done by phone, the schemes are prospering under the anonymity of no physical locations. All transactions are faceless.

They have simple messages that they were helping Nigerians to weather the storms of COVID-19. They made a kill with the message. People locked down without access to new incomes lapped up the offers. They lost millions of Naira.

One called Wazobia operated much like MMM. It was quicker though. Payments were made every three days. All transactions were by telephone. After three payments, they cut off contacts the depositor whose greed would have enticed into making higher deposits to earn more.

Wisdom seems to rest with those who did not fall into the temptation of reaping the easy money MMM promised. It was enticing, almost more alluring than any temptation.

Four years after the ponzi scheme predictably died, hundreds, possibly thousands of the same scheme have sprouted to fill the vacuum the collapse of MMM created. They have learnt from MMM to be more deceptive, more decisive, more desperate.

The payment schedules are supposedly shorter. Double returns on investments are made in an hour! Credit alerts of supposed recipients are posted as confirmation that they work.

Yet those making the proposal, and the recipients who celebrate the quick return on their investments are the same people. One person using different telephone numbers can type out the bank credit alerts for different banks under different names.

People are still joining schemes where they would make money for doing nothing other than putting some money into a group that makes no sense; the more anyone tries to explain it. MMM proudly proposed that it made nothing, sold nothing, except promises it finally failed to keep. The new ones are not much different.

Groups on the social media have become the latest hunting grounds. WhatsApp groups, Facebook accounts, supposed Zoom meetings are new opportunities for fraudsters to swindle people. Once they hack an account, they make their proposal using names and telephone numbers of prominent group members.

MMM claimed it shut down operations in December 2016 because of the anticipated high withdrawals from the scheme. It never came back in the original form. MMM and such schemes make no sense. Whether the contributions were small, N5, 000, for instance, or big sums like N5 million, what both contributions had in common was that they dug holes that could not be filled, even if 180 million Nigerians joined MMM. Each new entrant created more irredeemable debt for the scheme.

If N5, 000 earned just an interest of 30 per cent in a month, MMM had to find N1, 500 to pay as interest, if we leave the bonuses, and “down the lines”. The N5 million contributor similarly entrapped MMM in a debt of N1.5 million, all these monthly. More contributors (helpers, as they dubbed themselves) meant more debts for MMM. It was doomed to crash, and it did.

Exploitation of people’s greed is central to the success of the schemes.

My concerns are not about the motives of MMM founders. Their history could tell a lot about them. I am very worried about how Nigerians survive these losses, particularly with the burdens of COVID-19.

We would be challenged with another wave of anxiety, tension, poverty, grief, hopelessness spread across millions of people. The multiplier effect appears to be under rated. MMM’s collapse in Nigeria reportedly affected over three million people.

The victims of MMM and similar schemes include all of us who pay more bills for relations who their disasters hit. We may never know that they participated in the scheme. If we knew, we would still have paid the bills.

Money stuck in MMM belongs to individuals, organisations, businesses, and small holders, who could have starved to put money in MMM. Many of them have not heard the news. We can say their reaction is still not part of the story.

Men (and women) who invested have their stories of successes, some of them possibly made up to justify their involvement, and as in other failed schemes, some made their investments only hours before the public knew MMM had collapsed.

Miasma of schemes of MMM kind persists. Why do people still patronise them? Do they see the mist? Do they recognise a balloon that keeps being inflated would burst? Do they expect a pyramid that stands on its tip to survive when it is not a news-writing model?

Let us, with our deep social tangles, networks, assist people to wean themselves of the impulse to follow easy money. MMM is still happening, under different names, different promises, all juicier than what the crashed scheme offered.

Government owes us the responsibility of punishing fraudsters of all shades. The promoters of such schemes have mostly gone unpunished. Government can do more than saying it warned the victims.

Regulatory authorities should punish slacks in operations of telecommunications companies that still permit use of unregistered telephone numbers. The fraudsters exploit them.

People were behind MMM. They can be found. They should be tried for fraud. We should legislate against MMMs with penalties against promoters as well as investors.

Postscript

The indifference of regulatory authorities remains astounding, four years after some known faces spread messages that led millions of Nigerians to lose their money to MMM. That the authorities knew enough to punish the organisers of the scheme is obvious. That they have done nothing is one of many reasons that have sustained the scheme under other names. After the death of the founder of MMM in August 2018, MMM announced the cessation of its operations – the truth is that it resurrected in other names.

Please share. Your comments, complaints, concerns, and commendations are welcome.

View pictures in App save up to 80% data.View pictures in App save up to 80% data.View pictures in App save up to 80% data.

END

Uncle Jimi, it’s unfortunate that MMM has resurrected with different nomenclatures. Very,very unfortunate!