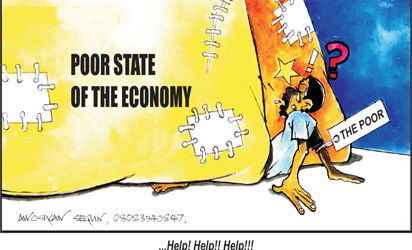

The CBN’s decision to float the Naira in response to dollar demand and supply, in such austere times, will probably be primarily remembered as another policy shift that breached the gates and unleashed devastating floods that swept away any flickering hope of economic diversification or credible inclusive growth. The serial devaluations dictated by the 1985 Structural Adjustment Programme (SAP) was another such event that disenabled our economy, traumatised our people and challenged our traditional value system in many ways.

It is undeniable that with SAP, Nigeria’s erstwhile, vibrant industrial landscape soon became eclipsed by the rapid closure of bustling industrial estates, as sharp increases in the cost of vital machinery/raw materials and the prevailing high cost of funds pushed investors to the brink.

Ultimately the carcasses of their factories were, eventually inherited years later, by Faith establishments who were conversely witnessing rapid expansion in followership, probably, because of overwhelming economic and social challenges. Sadly, the fervent prayers from these Houses of worship have obviously not been directed to bringing about a positive turn around in our economy.

Curiously, however, the IMF and reputable international and local experts had actually encouraged the belief that our economy will be enriched if we embraced SAP! Regrettably, thirty years later, we seem to have come full cycle, and the same IMF and acclaimed financial powerhouses have again commended our government for swallowing the bitter pill of 50% Naira devaluation which they again claim as the path to economic recovery. Ironically, President Buhari who stoutly resisted devaluation between 1983-1985, and later also made Naira exchange rate parity, a campaign promise in 2015, has unexpectedly capitulated to the odious demand for more Naira devaluation, despite the contrary historical evidence of the unfulfilled expectations for a benevolent impact of this policy. President Buhari’s volte face is intriguing, particularly after his public admission that his Economic experts always talked above his head and never truly convinced him that devaluation would bring any favors to our economy.

In retrospect, our social values became misaligned with implementation of SAP, as all income values were grossly eroded, and the dignity of pension earners also became seriously abused, while thousands of professionals took flight abroad to greener pastures. Regrettably, the ensuing brain drain still subsists and has certainly deprived us of homebred enriched human capital. Invariably, thousands more Nigerian youths will still be propelled to join the desert caravan to North Africa en route Europe, choralled in suicidal bath tubs, as job opportunities, which offer reasonable living wages remain in short supply, because of the devastating impact of the present 50% Naira devaluation on industries and businesses.

Indeed, the only immediate apparent advantage of the present devaluation, is the “vanishing” advantage (because of spiraling inflation) of increasing government revenue, from the extra N100 that will now be printed for each additional dollar earned from crude oil sale. Thus, the expected revenue shortfall from prevailing lower crude prices, will be significantly compensated by the 50% Naira increase for each dollar exchanged as allocation to the tiers of government. In effect, this cash bounty should significantly reduce or indeed eliminate the over N2Tn 2016 budget deficit.

However, the additional cash bounty may still not discourage government from processing and spending the N900bn domestic loan already budgeted, to partly fund the initially projected deficit budget; in other words, the subsequent revenue excess created by devaluation may still be shared amongst the tiers of government in addition to the proceeds from loans without enacting a fresh supplementary Appropriation bill to account for this expenditure. Indeed, such fiscal rascality has prevailed since our return to civil rule, when revenue expectations were generally deliberately understated, with inappropriately low crude oil price benchmarks to contrive budget deficits, which were subsequently approved as public debt with suspiciously high double digit interest rates, which are clearly inappropriate for such sovereign loans.

Indeed, if more realistic crude benchmarks had predicated the same budgets, these oppressive additional government loans would be happily avoided; furthermore, the fiscal irresponsibility is, instead further magnified by regular additional disbursements, usually without appropriate prior legislative endorsement, from the excess revenue consolidated from actual higher than budget benchmark oil price. Hereafter, we will assess the direct impact of the present 50% Naira devaluation on critical factors such as inflation, productivity and the lack of public confidence in holding the Naira as a store of value. Ironically, the fiscal cash excess from naira devaluation, ultimately provides little succor for the economy as it primarily succeeds in further fueling inflation to reduce the purchasing power of all income earners.

Evidently, since local industries are still also largely dependent on raw material imports, all import bills will invariably also rise by about 50% if Naira exchanges for N300=$ as speculated. Thus, an already disenabling production cost burden, is unfortunately further compounded with 50% additional increase in the prices of diesel and gas required to power their plants. Furthermore, with almost 20% inflation rate and much higher production cost, the bloated working capital, consequently required to sustain businesses will invariably also attract over 20% interest rates to make Nigerian industries’ output uncompetitive against import substitutes.

Furthermore, agitations for wage increase will also become inevitable and strident to further challenge businesses survival. The predictable outcome would be serial retrenchments and business closures, with serious implications for our economic and social security, while Faith organizations may again become beneficiaries of increasingly vacant factory/warehouse spaces.

Nonetheless, retirement will also become a nightmare for wage earners whose pension contributions, have already depreciated by more than 50% through Naira devaluation and persistent annual inflation rates which may rise well beyond the current 16%, especially if petrol price rises to N300/litre and electricity tariff also spikes by over 50%, because of this devaluation. Furthermore, investment values in the stock market have also depreciated from over $45bn when the Naira was N200=$ to less than $25bn with N300=$ as exchange rate.

Indeed, the value of your houses and all Naira denominated assets, including the cash in your pocket and savings accounts have all now lost up to 50% of their dollar purchasing values while payment for outstanding import bills, and dollar denominated loans may send these debtors to an early grave. Frankly speaking our collective net worth and value of all Naira denominated assets have now been cut in half, with a stroke of the pen, but it is very unlikely that the speculated inflow of foreign exchange, as a result of this devaluation will ever approach $20b. However, since the CBN’s devaluation project denies the role of systemic Naira surplus as the prime cause of Naira devaluation, rather than dollar demand and supply, further Naira devaluation will become inevitable.

END

Henry Boyo,

Please do not tweek facts. I would have Thought you would profer alternatives. Basically, current 16% inflation has already built in the average 360/$ hence any possible reduction in average rates would most likely stem inflation downwards.

With the current government’s frugal fiscal responsibility drive one can only expect that the waste in the system would be reduced and hence debt servicing should be better managed.

God bless and help our beloved country, Nigeria!!!