From our earlier two publications on this topic, IFRIC 12 describes the accounting treatment of concession contract arrangements which until the 1st of January 2008 did not possess clear and simple guidelines for booking due to the many differences in the Public Private Partnership (PPP) project’s concession arrangement. The IFRIC came as a response to the plurality of practice found within the treatment of concession arrangements and focuses on Build-Operate-Transfer type arrangements and Rehabilitate-Operate-Transfer type arrangements.

An arrangement is within the scope of IFRIC 12 if the grantor controls what services are provided using the infrastructure. An arrangement also falls within the scope of the IFRIC 12 if the grantor controls any significant residual interest in the infrastructure at the end of the concession period. According to IFRIC 12:AG6, situations in which the grantor controls the asset for the whole of its economic life are within the scope of IFRIC 12. Another feature of IFRIC 12 is a situation where the grantor determines services the operator must provide with the infrastructure, to whom it must provide them, and at what price. For the purposes of IFRIC 12:5(a), in general, the grantor’s power to impose a price cap means that the grantor ‘controls or regulates’ the price at which services are delivered, provided that the capping mechanism is not considered to be non-substantive.

A financial asset is recognised to the extent that an operator has an unconditional right to receive cash irrespective of the usage of the infrastructure, while the intangible asset is recognised to the extent that the operator has a right to charge for the usage of the infrastructure.

When a service concession arrangement involves an-operate only arrangement, IFRIC 12 does not deal specifically with situations in which a service concession arrangement consists only of an operation phase. However, in the absence of specific guidance in IFRIC 12, it is necessary to apply the requirements of other relevant IFRS Standards, in particular IFRS 15 Revenue from contract with customers and IAS 37 Provisions, Contingent asset and Contingent liabilities. Because no construction services have been supplied by the operator, it will generally not be appropriate to recognise a financial asset or an intangible asset at the outset of the contract. However, if the operator pays the grantor to acquire a license to charge users for a public service, the operator should recognise an intangible asset at cost, including the present value of all future fixed payments to be made by the operator to the grantor, in accordance with IAS 38.

Typically, the operator in a service concession arrangement receives consideration from the grantor, the accounting for which is addressed by IFRIC 12:15 to 20. However, payments are made to the grantor by the operator, the operator should determine whether the payment is separate from the construction or upgrade of infrastructure within the scope of IFRIC 12. Because the infrastructure in a service concession arrangement is considered the grantor’s asset, any payment to the grantor as part of the construction or upgrade services is considered a payment to a customer. If the operator pays the grantor periodic payments that cannot be separated from the concession arrangement then such arrangement falls within the scope of IFRIC 12.

Finally, a typical private-to-private arrangement may include an operator subleasing its right to a third party. IFRIC 12 does not include within its scope private-to-private arrangements but it could be applied to such arrangements by analogy under the hierarchy set out in paragraphs 7 to 12 of IAS 8 . Given that the operator only has a right to access and not a right to control the use of the infrastructure, judgment is therefore required in order to assess whether such an arrangement contains a lease in accordance with IFRS 16 or should be accounted in accordance with IFRS 15 revenue from contracts with customers with regards to the contractual arrangement amongst the grantor, operator and the lessee. While taking into consideration the requirements set out in paragraphs 7–12 of IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors.

IFRIC 12 and IFRS 16; do they address the same concept?

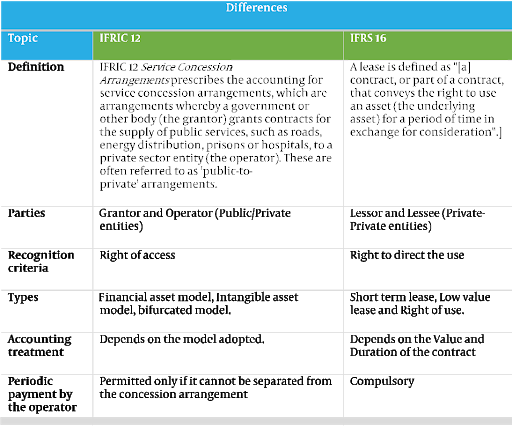

While IFRIC 12 is the interpretation with regards to Service Concession; IFRS 16 is the standard that provides guidance on the treatment of leases.

It can be said that both IFRIC 12 and IFRS 16 share some similarities, so much that if not properly assessed one may erroneously recognise a service concession arrangement as a lease in its financial statement. While both arrangement share some similar characteristics (e.g. arrangement is governed by a contract, lease term, periodic payment) there are still some key differences between IFRIC 12 and IFRS 16, below are some of those differences:

Reference

iGAAP 2020 Deloitte Accounting Research Tool (DART)

IASPLUS.com

This article was reviewed by Dr. Oduware Uwadiae FCA

END

Be the first to comment