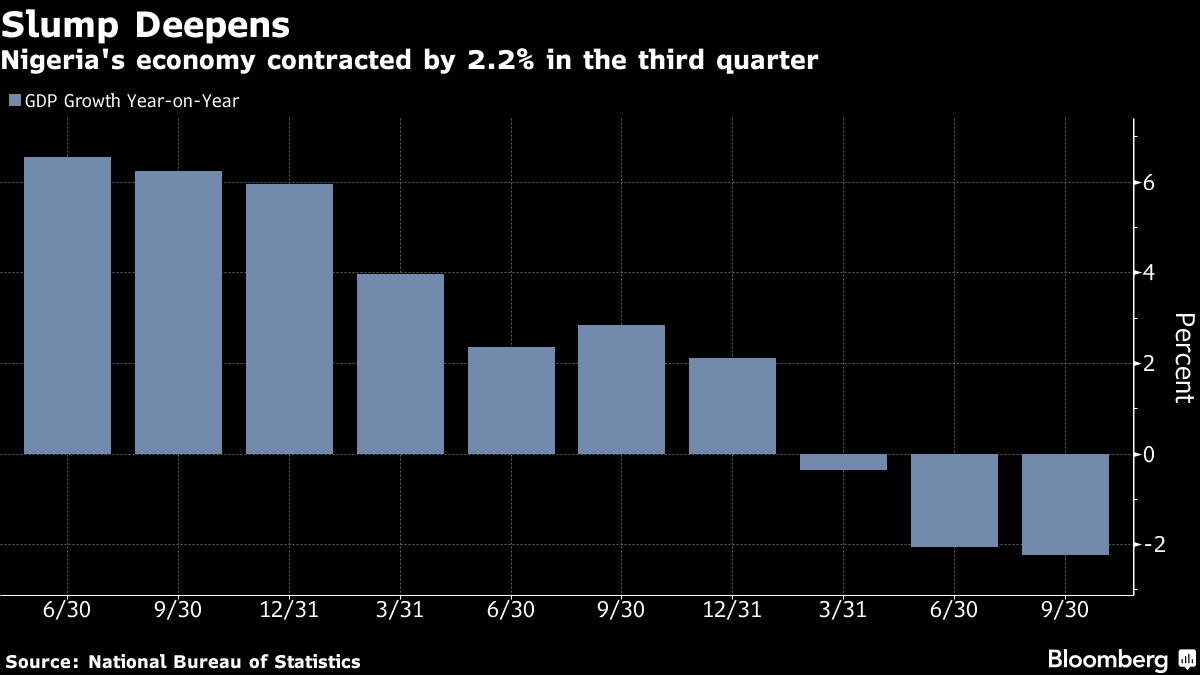

Nigeria’s economic slump deepened in the third quarter as oil production continued to fall and factory output was hit by a shortage of dollars.

Gross domestic product in Africa’s most populous country contracted 2.2 percent in the three months through September from a year earlier, after shrinking 2.1 percent in the second quarter, the Abuja-based National Bureau of Statistics said in an e-mailed statement Monday. The median of 15 economist estimates compiled by Bloomberg was for a 2 percent contraction. The economy expanded a non-seasonally adjusted 9 percent from the second quarter, the statistics office said.

Government revenue has plunged and foreign currency became more scarce with the decline of oil prices, the country’s main export, since mid-2014, and production fell as militants in the Niger River delta blew up pipelines. The authorities have struggled to manage the economic fallout, at one point pegging the exchange rate against the dollar for more than a year and more recently using law enforcement to bring down the street price of foreign currency.

“The key drag on the economy remains issues around oil production,” Wale Okunrinboye, an analyst at Asset & Resource Management Co. in Lagos, said in an e-mailed response to questions. “We do not think this reading is a trough for the economy and see downside to growth from a combination of continued militant attacks, depressed real wages and persisting dollar shortages.”

Crude production fell for the fourth consecutive quarter to 1.63 million barrels per day, from 1.69 million barrels in the three months through June, the statistics office said. The oil industry contracted by 22 percent from a year earlier. The non-oil sector, which includes manufacturing, banking and agriculture, expanded 0.03 percent. Factory output contracted 4.4 percent, the third consecutive quarter of decline, and construction shrank 6.1 percent, the fifth straight quarterly contraction.

Manufacturing was “affected by the foreign-exchange volatility and depreciation of the naira,” Damilola Akinbami, an analyst at Financial Derivatives Co. in Lagos, said by phone. “We saw significant injection in construction, but there is a time lag between when something is implemented and when you see the impact, that’s why we didn’t see the impact in the third quarter.”

The slump in oil and shortages of foreign currency and power could cause the economy to shrink 1.7 percent this year, according to the International Monetary Fund. That would be Nigeria’s first full-year contraction since 1991, according to data from the Washington-based lender.

Bloomberg

END

Be the first to comment