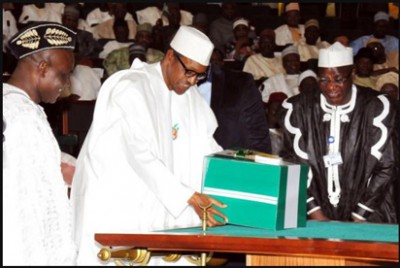

The National Assembly yesterday passed the 2016 Budget into law. The breakdown of the N6.06 trillion budget included statutory transfers, N351 billion; debt servicing, N1.4 trillion; recurrent expenditure, N2.6 trillion and capital expenditure of N1.5 trillion.

The budget is resting on three key assumptions of crude oil price benchmark of $38 per barrel; exchange rate at N197/$ and oil production volume at 2.2 million barrels per day.

Although, the breakdown is still being awaited, the key highlights of the budget have generated mixed comments from financial and investment pundits.

Leading financial and investment firms commended the passage and general nature of the budget.

Economists, investment advisors, research and intelligence experts agreed that the budget will serve as a stimulant for the economy, with the trickle-down effect expected to also boost the capital market.

The recurring caution is however on implementation, which the analyst believe, will determine the success of the budget.

Analysts from several financial and investment firms including FDSH Merchant Bank, SCM Capital Market, GTI Securities and GTI Capital agree that the budget might lead to increase in interest rate and crowding out of the private sector, which will further raise the cost of funds for hard-pressed companies.

The Federal Government has a plan to borrow about $5 billion from multiple sources, including the Eurobond market.

With the current foreign exchange strain, increased borrowing implies a double-jeopardy situation for the government, which will have to borrow at higher cost to attract foreign investors, and the domestic companies, which will also have to pay premium on the sovereign yields to attract investors to their corporate bonds. There are fears that the budget will again fuel inflation, which rose to 36-month high last month.

Managing Director, GTI Securities, Mr. Amos Aledare, said the high budget deficit means higher borrowing.

On Tuesday, the Central Bank of Nigeria (CBN) raised the benchmark interest rate from 11 per cent to 12 per cent. Issuing bonds will increase the national debt which stood at N10.94 trillion by December 31, last year.

Aledare said the annual interest payment is on the high side with a consequence of future higher taxes.

END

Be the first to comment