…the book provides recommendations on how to improve the effectiveness and efficiency of anti-money laundering law compliance by introducing the theory, framework and approach for dealing with the concerns of money laundering reporting officers within the banking industry.

Apart from the suspects, only very Nigerians can identify the faces of anti-corruption operatives who were actively involved in the investigation of several high-profile cases of money laundering in the country. The officers, mostly in the Economic and Financial Crimes Commission (EFCC), have their names and identities hidden from the public glare because they investigate highly complex and risky cases of financial crimes.

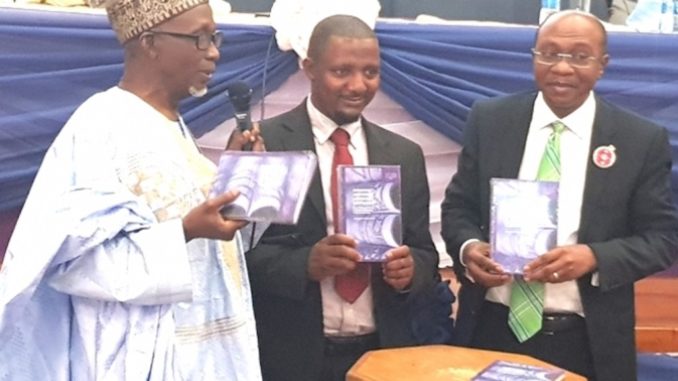

The identity of one of the dogged anti-fraud operatives was recently unveiled by the pioneer chairman of EFCC, Mallam Nuhu Ribadu at a presentation of a book on anti-money laundering (AML).

Launching the book Improving Anti-Money Laundering Compliance: Self-protecting Theory and Money Laundering Reporting Officers by Dr. Bello Abdullahi Usman, Nuhu Ribadu described the author as a thorough, disciplined and intelligent investigator who had handled high profile cases at the anti-corruption agency.

Dr. Abdullahi Usman Bello, the author of the book holds a PhD in Anti-Money Laundering Compliance. He also obtained a degree in Applied Accounting from Oxford Brookes University, and a Post Graduate Diploma in Islamic Banking and Insurance from the Institute of Islamic Banking and Insurance, UK.

Bello is also a chartered certified accountant (ACCA), a certified anti-money laundering specialist (CAMS) and a certified fraud examiner (CFE). He was the deputy head of department, Monitoring and Analysis at the Nigeria Financial Intelligence Unit and the head of Forensic Accounting and Financial Investigation at the EFCC. He was also a lecturer at Newcastle Business School, UK and a former bank worker. He is currently the managing consultant at Abdubel Consulting, a forensic accounting, financial intelligence analysis and anti-money laundering firm located in Abuja.

At the book presentation, Ribadu said: “Dr Abdullahi Bello is no doubt a thorough professional and authority in this particular area, and any offering from him should be taken with all seriousness. He is a rounded expert that was from the financial sector background and has worked as a law enforcement officer to the satisfaction of his superiors.”

Ribadu recalled how Dr. Abdullahi Bello, among a few others, were poached from the financial sector to help in cracking the nut of money laundering. He said Abdullahi particularly worked on a number of very key cases, and provided links that helped in the process of investigation and prosecution.

Reviewing the book at the occasion, former director general of the Inter-Governmental Action Group Against Money Laundering in West Africa (GIABA), Professor Abdullahi Shehu said that the book provides recommendations on how to improve the effectiveness and efficiency of anti-money laundering law compliance by introducing the theory, framework and approach for dealing with the concerns of money laundering reporting officers within the banking industry.

Also speaking as the chairman of the occasion, the governor of Central Bank of Nigeria (CBN), Mr. Godwin Emefiele said the author produced a timely scholarly material in understanding the theoretical framework on anti-money laundering and how the flow of illicit financial transactions can be curtailed and combatted globally. He therefore recommended the book to policy makers, scholars, bankers and students, as he bought copies for Central Bank and select financial institutions and libraries in Nigeria.

In the 207-page book, which is currently available for purchase online, the author explains the dilemmas encountered by reporting institutions, particularly designated Money Laundering Reporting Officers (MLROs).

Chapter One introduces the money laundering as a global phenomenon and the challenges of compliance with acceptable international standards against money laundering from the perspective of the MLROs. The chapter also outlines the aims and objectives of the book, which is to provide an understanding of the AML environment from the perspective of MLROs and suggests an effective and efficient approach to compliance among other objectives.

While Chapter Two provides the background and context of the legal framework for AML and the role of international organisations in setting standards, Chapter Three justifies the articulation of the “Self-Protecting Theory” by presenting the main thrusts and key elements of discharging, complying, communicating and complaining.

Chapter Four reviews some literature on regulation and in particular the challenges of AML compliance. And Chapter Five demonstrates the academic and theoretical prowess of the author in analysing in detail the concept of “self-protecting theory.”

Chapter six generalises the theory to other areas of human endeavour by integrating it into other theories in social and management sciences. In the concluding Chapter Seven, the author posits that his “self-protecting theory” emerged out of the exigencies of defective regulation based on a risk based approach, which did not take into account the constraints, limitations and challenges of MLROs and their organisations.

Apart from the depth of theoretical and eloquent presentation in an academic style of narration, the book largely focuses on the United Kingdom rather than Nigeria, the author’s home country. His grounded theoretical analysis were based on research and interviews conducted amongst reporting officers in the UK on “Self-Protecting Theory.” He could have made a comparative analysis of the challenges of regulation across the United Kingdom and Nigeria to represent the challenges and similarities between the two continents of Africa and the Europe.

Nevertheless, the scholarly book has made significant contributions to the evolution of self-protecting theory on anti-money laundering. I therefore join Ambassador Ibrahim Yerima Abdullahi – as done during the official presentation of Improving Anti-Money Laundering Compliance: Self-protecting Theory and Money Laundering Reporting Officers – in recommending the book for policy makers, bankers, legislators and those involved in anti-money laundering campaigns.

Yushau A. Shuaib is publisher of PRNigeria; www.YAShuaib.com; yashuaib@yahoo.com.

END

Be the first to comment