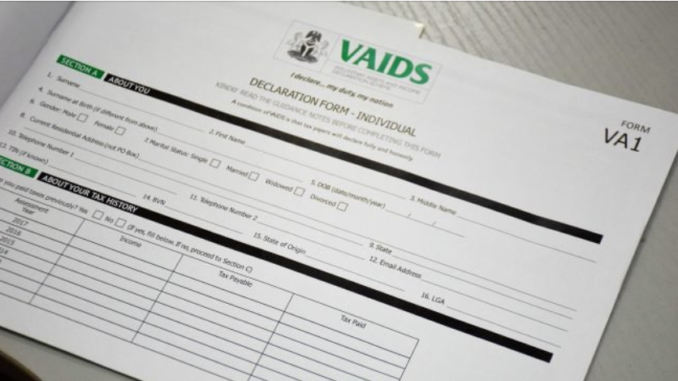

Nigerians who own property in the United Kingdom have inundated the ministry of finance’s Voluntary Assets and Income Declaration Scheme (VAIDS) hotlines with calls, causing the lines to crash on Friday.

NAN quoted a source at the VAIDs office as saying the unprecedented level of calls is not unconnected with the new UK regulation on Unexplained Wealth Orders (UWOs).

The source disclosed that the VAIDs office has been receiving massive calls and frantic requests from taxpayers based in the UK, in the last 72 hours, asking for the extension of time to enable them complete their declaration forms.

The UK government had last week introduced a new law that requires foreigners who own property in the country to explain the source of their funds or risk forfeiting them to the government.

According to the new law, the UWOs could be obtained on any property or combination of property valued at 50,000 pounds ( N25 million) or more, for which the owner is unable to explain a legal source of its funding.

The source said that the data already in the possession of the VAIDS office in the ministry of finance revealed that many UK property owners had underpaid their taxes before transferring funds overseas to buy property.

“Concerted efforts are ongoing to restore the hotlines following the crash on Friday,” the source said.

“Most of the calls received are from high net worth individuals, including company executives, bankers and even a governor.

“All seem to be in panic over the prospect of losing their investments.”

The official said that some of the apprehensive Nigerian property investors in UK had even visited the finance ministry requesting to see the minister and also the head of the VAIDS Office.

The source explained that most of the inquiries were about seeking assurance from the Nigerian government that the VAIDs programme could protect them from potential asset forfeiture to the UK government.

Others requested to know if their names had appeared on the lists the VAIDS office had obtained from overseas.

The UWO law, coupled with the revelation that many foreign governments are automatically sharing bank and property information with Nigeria, has resulted in an upsurge in inquiries about VAIDs.

VAIDS allows Nigerian tax payers to restate their income and assets without limit and thus could potentially allow those who own property that cannot be explained by their previously declared income to regularise by declaring and paying the correct taxes.

END

Be the first to comment