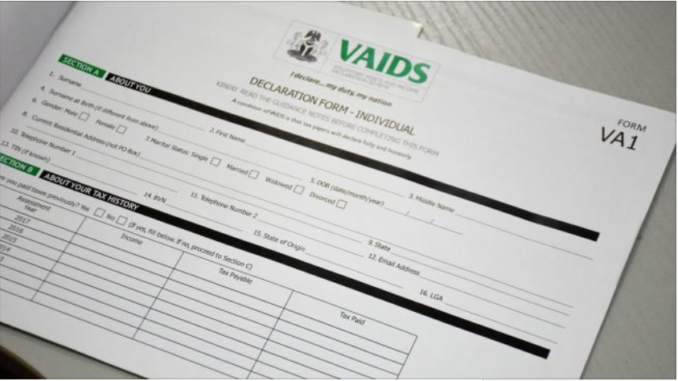

In 2017, the Federal Government of Nigeria launched the Voluntary Asset and Income Declaration Scheme (VAIDS) as a “time-limited opportunity for taxpayers to regularise their tax status relating to previous tax periods and pay any taxes due.

“In exchange for fully and honestly declaring previously undisclosed assets and income, tax payers will benefit from forgiveness of overdue interest and penalties” and the assurance they do not face criminal prosecution for tax offences or tax investigations.” In other words, a regime of ‘tax amnesty’ was put in place.

The 2014 gradual collapse in the price of crude oil, the mainstay of the Nigeria economy and the ensuing recession that ravaged Nigeria in 2016 and 2017 finally forced Nigeria as a nation to look inwards for self-sufficiency, focusing on the hitherto neglected taxation as the primary means of funding government.

This belated recognition of tax as the foundation of any governance process and the core of the bond between the state and its citizens was thus compelled by circumstances. Easy oil revenue had made that relationship tenuous and for the vast majority of Nigerians, almost non-existent.

The absence of governance had become the norm and for the average citizen and the less they had to do with government the better.

With free oil revenue being shared monthly, everybody lived the lie that the nation was rich. Until the burble burst.

Taxation is a painful process globally and it is fundamental that there is trust built on painstaking transparency and accountability on the side of government and that of the people. The huge collective deficit of both these attributes on the part of all is, of course, well known.

It is noteworthy therefore, that the VAIDS scheme was clearly well-thought out and that the Federal Government chose a persuasive carrot approach which is an implicit acknowledgement of how only few Nigerians are actually contributing from their economic activities into the tax pool.

The scheme was widely publicised and we commend the engagement strategy at educating the citizenry on performing their most significant civic duty.

The scale of this challenge was recently inadvertently highlighted by Mr. Babatunde Fowler, chief executive of the Federal Inland Revenue Service (FIRS) when he announced that thus far “N30 billion had been realised from individuals and corporate establishments – 262 taxpayers at the original 9 month expiry date.”

Simply put, this is an abysmal amount with a scandalously low number of ‘volunteers.’

The low level of voluntary compliance, he attributed to “experiences in other countries that show people wait until the last minute.”

But in Indonesia, the nine-month tax amnesty programme ended in March 2017 and resulted in 965,983 taxpayers declaring assets of $366 billion; a huge number that equates to almost 40% of the GDP of Indonesia. Of more significance is that 200,000 of these taxpayers were ‘brand new taxpayers’ that had never filed a tax return in their lives.

This is far greater success than what Nigeria has recorded. Meaning Nigerians are still been unwilling to pay. Thus, a programme that was founded on moral suasion has, as it drew to its close, morphed into an old-fashioned enforcement programme.

Properties are being identified, lists are being drawn up, foreign governments are sending details on Nigerian-owned assets, the language was less accommodating and the consequences of non-compliance were being signaled as significant.

There then appeared to be a whiff of desperation around the whole exercise.

A more conciliatory tone that had been struck with more recognition of ‘the impact it has had in promoting voluntary compliance’ may be jettisoned while a bit of cane may have to be welded.

In recognising the nexus between governance, taxation and development, it must be acknowledge that Nigerians act in the knowledge that their governments have failed them.

They have responded therefore by being unwilling and unable in many cases to fulfill that part of the compact between the governors and the governed.

The Minister of Finance, Mrs. Kemi Adeosun, once revealed an even more worrisome statistic.

Of the 14 million taxpayers (pre-2016), 13.5 million are PAYE, meaning there were only about 500,000 voluntary taxpayers in the entire country.

It is gratifying to note that this has been updated and figure show that the taxpayer base is now about 19 million. There cannot be a clearer indicator of the challenge of trust.

The government now has the burden of proving to the people that it will always judiciously utilise the collective resources at its disposal to act in the collective interest.

Perhaps now is the time to consider a “TOTAL’ amnesty. Whilst a controversial suggestion, it is worth considering in sustaining the momentum that is being gained in expanding the taxpayer base.

It may just encourage more people to come forward, register and start paying their taxes going forward.

In return, they should receive complete amnesty on previously undeclared income and assets.

Whilst this may be unjust to currently diligent taxpayers, it is hardly realistic to expect a significant enough number of people to voluntarily come forward and pay eight years of back taxes.

Given the less than satisfactory response so far to VAIDS, the Nigerian government should try to just expand the tax payer base and earn the peoples trust.

The current government needs to realise that rebuilding trust in the relationship with the citizenry is a very slow and excruciating process.

This environment is one where the reality for almost all citizens in dealing with government is inequality of access, benefits and outcomes.

Yet the government must earn this trust.

There will be many false starts and it will take more than a one-short programme.

The government must persevere and sacrifice since, to a large extent, it has been responsible for the erosion of the trust over the years.

END

Be the first to comment