With limited capacity to raise the prices of their products, alongside the intensive use of energy, local manufacturers have yet again raised concerns about their inability to manage energy shocks arising from high energy prices in an inflationary environment.

According to the operators, the cost of energy has significantly increased the operational expenses of quoted blue-chip companies by over 50 per cent, a situation that is currently unsettling investors and chopping off a chunk of their returns.

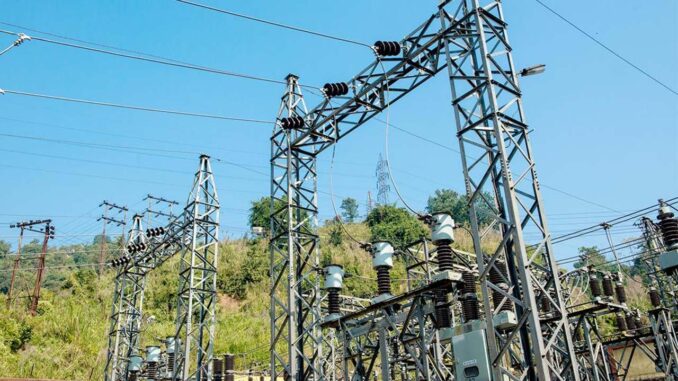

Indeed, grid unreliability remains a source of concern to operators who noted that alternative energy should not be the main source of energy if supply from the grid is reliable.

Stakeholders have expressed fear that the trend could shrink listed firms’ potential growth, and ultimately hamper equities investors’ dividend payments, especially with some of the firms still battling with the effect of the COVID-19 crisis.

Findings revealed that an increasing number of listed firms are reducing their operations, while others are struggling for survival as energy takes a toll on their survival.

Worried by the increasing challenges and falling performance indicators, stakeholders have appealed to the Federal Government to create alternative arrangements to give manufacturers access to affordable diesel for enhanced production.

A close look at the listed firms’ energy consumption for both 2021 and 2022 financial years showed that firms listed under the industrial goods sector have been compelled to increase their energy budget.

For instance, Dangote Cement Plc., energy consumption increased from N98.98 billion in H1 2021 to N129 billion in H1 2022, representing a growth of 31.3 per cent or 13.9 billion. From N113.9 billion in 2021, the company’s energy cost jumped to N133 billion last year.

Following the high cost of operations, the company’s Profit After Tax (PAT) declined by 10.19 per cent to N172.1 billion for the half-year 2022 as against the N191.6 billion it posted in the comparative period of 2021. It also spent N198.1 billion during the third quarter (Q3) ended September 31, 2022.

BUA Cement Plc, another company under the industrial goods subsector, spent N43.6billion on energy in H1 2022, representing an increase of 64.66 per cent over N26.446 billion reported in the corresponding period in 2021.

The total amount expended in energy consumption by Dangote Cement and BUA during the Q3, 2022 operations was N263 billion.

For the consumer goods subsector, Flourmills Plc incurred a total of N25 billion in Q3, 2022while BUA Foods also spent N8.2 billion.

Under the healthcare subsector, GlaxoSmithkline Plc., expended N100 million in energy in Q3, 2022, while another pharmaceutical firm that craved anonymity said the company’s diesel cost skyrocketed between the first half of 2021 and a half year of 2022 by about 220 per cent.

“We used to buy 33,000 litres of diesel for N7 million. Now, we pay as much as N26 million, which is a whopping 271 per cent increase. Generally, there is a high energy cost.

“Even those factories that use gas are equally experiencing cost escalation. Companies that paid an average of N300 million per month for gas now have to pay as much as N800 million. This will adversely affect operations and our ability to pay dividends to shareholders.

“Our profit has been cut down by over 50 per cent. It is not possible to pass all the cost to customers, and this makes achieving profit targets impossible,” the company said.

Cutix Nigeria Plc. spent N64 million on energy in its half year 2021 operations and N87 million in 2021. The spending outlay rose to N141 million in H1 ‘2022, showing a percentage increase of 119 per cent or N76 million.

Managing Director of the company, Ijeoma Oduonye, in a chat with The Guardian, disclosed that rising diesel cost was seriously affecting the company’s operating cost, noting that this would eventually negatively impact the firm’s profit and dividend payout.

“Constant and stable electricity will eliminate the need for diesel. The resurrection of the local refineries will also reduce dependence on imported diesel. Empowerment of green energy projects by the government is a good strategic move,” she said.

Another manufacturing firm, Academy Press Plc.’s total funds spent on diesel between January and December 2021 stood at N54 million, while public power took N71.6million totaling N131 million.

Managing Director of the company, Olugbenga Ladipo, said it was obvious that the amount spent on energy from January to June 2022 was higher due to an increase in the cost of diesel coupled with worsening power supply, increasing by 113 per cent.

According to him, the effect of this is that the budget made by the company for the year was exceeded leading to an increase in overheads. This has affected profits and dividend payouts.

“The public energy supply should be made to function and cater to full industrial demands. It is better and cheaper to generate energy collectively rather than individually as we experience currently. Nobody will need to invest heavily in energy with its attendance distractions.

“The effect on costs is huge. It deprives us of the affordability of other important needs. Again, lots of physical discomforts because rationing becomes imperative. As you can see some banks cut off operating hours. We did so much rationing to survive the cost,” he said.

Founder of the Independence Shareholders Association of Nigeria (ISAN), Sir Sunny Nwosu urged the government to find a lasting solution to the diesel shortage in Nigeria.

He pointed out that the lingering issues of the parlous state of infrastructure, poor access roads to the ports, with the associated traffic gridlock, as well as the activities of multiple government agencies at the terminals have contributed to the current negative position of the manufacturing industry.

According to him, if the government fails to put a lasting solution to diesel scarcity by increasing the production, it will ultimately affect the Internally Generated Revenue (IGR) of the sub-nationals and reduce taxation.

He listed other implications to include: the exertion of untold hardship leading to the closure of many industries, reduction in capacity utilisation, further decline in GDP, large scale unemployment and increase in crime rate.

“Most of the companies will be grounded to a halt when there is no petrol and there is no diesel. If the government does not find a way to increase the production of diesel, it will affect IGR and tax generation will also reduce because it is only when these companies have money that they can pay tax. If they do not have it, they evade tax.

“Also, the rate of unemployment will increase because they will disband a lot of people and insecurity will increase. It is going to be a chain effect. Government should show concern and not liken us to the developed world, where diesel is scarce, they should find a home base solution to make this product available. It is affecting millions of Nigerians.

“Each person that works in Nigeria caters to about 20 people, by the time the person is out of work, insecurity will be on the rise too. There is indeed a big problem in the country. Rice is not reachable and stable food is not reachable. It will affect the capital market investors. If these companies do not make a profit, how would they pay dividends and take care of their workforce,” he said.

Founder of Performance Earning and Returned Leadership (PEARL) Awards Board of Governors, Tayo Orekoya, said the rising diesel costs are affecting the production, cost, pricing and purchasing power of Nigerians.

He pointed out that the amount the country spends in subsidies is outrageous, stating that no economy can achieve any meaningful growth under such a structure.

“We cannot over-emphasise the challenges that this has thrown into the economy, it is a shame that a country that has crude oil is importing, we need to rethink the very bases of our economy. A country that is blessed, look at what is happening with Russia invasion of Ukraine. All oil producers are making money, while Nigeria is in deficit.

“We cannot take advantage of it, it is really sad. We need to rejig our strategies, particularly in terms of how to manage the resources. We should be able to refine our crude rather than exporting and then importing the same as refined oil. It is a shame,” he declared.

Head of Equity Trading, Planet Capital, Paul Uzum said the effect on listed firms’ operations would be felt by the time the full-year financials are published.

“However, it is natural that this will have a tremendous impact on many firms. Consumer goods firms’ reaction would naturally be to increase sales prices, which is manifesting the rising inflation levels. But many service firms, especially banks, will struggle with it,” he said.

END

Be the first to comment