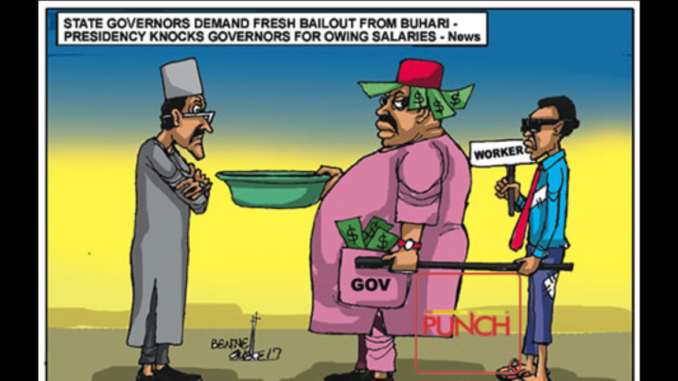

WITH workers’ agitation over unpaid salaries at a feverish pitch, state governors have instigated a fresh bailout package from the Federal Government. In line with this, the Nigerian Governors’ Forum has made a strong case with President Muhammadu Buhari to refund quickly the outstanding 50 per cent of the Paris Club loan excess deductions from their accounts between 1995 and 2002. On the surface, this is a legitimate request. Yet, the more easy money the states receive, the deeper they indulge in reckless spending and drive their states into insolvency.

It is depressing that across many of the 36 states, workers are groaning and dying. At the last count, 23 states still owed workers salaries, gratuities and pensions, some for between two and 42 months. In Kogi, which has witnessed strikes and protests over unpaid salaries, a senior civil servant, Edward Soje, committed suicide in October because he had not been paid for months. Pensioners are the worst hit. In one state, pensioners have been owed since 2006; another state in the South-South reportedly owes pensioners 42 months in arrears.

Yet, estimates calculated by different agencies, including BudgIT (a Lagos-based civic organisation), put the total extra-statutory bailouts, budget supports and Paris Club refund to the states between 2015 and now at N1.75 trillion. It started in 2015 with a salary loan of about N338 billion disbursed to states with a 20-year tenor at an interest rate of nine per cent. This was swiftly followed by the N575 billion restructuring programme bond, the N92.18 billion from the $2.1 billion Nigeria Liquefied Natural Gas dividends and another N7.85 billion. The first and the second tranches of the Paris Club refund to the states totalled N760.1 billion.

In 2016, the Federal Government doled out N117.3 billion to the states. The money was taken out from the excess revenue generated in the Petroleum Profit Tax. Normally, this money should have been remitted into the Excess Crude Account, but Buhari succumbed to the pressure from governors that the bailout would ameliorate workers’ suffering. Evidence, seen in the unending crisis over unpaid salaries, suggests that this is not the case. Corruption has been discovered with some governors implicated in fraudulent consultancy deals.

Really, bailouts are like free lunch; they are not the solution to the states’ financial ruin. Frankly, the economies of most states are not geared towards production, but consumption. Apart from Lagos, almost all the other 35 states, including, curiously, the oil-producing states in the South-South, depend mainly on federally shared revenue to survive. They do not generate enough IGR to run their states. This is not a sustainable public finance model.

As long as this dependence on federal allocations subsists, states will remain economically crippled, unable to pay workers, develop infrastructure, create jobs and lift themselves out of the debt trap. The scenario in Benue – like most states – is a classic example. Governor Samuel Ortom says that if the state does not reduce its monthly wage bill to N4.5 billion, it will implode. Benue currently has a monthly wage burden of N7.8 billion, whereas its total income from the Federation Account and IGR averages N6 billion. “So, if you are paying salaries alone, you have a deficit of N1.8 billion a month,” Ortom lamented.

Therefore, states ought to get their priorities right. They have to embark on governance models that can stand the test of time. Before the next set of bailout, the Federal Government should enact rigorous clauses for benefitting states. In the past, Abuja released the funds after just asking the states to deploy such money to the payment of salaries. But many governors did not keep to the agreement.

Following the global recession of 2008, the United States government implemented a $700 billion bailout, especially for the auto industry, the banks and the mortgage sector. The package came with stringent conditions, including a cap on pay for top company executives, while the government took equity in the companies and replaced several executives with its own nominees. The bailout not only rescued the American economy and saved 1.2 million jobs in the auto industry, the US Treasury also announced a profit of $15.35 billion a few years on. For Greece to receive a bailout of €130 billion in 2012 from the European Union, it had to meet stringent conditions, including €325 million in budget cuts; reform of its pension system and liberalisation of labour laws. Every bailout handed out to Nigerian states without rigorous conditions is simply money flushed down into some corrupt pockets. If bailouts are to be given at all, Abuja should attach stringent conditions to them.

In the meantime, states have to live within their income. Governors should cut down drastically on the cost of running government: living in opulence, driving around in convoys, buying aircraft and keeping a bogus retinue of aides. For maximum impact, states ought to address their bloated workforce. In 2007, the Federal Government initiated the Integrated Payroll and Personnel Information System that discovered large number of “ghost workers” from the system. It has saved N120 billion in salary payment since then. State governors should diligently implement this system to reduce their wage bills.

An effectively restructured political system will allow states to develop alternative sources of revenues away from hydro-carbons. It is time state executives looked inward and stopped depending on the monthly federal allocations. According to experts, almost all the states in Nigeria can generate income from identified solid minerals within their territories. Kogi and Nasarawa, for example, are said to be home to about 30 solid minerals each that can generate a huge income, employment and foreign direct investment. Such states should, therefore, not be dependent on the centre.

In conjunction with the civil society, the organised labour has to engage governors, to make them accountable. The workers directly bear the burden. They should own the fight for the payment of their wages as and when due. The state Houses of Assembly should, however, ensure that bailouts are appropriated before governors spend them.

END

Be the first to comment