MTN Nigeria shares public offer is closing today December 14, 2021, at 5 pm. The offer, which is the first from any of the big telcos in Nigeria, has been on since December 1, 2021, with the aim of deepening retail participation in the Nigerian stock market.

Before the closure of the first public offer, TheCable takes a quick look at how MTN shares have fared over the past 29 months on the Nigerian bourse.

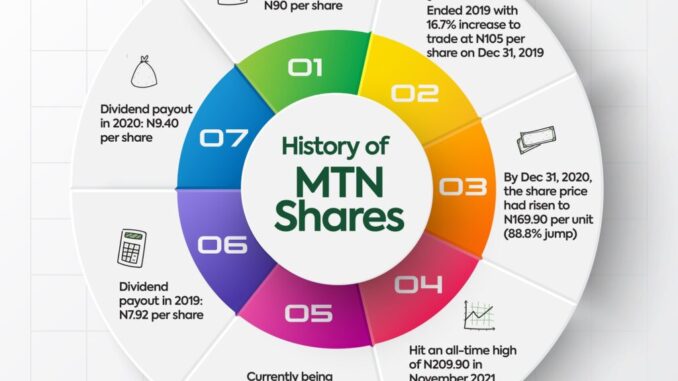

MTN’s listing was consummated by the introduction of 20,354,513,050 ordinary shares of MTN Nigeria at a listing price of N90.00 per share.

Oscar Onyema, the Group CEO of the Nigerian Exchange Group (NGX), said at the time that “today’s listing is a promising development in the country’s telecommunications sector and we encourage other players in the sector to explore the different opportunities in the capital markets for raising long term capital.

“This listing will promote liquidity for MTN Nigeria, enhance its value and increase transparency, as our platform remains one of the best avenues for raising capital and enabling sustainable growth for national development”.

MTN SHARES GAINED N180BN IN 16 MINUTES

MTN was admitted into the Nigerian stock at a share price of N90 per ordinary share. Following formalities like speeches, meetings, and handshakes, the South African telco giant could not trade until 2:14 pm on Thursday, May 16, 2019. This meant the shares had only 16 minutes to trade before the market closed.

However, in those 16 minutes, MTN share rose by 10 percent, from N90 to N99 per ordinary share — raising its market cap from N1.83 trillion to N2.01 trillion, immediate addition of 10 percent to its market size.

This means MTN Nigeria gained N183 billion — or over $500 million (at the time) — in 16 minutes.

It ended the year 2019 with 16.7 percent increase to trade at N105 per share on December 31, 2019. A year on, by December 31, 2020, the share price had risen to N169.90 per unit — representing an 88.8 percent jump from its listing price.

The share hit an all-time high of N209.90 in November 2021, and is currently on sale at N169 per share — a lot lower than it’s maximum price.

RISING DIVIDEND PAYOUT

For many long term investors, price movement is not the most important factor for vesting their monies into an asset class; for them, dividend payout is the ultimate factor.

In this regard, MTN Nigeria also has quite a record in dividend payout. In 2019, less than a year after it was listed on the Nigerian exchange, MTN paid N7.92 per share to every investor. This increased in 2020, when MTN Nigeria paid N9.40 per unit.

The numbers are estimated to increase in 2021/2022 based on MTN’s new business lines premised on the acquisition of approval-in-principle to operate payment service bank (PSB) and the new 5G licence. Based on numerous metrics, MTN shares have been profitable since listing in 2019.

END

Be the first to comment