THE decades-old crisis in Nigeria’s power sector has recently taken another turn for the worse with daily power supply averaging an embarrassing 1,393 megawatts in March. Disappointingly, this is happening seven years after the President, Major General Muhammadu Buhari (retd.), took office pledging a turnaround. Unless he takes radical action to truly turn things around, he will leave another legacy of failure in the power sector, among other letdowns.

Reports that power supply from the national power grid fell by 25.3 per cent to 3,320.7MW from 4,446.02MW on May 7 calls for action. The Nigeria Electricity System Operator revealed that the 11 electricity distribution companies were willing to take only 2,949.02MW, leaving 371.68MW unallocated and denying millions of Nigerians and businesses access to power. This happens too frequently. Urgently, the systemic regression should be addressed.

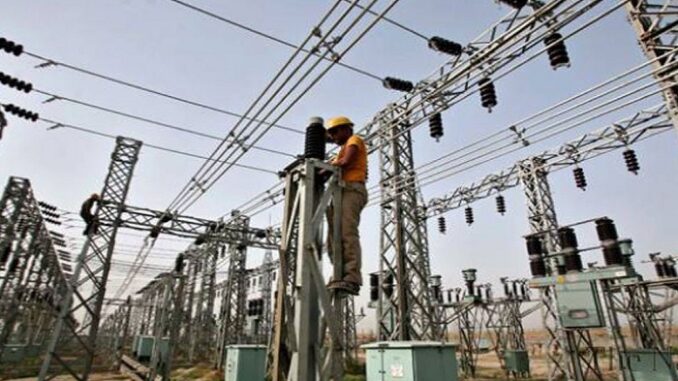

Nigeria’s power sector is a national disgrace. Though estimates of power needs for Africa’s largest economy range from 25,000MW to 40,000MW, installed generating power capacity is about 12,522MW, and transmission and distribution infrastructure can only deliver an average of 4,000MW to businesses and homes. Afflicted by under-investment, obsolete infrastructure, debts and inefficiencies, power shortages have crippled SMEs, stunted the productive sectors and made the cost of local products uncompetitive.

The United States Agency for International Development said, “The Nigerian power sector experiences many broad challenges related to electricity policy enforcement, regulatory uncertainty, gas supply, transmission system constraints, and major power sector planning shortfalls that have kept the sector from reaching commercial viability.”

Given that electricity is a major booster of industrial growth, the country’s development aspirations are severely constrained. The Electric Power Sector Reform Act 2005 and the succeeding Roadmap for Power Sector Reform 2010 set out to comprehensively transform the power industry through privatisation, raise output to 40,000MW by 2020 and attract investment and the global best players into the market. Regrettably, by mismanaging the privatisation, the milestones have been missed. The government has also failed to review the post-privatisation targets despite the glaring underperformance of the operators.

Data from the Federal Ministry of Power indicate that the highest peak power ever generated and transmitted was the 5,802MW delivered on March 1, 2021. Nigeria’s 144 kilowatts per capita power consumption, said the World Bank, is a mere 3.5 per cent of South Africa’s. The fallout says the International Energy Agency, is that power is a primary constraint on economic growth, adding about 45 per cent to manufacturers’ costs and forcing recourse to self-generation that imposes significant economic and environmental costs.

Some 90 million Nigerians lacked access to electricity by 2019, the world’s worst; below Congo DR’s 70 million, and Ethiopia’s 58 million, the World Bank added. The International Monetary Fund says Nigerian businesses bleed by about $29 billion annually due to power shortages.

The take-off of the critical elements of the power liberalisation such as the Transitional Electricity Market, the Power Purchase Agreements-Gas Supply Aggregation Agreements and Gas Transportation Agreements, which would have unlocked the potential of the market, are apparently stalled. It is imperative to resolve all impediments and quickly implement the agreements to deliver the kind of game-changing dynamics that followed the telecoms sector liberalisation.

Currently, about 80 per cent of generated power in the country comes from gas-fired turbines. The GenCos consistently complain about gas-related challenges; gas volume, quality, pressure and transportation that have perennially curtailed capacity utilisation. Efforts made so far by the stakeholders and the government have failed to solve the challenges to gas flow to the power plants. More pragmatic initiatives should be adopted.

Among other issues, the GenCos also bemoan the over N1.64 trillion owed them by the Nigerian Bulk Electricity Trading Plc. Like GenCos too, the DisCos are overburdened with debt. Combined, the different industry segments owe lenders over N840 billion.

Consequently, current power generation stands at about 3,800MW and the per capita electricity usage is 136 KW/h, one of the world’s lowest. In Libya, it is 4,270 KW/h; India, 616KW/h; China, 2,944KW/h; South Africa, 4,803 KW/h; and Singapore, 8,307KW/h.

To resolve the crisis, experts recommend efficient and competitive service delivery involving deployment of smart and micro-grid technologies, distributed energy resources and energy efficiency and demand management tools; and cost-reflective tariffs. There is also the need for the automation of review processes; enhancement in data analytics; new markets models; franchising; embedded generation, mini-grids, flexible and secure energy sources; and redesigned network structure comprising hybrid networks, smart grid technology, and distributed generation capabilities. Diversification from fossil fuel-fired plants to renewable sources offers immense potential.

Additionally, the power sector remains in dire need of significant investment across its value chain. Businesses’ reliance on self-generation via diesel-powered generators has resulted in negative environmental impacts that using cleaner fuels could reduce, and also in higher costs of goods and services.

Planning experts estimate that for the Nigerian economy to grow at 10 per cent yearly, electricity requirement must reach 78,000MW by 2030. Market intervention and fundamental reforms are vital to achieve this. Heavy investment is needed to address the insufficient gas supply due to poor gas infrastructure, obsolete transmission and distribution assets.

Critical financial interventions like the $750 million Power Sector Recovery Operation from the World Bank in 2020 are needed at this point. South Africa has total installed capacity of 58,095MW and aims to ramp up its generation substantially by 2030. Egypt raised capacity from 24,000MW to 59,000MW in 10 years, Africa’s largest. Foreign direct investment is essential.

Tackling the power crisis requires a strong political will. The government should adopt a multi-prong strategy: break the stranglehold of the DisCos; promote regional, mini, and dedicated transmission and distribution grids; break the state monopoly on transmission by licensing others via a private sector-led process to significantly modify the transmission system, and promote diversification of energy sources. These should include renewables like wind, solar and water.

The government and the investors in the DisCos need to dilute their shareholding to bring in capable international investors with funds and expertise.

END

Be the first to comment