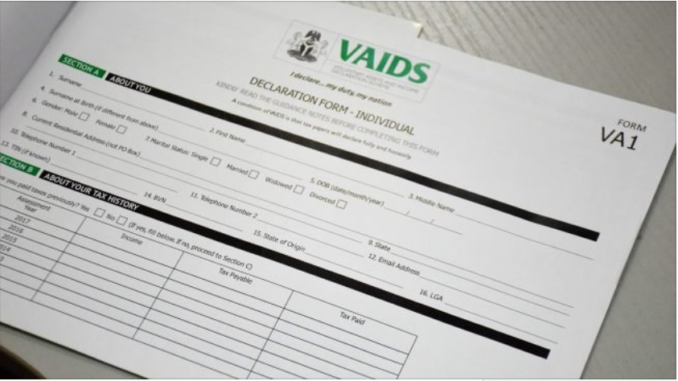

AS the Sunday, March 31, 2018 deadline for the Voluntary Asset and Income Declaration Scheme, VAIDS, draws nearer, public finance executives have intensified campaigns preparatory to unleashing the full weight of tax laws on defaulters.

Part of what is expected to happen is the use of VAIDS ‘project light house’ to fish out the hidden wealth of individuals for the purpose of taxing them. We commend efforts in this direction while urging utmost transparency and fairness, especially as it concerns treatment of certain groups of citizens.

First, we have politicians and elites in two camps: those within and in support of the government in power as against those outside and in partisan opposition. The other important grouping is the public servants and the private citizens. Every effort must be made to ensure that the noble objectives of VAIDS are professionally and patriotically applied; no witch-hunting.

We must eschew media trials; neither should the tax authorities concentrate on individuals/organisations unallied to the ruling party and the government of the day, as we have seen in the controversial anti-corruption war of the current Federal Government. This is very important in the run-up to another general election that promises to be anything but a smooth contest.

But more important is the need for the project light house to throw the light on the assets of public servants known to have milked the nation’s treasury and stashed same in foreign accounts. Abuja, the Federal Capital Territory, is also known to harbour many of the ill-gotten wealth of public servants in real estates, many of which are unoccupied.

It would be particularly impactful to capture the ill-gotten wealth of public servants into the tax net not just for the purpose of tax revenue but also to stem corruption and shore up the flagging credibility of the anti-corruption war.

The dynamism that greeted the launch and execution of VAIDS should not fizzle out just because we have gone past the deadline. The implementation should border on living up to the expectations of a new tax culture which we believe would activate the citizenry to demand for good governance, transparency and prudent spending of taxpayers’ money.

The awareness of the need to pay tax is expected to become more pronounced. A lot of Nigerians who were totally disconnected from the tax system are starting to hear about it with the advocacy in the media. This should continue with wide publicity of post-VAIDS actions.

In addition, VAIDS should operate on the principles of freedom of information where the improved data and documentation on tax performance is made public and timely.

Successful implementation of VAIDS is one giant leap towards diversifying the economy from oil-dependence and vulnerability to shocks in the international oil market.

END

Be the first to comment