It has sadly become a tradition for annual fiscal plans to be packaged with flowery phrases which elicit the hopes of Nigerians for rapid social and economic enhancement, from the implementation of the budget. Regrettably, this promise of El Dorado is never fulfilled, while this hopeless cycle of social distress is unfortunately repeated annually. Sadly, therefore, the 2017 title of “Budget of Recovery and Growth” is probably just another cosmetic expression, in the serial chain of failed budgets, which were similarly heralded as potential game changers to a gullible populace.

Hereafter, the salient features in the 2017 Budget will be discussed in an interview format. Please, read on.

In what way is the 2017 budget similar to other failed budgets?

It will be fair to say that the success of any fiscal plan will correlate with the level of attention to details in the budget process. Indeed, any budget that is hastily put together without meticulous attention to realistic sources of revenue and the recognition of potential challenges to implementation, will invariably fail. Sadly, in addition to the customary delay in passage, our fiscal plans often seem to be hurriedly consolidated and usually at variance with prevailing realties. For example, comprehensive budget implementation is clearly challenged when the President lays the budget, before Parliament, in December, such that formal approval will stretch beyond March/April of the budget year. This regrettable lapse implies that there will be barely eight months for implementation of the capital budget, despite the critical responsibility of this sector, for infrastructural development.

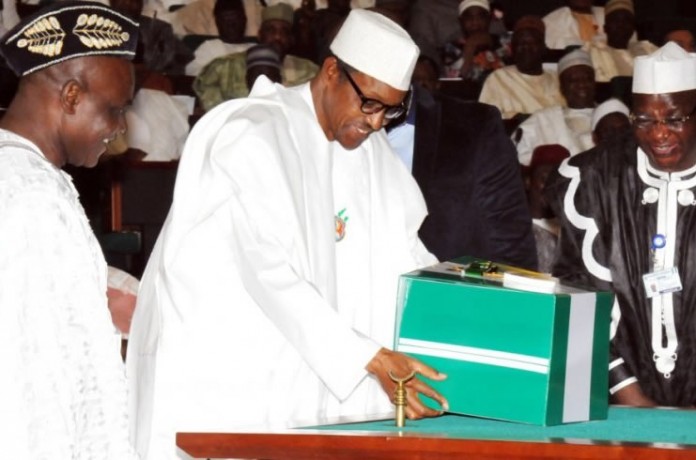

Unwittingly, the 2017 budget keeps faith with this unfortunate tradition, as it was presented to the National Assembly on December 14, 2016. Consequently, the expanded capital vote of N2.24tn in 2017 may, like earlier votes, also fail to produce the expected positive change.

The capital vote of N2.24tn is the largest ever capital allocation; surely, this should have positive impact on infrastructure, shouldn’t it?

As I said earlier, if the 2017 budget suffers from delayed passage, and there is no fundamental shift from the usual, uncoordinated schedule and process of budget preparation, approval and implementation, the 2017 capital budget will also be partially implemented. Instructively, in real value terms, the N2.24tn capital budget is unexpectedly much less than the N1.8tn capital budget of 2016 and may in fact be less than the N557bn budgeted as capital expenditure in 2015. The unexpected disparity is traceable to the naira exchange rate, the 2015 N557bn capital budget was above $5bn with naira exchange rate below N200=$1. However, with an exchange rate between N300 and N500=$1, the projected N2.2tn 2017 capital budget may have unfortunately fallen below $5bn in real value terms. In this event, it will be misleading to suggest that the capital budget is the highest ever.

Furthermore, several sectoral votes are clearly inappropriate and contentious. For example, the meagre allocation of N448bn for education is barely six per cent of the total budget, and this is a far cry from UNESCO’s best practice recommendation of 26 per cent for this very vital sector.

Why then is the 2017 N2.24tn capital vote canvassed as a very bountiful allocation that will promote economic recovery and growth?

Indeed, earlier budgets generally allocated about 70 per cent to recurrent expenditure, while infrastructural expenditure accounted for a relatively modest 30 per cent or less. Clearly, a 70 per cent capital vote should achieve much better results, if the rather nebulous components of recurrent expenditure became reduced below 30 per cent. Incidentally, the impressive gradual infrastructural enhancement, presently witnessed in Lagos State, is actually the product of the state government’s commitment to urgent infrastructural remediation by dedicating almost 70 per cent of annual budgets to capital and social infrastructural enhancement annually. Unfortunately, the Federal Government authorities have appeared unable to emulate this commendable Lagos model.

In fact, it is disturbing that despite, the elimination of over N1tn annual fuel subsidy and thousands of “ghost workers” from government’s pay roll, and the multiple financial leakages which the Buhari administration promised to plug, together with the substantial funds recovered from treasury looters, the recurrent expenditure inexplicably leaped from N2.65tn in 2016 to N2.98tn in 2017. Such expansion in consumption spending is certainly not in sync with the public’s perception of President Muhammadu Buhari’s acclaimed frugality in governance.

What about the critical benchmarks for crude oil price and output and the dollar exchange rate in the 2017 budget proposal? Are these realistic?

In recent years, federal budgets were usually predicated on very conservative benchmarks for crude oil and output, even when market prospects were clearly brighter than the adopted benchmarks. Consequently, even when crude oil price and output remained exceedingly robust within the budget year, the more conservative lower benchmarks deliberately adopted, generally induced budget deficits. Unfortunately, these deficits were funded by borrowing with rather oppressively high interest rates, for such risk-free government loans. Alarmingly nonetheless, in addition to consuming the proceeds from these high cost loans, the additional revenue from the predictably more bountiful harvest of sustained high crude oil prices and output was unfortunately also consumed with no positive impact on social welfare and economic growth. In other words, Nigeria’s spiralling high cost loans were recklessly acquired for several years even when revenue from crude oil clearly exceeded the earlier projected budget deficits.

Conversely, the 2017 budget seems to have adopted very ambitious output and price benchmarks for crude oil; the National Assembly has already almost unanimously decried the exchange rate of N305/$ as clearly ambitious, because of the huge disparity between the adopted rate and N500/$ parallel market rate.

Consequently, the clearly intimidating N2.36tn projected deficit in the 2017 budget, will invariably be largely exceeded, if the ambitious benchmarks adopted do not materialise. Thus, the projected borrowing requirement of N2.32tn may still require supplementary loans in 2017. Evidently, such additional loans will seriously challenge government’s capacity to service current debts for which over 35 per cent of aggregate annual revenue is already presently allocated. Ultimately, we may therefore require up to 50 per cent of aggregate revenue to service debts, especially when the recently “unearthed” N2.2tn, which the Minister of Finance, Kemi Adeosun, reveals is owed to various contractors from previous years is captured. The debt situation will be compounded, if the undenied extra fiscal advances of about N1.5tn from the Central Bank of Nigeria (not N4.5tn as alleged by former CBN Governor, Lamido Sanusi) to government is also factored in.

It is a no brainer that expansion in capital vote and economic recovery and growth will be challenged when N500bn is ultimately allocated out of every N1000bn aggregate revenue to debts servicing, particularly if consumption expenditure continues to spiral.

Will the 2017 budget be fully implemented with inflation rate at almost 20 per cent?

In reality, inflation reduces the purchasing value of all naira denominated income values. Consequently, the proposed N7.3tn 2017 budget will lose 20 per cent of its value, if inflation trends beyond 20 per cent and/or if the naira exchange rate further depreciates. Invariably, these seriously adverse monetary indices will clearly shortchange the scope of successful budget implementation.

What is the relationship between the Medium Term Expenditure Framework and Budget 2017?

The 2017-19 MTEF and Fiscal Sustainability Plan are a consolidated three-year plan which seeks to promote continuity and efficiency in the budget process. However, legislative approval of the MTEF should precede parliamentary consideration of the 2017 budget. In the absence of such an approval, the National Assembly may be constrained to return the Appropriation Bill to the President for review, if the content of the present fiscal plan is out of sync with the Parliament’s expectations. Clearly, such an outcome would further delay passage and challenge full budget implementation, particularly of the capital expenditure component.

Punch

END

Be the first to comment