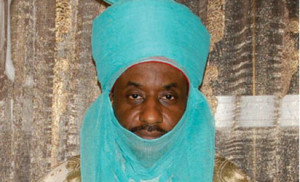

I perfectly understand where Emir Muhammad Sanusi 11 was coming from when, at the All Africa Business Leaders Award West Africa in Lagos last week, he not only added his weighty voice to the strident calls for the removal of the subsidy payments on fuel, but went as far as calling for the devaluation of the naira. If his exasperation with the Buhari administration’s fixation with the past – which I also share – was palpable, even more frustrating is the current situation in which Nigeria “in the first two quarters of this year… spent over 500 billion naira on debt servicing”, a figure expected to climb over the N1trillion mark by the end of the year. His summary that the sum involved is “more than the amount of money budgeted for health, education and defence combined” obviously calls for sober reflection.

I perfectly understand where Emir Muhammad Sanusi 11 was coming from when, at the All Africa Business Leaders Award West Africa in Lagos last week, he not only added his weighty voice to the strident calls for the removal of the subsidy payments on fuel, but went as far as calling for the devaluation of the naira. If his exasperation with the Buhari administration’s fixation with the past – which I also share – was palpable, even more frustrating is the current situation in which Nigeria “in the first two quarters of this year… spent over 500 billion naira on debt servicing”, a figure expected to climb over the N1trillion mark by the end of the year. His summary that the sum involved is “more than the amount of money budgeted for health, education and defence combined” obviously calls for sober reflection.

Certainly difficult to fault is his prescription that the federal government “shut down, especially those expense lines that have been known historically to be the sights of those seeking rent” of which fuel subsidy stands out; so also is his call for the expansion of the tax base and an increase in Value Added Tax (VAT) borne of sound realism.

I would even argue that the momentum for changing the status quo may have been lost by the federal government’s vacillation.

Again, I couldn’t agree more with His eminence when he says: “We can’t continue having an economy where we collect tax from oil companies, collect tax, maybe, from the telecoms companies, and then 60, 70 per cent of the GDP does not pay taxes.” Clearly, an overhaul of our entire tax system is long overdue.

Just as relevant is his historicity: “In 2009, we had a huge crisis. Oil prices crashed from 140 dollars to less than 40 dollars….But at that time, the government had a number of advantages. The previous administration had saved a lot. There were physical buffers”.

“The situation today is different. We spent years deceiving ourselves, calling ourselves the 21st biggest economy in the world based on something called rebasing. We said our debt to GDP ratio was 11 per cent and that the ratio looked very good. Yes we had a debt to GDP ratio of 11 per cent, but we were spending 33 per cent of government revenue servicing debts.”

His prescription of devaluation is however a different kettle of fish: “Let’s stop being in denial, we cannot artificially hold up the currency…If we have to make a choice between economic growth and devaluation, my recommendation is that we protect growth.”

His argument, though wearisome, is somewhat familiar: We should be easing monetary restrictions at this time, to allow the naira to find its true value (whatever that means), to stem the run on the foreign reserves, and ostensibly to halt the flight by portfolio investors said to be leaving in droves.

Such line of reasoning, I would argue, is not only specious but clearly disingenuous. That these are the kind of arguments you hear from boardroom gurus, our elite club of financial analysts, the so-called players and dealers in the financial markets sometimes leaves one to wonder about the interest(s) they represent.

Agreed, the current monetary policy restriction is bad business for many. For the trader whose sole merchandise is trade in tooth-picks; or the importer of rice who suddenly finds that he can no longer access the official foreign exchange window, and the importer of 39-odd assorted items effectively barred from making transfers from the local domiciliary account; these are hardly the best of times. It is understandable that the weeping have been quite strident among the members. These are however the minor players in the rot that have defined the Nigerian condition.

There is however another club for which the current restrictions have come to spell BIG TROUBLE. I refer to the elite club that have long perfected the art of preying on the financial system through illicit financial outflows. Because members of the class have the voice and money to buy spaces in the media, they are best placed to push their toxic agenda on the unsuspecting public. Their tools which could range from outright plunder through direct over-invoicing to illicit transfers packaged through such institutions as National Office for Technology Acquisition and Promotion (NOTAP) are only coming into focus because our store of foreign exchange once considered inexhaustible is drying up.

By the way, Nigerians would be seeing more wailing and gnashing of teeth in the coming days. The best we can do at this time is strip their pretence, their cleverly-disguised but less-than altruistic motives bare for the world to see.

I must make the point: Nothing can be said to be wrong with self-interest. Self interest is perhaps as old as Homo erectus; as a matter of fact, classical economic thinkers have long recognised it as one of the drivers of economic action. Modern nations do more than merely draw a line between special interests – particularly of an injurious kind– and the collective interest – going as far as aligning the former with the latter. In Nigeria, the reverse – or worse – is the case. In our case, our hordes of ruthless players exist merely to take advantage of our weak institutions to plunder and rape.

Clearly, these are what the current restrictions are expected to correct. Perfect resistance is therefore expected.

Back to the issue of the sweet-poison of devaluation being prescribed. Question is – what will it achieve? Pretty little that I can see. For a nation that produces next to nothing, it can only inflict more hardship and suffering – a situation of double jeopardy on the people. As for our volume of crude, it is set by OPEC quota which means that we cannot produce more even if we wanted to. As one would imagine, prices of goods are guaranteed to rise astronomically. For our hordes of ailing industries, input costs will certainly rise. For the many already in the throes of death, it would sound their death knell. By the way, where are the factories in the event of the devaluation to earn foreign exchange into the nation’s coffers?

For those vilifying the tight monetary policy measures, the question must be – what options are left for the monetary authorities in an environment where the economy is awash with slush funds but not enough to plough into the real sector? Allow the naira to continue to ‘find value’ until we have the Zimbabwe scenario in our hands?

Left to me, prodding the federal government to go after our big time actors involved in illicit capital transfers should deliver far more benefits to everyone that the hues and cries over nothing. Or what do you think?

NATION

END

Be the first to comment