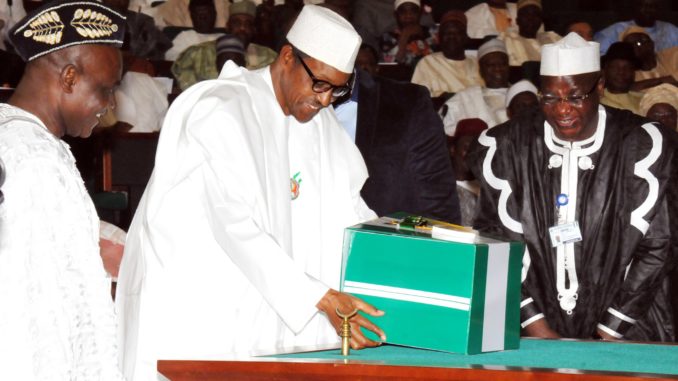

The 2020 Federal Government budget was presented to the National Assembly by President Muhammadu Buhari on 8th of October, 2019 at a time of subsisting domestic and global economic challenges. The budget is expansionary on the side of recurrent expenditures in recognition of domestic realities relating to payment of the new minimum wage and servicing of public debt which has become worrisome. Nevertheless, although the capital budget is about 24 percent of the total budget, if timeously and effectively implemented, the budget has the potential to achieve the objectives of increased pace of economic recovery and social inclusion. The fiscal and related reforms are commendable just like the government’s strategy of completing on-going projects in order to increase availability of critical infrastructure, obtain value for money and avoid waste of public financial resources. The fiscal reforms/Finance Bill will enhance revenue, improve the efficiency of public spending and reduce the cost of governance.

Although it has been rightly argued that the debt to GDP ratio is low compared to benchmarks, the debt service to revenue ratio is very high. This is the ratio to watch along with debt service to export ratio in the case of external debt. Considering that debt service accounts for about 24 percent of the proposed 2020 budget, while capital expenditure accounts for about the same proportion, it is imperative for government to carefully watch the growth of public debt. There is need to avoid the temptation to borrow to finance consumption. Where foreign borrowing is considered inevitable, the loans must be for projects that can contribute foreign exchange to service the debt or reduce the need for foreign exchange for importation.

The budget parameters and assumptions – crude oil production, 2.18 mbpd; crude oil price benchmark, US$ 57.00; exchange rate, N305 : US$ 1.0; GDP growth rate, 2.93% – are understandably conservative compared to previous budget estimates. It is not necessary for the National Assembly to review the oil price upwards; futures oil price projections for 2020 are in the mid –fifties. Should high prices prevail in 2020 fortuitously, the excess earnings above the benchmark can be used to build fiscal buffers or appropriated through supplementary budgets. The growth projection is realisable if the revenue estimates are realised and capital budget is reasonably implemented against the backdropof a normalised fiscal year. The payment of the minimum wage would also boost aggregate demand and growth just as sustenance of exchange rate stability and CBN interventions in priority real sectors would boost growth. However, going forward, the government would need to reconsider the budget exchange rate of N305.00 : US$ 1.00. It is being misunderstood as the face of a multiple exchange rate system whereas this is not the case and the Investors and Exporters (I &E) exchange rate is the primary exchange rate for foreign exchange transactions in the country. Using the official rate for budget estimates has implications for the estimated aggregate revenue available and budget deficit. Therefore, the public should be educated on the limited role of the official exchange rate; its harmonisation with the I& E exchange rate would not tantamount to devaluation of the naira in any way. Thereafter, the two rates should be merged.

The performance of budgeted revenue in the first half of 2019 indicates a serious revenue challenge for the Federal Government. Only 58 percent of the projected revenue was realised. In light of this, the amount of funds to be available for capital budget implementation in 2019 will be less than one trillion naira (about 31 percent implementation). Oil revenue is not predictable and the heavy reliance on non-oil revenue to implement the 2020 budget may be misplaced if revenue mobilisation is not stepped up aggressively. Nigerians need to appreciate the need to pay taxes so as to have public goods and services provided by the government. We seem to want government to provide almost everything, yet we are reluctant to pay tax. It is in light of this that we need to appreciate the Finance Bill which accompanied the budget. It has provision for VAT increase to 7.5 percent. This needs to be supported by all as the extant VAT rate of 5.0 percent is one of the lowest in the world. Importantly, the poor and vulnerable people will not be affected by the VAT as most of the goods and services they consume are exempted from VAT.

Finally, it is reassuring that President Buhari’s faith in national development planning is being sustained. The President stated in the budget that successor medium and long-term development plans to the ERGP and NV 20:2020 are to be prepared. The Nigeria Vision 20:2020 was never taken seriously by the previous government; indeed, it was set aside. One limitation of the ERGP is its not having an accompanying investment programme. Therefore, the successor ERGP should have an accompanying investment programme.

Obadan is professor of economics, chairman, Goldmark Education Academy, Benin City. And former Director-General, National Centre for Economic Management and Administration, Ibadan.

END

Be the first to comment