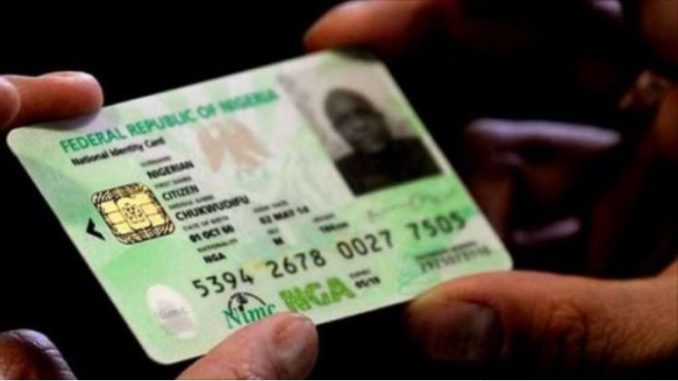

NIGERIA’S identity card system is about to get more complicated. This is after the National Identity Management Commission notified the public of its intention to launch three new national ID cards for 104 million Nigerians by June. Currently, there are different ID cards that have not been successfully implemented years after initiation. The new initiatives amount to a waste of time, and taxpayer’s money. Therefore, President Bola Tinubu should cancel it as it is a misplacement of priorities.

According to NIMC, the cards are a bank-enabled National ID card, a social intervention card for the vulnerable, and an optional ECOWAS National Biometric ID card. The NIMC assured Nigerians of a seamless registration process and delivery within two months of the launch. This is laughable. Years after initiation, many Nigerians are still struggling to register for the National Identity Number.

Justifying the rationale of the new cards, the Technical Adviser, Media, and Communications to the Director-General of NIMC, Ayodele Babalola said: “We expect the bank-enabled National ID to meet the needs of the middle and upper segments who typically use banks within the next one or two months after launch. Also, activation of the National Safety Net Card to meet the urgent needs for authentication and a secure platform for government services such as palliatives within the next one or two months.”

Essentially, this is a duplication of the existing ID cards. Nigerians carry many IDs. These include the Bank Verification Number, NIN, driving licence, and passport. Therefore, the introduction of these three new IDs to serve the same purposes is counterproductive. The BVN and NIN databases can assist the government in determining the demography of the financially vulnerable and the number of the unbanked.

The new scheme will entail huge costs. In 2019, the World Bank, the European Union and the Agence Française de Développement provided $433 million to support the NIN project. Therefore, NIMC should transparently disclose the cost of the new projects.

With support from the Central Bank of Nigeria, state and local governments, the tracking of the poor and vulnerable for palliatives should not be a cumbersome task that requires a special ID card. The ongoing NIN and BVN exercises should suffice for the new bank-enabled ID.

Nigerians have had harrowing experiences while applying for and acquiring the existing cards. Many go through endless strain to receive or renew their driving documentation and passports. Others suffered losses on their way to the registration centres, where electricity and internet connection could be erratic.

Since 2020, Nigerians have been grappling with linking their NIN to their SIM cards, leading to frustration. At least 42 million phone lines were affected by the threats of disconnection as of March by the Nigerian Communications Commission. Only 104 million citizens, or less than 50 per cent of the population, have their NIN.

It is the same torrid experience for Nigerians wanting to link their bank accounts with their NIN. Over 70 million bank account holders are at risk of being barred from accessing their accounts because they have not been able to activate their BVN. The policy threatens to plunge millions into financial uncertainty and hardship.

In a way, ID card schemes are backward. In 2011, the United Kingdom scrapped the national ID card. There, the passport suffices. Nigeria should gradually move in that direction.

The government should rejig the existing system to engender a seamless registration process rather than compound the situation. It should aggregate the existing databases to issue a single and multifunctional ID card.

END

Be the first to comment