A fresh warning of imminent famine by United Nations agencies crowned a week of bad news for Nigerians and the economy. The listing of the country among three vulnerable “hunger hotspots” followed a further spike in inflation, rising fiscal deficits, crippling debts and repayment obligations, as well as the continuing crisis in the energy sector. With no let-up in the COVID-19 pandemic and accompanying global meltdown, mounting insecurity and joblessness, the country urgently needs a coherent, comprehensive economic recovery plan to avert disaster.

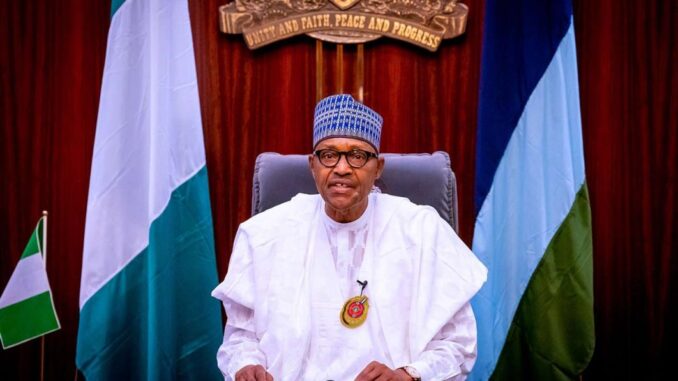

The country’s socio-political social fabric is stretched, compounded by a worsening economic crisis. Most Nigerians despair that in addition to his failure to keep the country safe, the President, Major General Muhammadu Buhari (retd.), also appears perplexed by the task of piloting the economy to prosperity. Yet, the country desperately needs a steady, dexterous hand on the wheel and a far-reaching emergency economic recovery plan. More than ever before, Buhari needs to empower an effective economic management team to weave all the ongoing programmes into an overall stimulus plan to revive production and commerce and create jobs.

The task is daunting. Inflation rate reached its highest mark in February at 17.33 per cent on higher food and energy prices. Federal fiscal deficits continued to rise, it was N1.48 trillion in the fourth quarter of 2020, said the Central Bank of Nigeria. Revenue collections atrophied under the lingering impact of the pandemic on the global and domestic economy and shortfalls in oil revenue, the victim of lower prices and reduced production quotas. Debts, domestic and external, and repayment obligations, are headed further north. By December, the Debt Management Office recorded additional N700 billion in Q4 to raise total public debt to N32.9 trillion. Though government officials remain smug over the relatively moderate 35 per cent debt-to-GDP ratio (up from 29.14 per cent in 2019), experts have warned that the indicator to watch is debt service-to-revenue ratio. This climbed to 61.4 per cent by 2019, compared to South Africa’s 13.7 per cent and well above the World Bank’s prescribed cap of 22.5 per cent, according to BudgIT, a non-profit. The government confessed to spending a staggering 99 per cent of its revenue on debt obligations in Q1 2020, crowding out funding for social services and poverty alleviation interventions. Pump head prices of petroleum products are moving higher again.

Amid all this, the Food and Agriculture Organisation and the World Food Programme jointly issued a fresh alert that millions of people in Northern Nigeria, Yemen and South Sudan, three of the 20 global “hunger hotpots,” were on track to face famine. They said these hotspots were already facing “extreme depletion of livelihoods, insufficient food consumption and high acute malnutrition.” Some 1.2 million persons in Nigeria are at risk “due to conflict and economic factors aggravated by the secondary effects of COVID-19.”

At the federal and state levels, remedial measures should be taken. Primarily, Buhari needs to lead effectively. The current disjointed plans should give way to an emergency master plan in coordination with the CBN that manages monetary policy and has several ongoing intervention programmes in various sectors of the economy. Recovery post-recession and the pandemic-induced meltdown requires not only spending the way out, but also spending creatively to maximise the objectives of boosting consumer income, retaining and creating jobs, propping up businesses, and reviving production, commerce and exports.

Nigeria often spends wrongly, borrowing for official consumption and for projects that are better left to private investment or partnership. Other governments target their spending specifically to reenergise their economies. The Guardian of London reports that Britain has spent £407 billion since 2020, over 40 per cent of its average yearly budget, to restart its economy; the European Union has rolled out another €750 billion recovery fund for its 27-member countries, while the recently legislated $1.9 trillion stimulus package raises America’s pandemic-related recovery spending to about $6 trillion. The OECD predicts that these interventions would have massive economic impact, accelerate savings and ensure a rebound. By putting “support for citizens and businesses front and centre,” the US economy is forecast to grow faster than China’s for the first time in years.

Improving the ease of doing business is essential. This entails achieving favourable lending and foreign exchange rates and trade tariffs more effectively. The ports must be cleaned up and multiple taxes, charges and levies on businesses by the three tiers of government harmonised. There should be a radical review of the troubled power sector; an economy powered by stand-by generators cannot realise its full potential. The CBN and the government need to support tech start-ups where, despite the odds, innovative Nigerian youths are proving their mettle.

Federal and state governments should place emphasis on attracting investment in agriculture, mining, SMEs and start-ups, transport and increased participation of women in economic activities. Providing basic infrastructure in the rural areas–access roads, storage and preservation, electricity, water, schools and clinics–is essential for success.

States must be self-reliant, devise autonomous economic policies and stimulus plans. In addition to federal recovery initiatives, five states–Kerala, Punjab, Tamil Nadu, Haryana and Karnataka–through local initiatives, were reported to be leading India’s economic recovery. States have to shake off their parasitic, sharing mindset and operate as autonomous economic units.

The Federal Government should stop borrowing for projects that would be more efficiently run and funded by private investment. Instead, like other pragmatic governments, it should privatise all its commercial assets to attract foreign and local investment, liberalise the operating environment, and foster competition and sustainable job creation. India’s massive privatisation plan for 2020/21 is expected to fetch about $24 billion from divestment from aviation, oil and gas and banking assets. Nigeria should follow suit. Insecurity and corruption must be tamed.

The roll-out of the vaccine programme and easing of the lockdown will stimulate business confidence. Without delay, Buhari should go beyond keeping idle advisory bodies and empanel an economic management team, meld together the diverse programmes and formulate an emergency comprehensive economic stimulus plan to promote a diversified, private sector-led economy.

END

Be the first to comment