Authorities in Seychelles have opened a criminal investigation into the multi-million dollar assets which Senate President Bukola Saraki and his wife, Toyin, are believed to hold through offshore shell companies in tax havens, PREMIUM TIMES can report.

Bukola and Toyin Saraki are being targeted by financial intelligence operatives for their “suspicious” use of offshore shell companies as uncovered in the Panama Papers investigation published in 2016, according to new records obtained by the International Consortium of Investigative Journalists and shared with PREMIUM TIMES and other partners.

Investigators at the Seychelles Financial Intelligence Unit said they are interested in determining whether or not Mrs Saraki stood as a front for her husband in the ownership of some of the offshore holdings linked to the family when a trove of offshore assets managed by Panamanian law firm, Mossack Fonseca, was leaked to the media.

The investigators are also working to determine if the transactions undertaken with the shell companies were used to launder funds or carry out other suspicious activities.

Two weeks after the Sarakis were exposed as owning undeclared offshore assets in violation of Nigeria’s code of conduct regulations, detectives from that country’s FIU asked Mossack Fonseca to furnish them with all documents relating to Sandon Developments Ltd, a firm registered in Seychelles under Toyin Saraki’s name.

Mossack Fonseca responded to the request on April 29, 2019, by forwarding a link to the PREMIUM TIMES article on the Panama Papers as well as all documents relating to Sandon Ltd, including international passports and business activities.

The status of the investigation, however remained unclear as there is no record of any update about it since Mossack Fonseca responded to the authorities’ requests at the end of April 2016.

Mrs Saraki registered Sandon Ltd in 2011 and used it to buy a family property at #8 Whittaker Street, Belgravia, London SW1W 8JQ.

Mr Saraki denied links to the offshore assets in 2016, saying they belonged to his wife’s family. But information obtained by PREMIUM TIMES at the time indicated that the Senate President merely used his wife as a front, and Seychelles authorities also found the denial unconvincing.

The revelations were amongst the findings of a lengthy investigation by the International Consortium of Investigative Journalists, German newspaper Süddeutsche Zeitung and more than 100 other global news organizations – including PREMIUM TIMES.

PREMIUM TIMES was the only Nigerian publication involved in the investigation, which lasted a year before the first set of stories started running on April 3.

For two weeks, Yusuph Olaniyonu, a spokesperson for Mr Saraki, did not return PREMIUM TIMES requests for comments about the criminal investigation of his principal and spouse in Seychelles.

Nigerian authorities had previously stated that they were investigating Mr Saraki’s offshore assets that were not declared in contravention of the law, but no charges have been brought against him.

Offshore shell entities are not necessarily fraudulent. There are legitimate uses for them by businesspersons across the world, but several other people, including criminals, have used them for untoward activities.

When Mrs Saraki registered Sandon Ltd on January 12, 2011 in Seychelles, she listed Babatunde Morakinyo, a long-term personal aide and friend of Mr Saraki, as a shareholder.

Mr Morakinyo was amongst the top aides of Mr Saraki who were identified by the Economic and Financial Crimes Commission as laundering billions of naira in suspected bribes from the Paris Club refund to Nigerian states in 2017.

While incorporating that Sandon Ltd, documents show, Mrs Saraki bought a curious service from Mossack Fonseca, the Panamanian firm under which she tucked the hidden assets.

PREMIUM TIMES further reported at the time that Sarakis used nominee directors in order to perhaps avoid being identified as the beneficial owner of Sandon. Nominee directors are sometimes used in tax havens to conceal real owners of companies and assets.

She then made an undertaking indemnifying the Panamanian company “in respect of all claims, demands, actions, suits, proceedings, costs and expenses whatsoever as may be incurred or become payable by you in respect of or arising out of any member or employee or associate of your company or associated companies holding any office, directorship or shareholdings in the company or by reason of or in consequence of any act or decision made by any such person or company in connection with the management and/or administration of the said company.”

Shortly after the company was incorporated, Mrs. Saraki used it, in July 2011, to buy the property on Whuttaker Street, Belgravia, London SW1W 8JQ.

The property, acquired from Renocon Property Limited, a company registered in the British Virgin Island, was never disclosed to Nigerian authorities as required by the country’s code of conduct law.

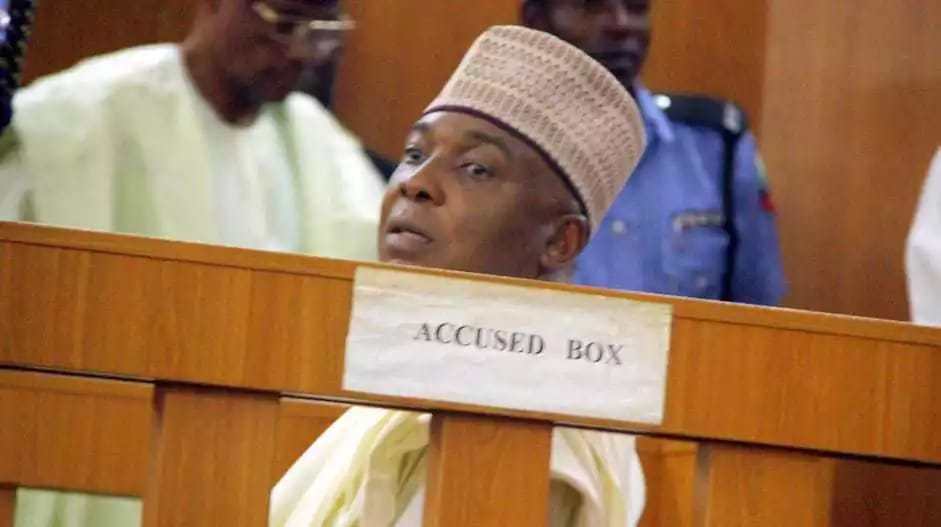

The revelations came at the time Mr Saraki was being tried by the Code of Conduct Tribunal (CCT) for failing to properly declare his local assets when he became governor in 2003, 2007 and when he moved to the Senate in 2011, having completed the two terms allowed under the Constitution.

In June 2017, the CCT found Mr. Saraki not guilty on all the 18 counts of false assets filings as brought against him by the Nigerian government.

The Nigerian government challenged the ruling at the Court of Appeal, which affirmed the conclusion of the tribunal on all but three counts in aDecember 12 ruling. Mr Saraki appealed the decision to the Supreme Court.

The Supreme Court is scheduled to deliver its judgment in the appeal on July 6.

Be the first to comment