Four separate documents retrieved from the massive #PanamaPapers database have countered the claim by the founder of the Synagogue Church of All Nations, Temitope Joshua, that he had no link with any offshore company at the British Virgin Island (BVI), a notorious tax haven.

PREMIUM TIMES had, as part of its #PanamaPapers coverage, exposed Mr. Joshua, one of Africa’s most famous televangelists, as having link with Chillion Consultancy Limited, a shell company incorporated in BVI on June 20, 2006.

But shortly after the story ran, the pastor posted a statement on his church’s Facebook Page, denying ownership of the company and suggesting the report was fabricated to pull him down.

However details in the documents PREMIUM TIMES is now making public point directly at Mr. Joshua and his wife as owners of Chillion Consultancy.

The documents include:

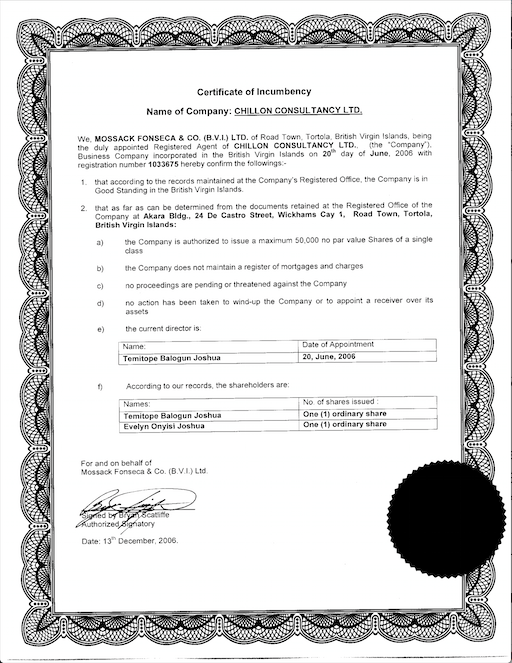

Certificate of incumbency which shows the company as being in good standing at least until December 13, 2006

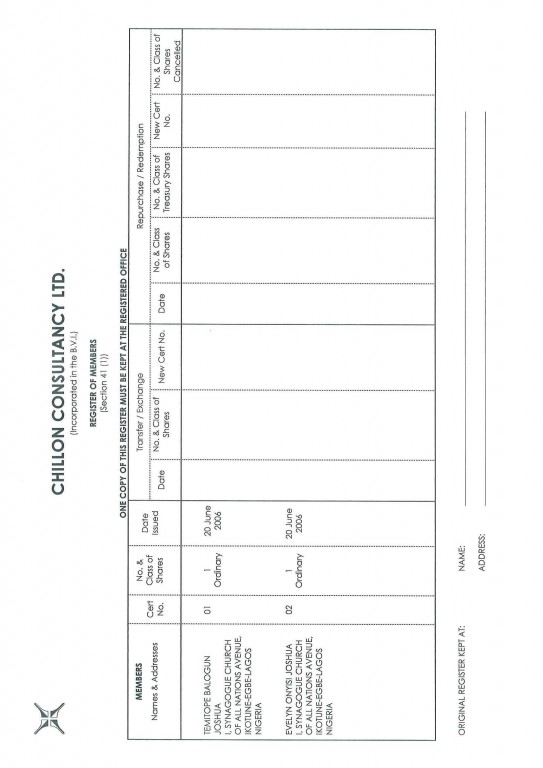

Register of members

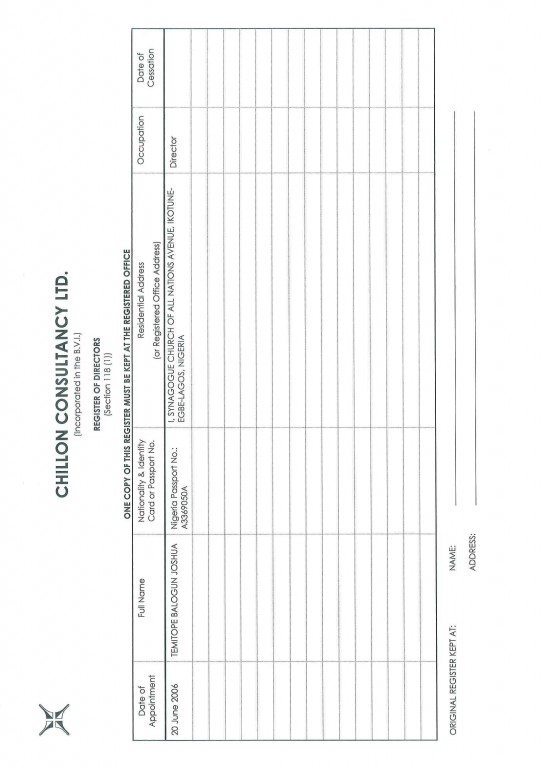

Register of Directors

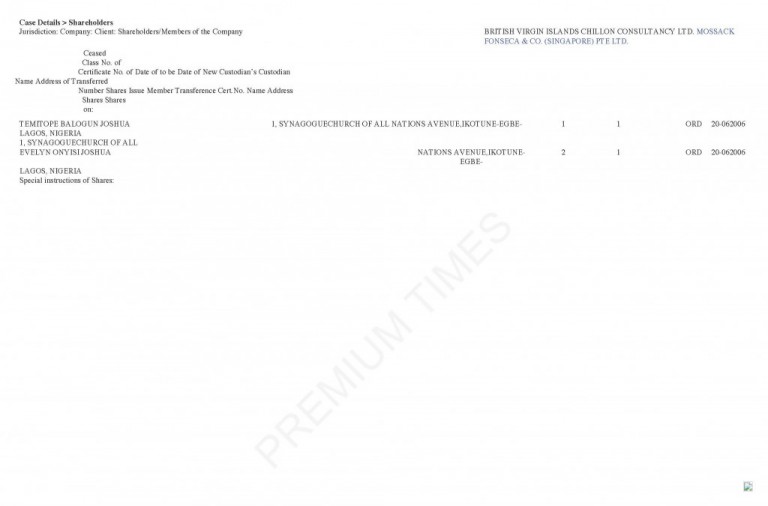

Case Details – Shareholders/members of the company.

The documents show that while incorporating the company, Mr. Joshua or his agent provided Mossack Fonseca with details of his valid passport at the time with which he was identified in all transactions related to him and the company.

Mr. Joshua’s passport number at the time was A3369050A, and that was reflected in the Panamanian law firm’s record.

The documents show that the pastor and his wife owned one ordinary share each, although the company, with registration number 1033675, was authorized to issue a maximum “50,000 no par value Shares of a single class”.

The document also revealed that Chillon Consultancy Limited has no physical address but uses the office address of its registered agent, Mossack Fonseca (Akara Bldg., 24 De Castro Street, Wickhams Cay 1, Road Town, Tortola) as its contact information in the British Virgin Island.

The pastor had ignored multiple telephone calls and an email requesting him to comment for the story before it was published. A spokesperson for the church, who answered his telephone, insisted “the man of God was not available to answer your call.”

He advised the reporter to send an email. But even that email is yet to be responded to.

Mr. Joshua’s name popped up as PREMIUM TIMES dug into the leaked internal data of the Panama-based offshore-provider, Mossack Fonseca, obtained by the German newspaper Süddeutsche Zeitung and shared by the International Consortium of Investigative Journalists (ICIJ) with PREMIUM TIMES and over 100 other media partners in 82 countries.

The unprecedented year-long investigation involving 11.5 million secret documents – which stretched from 1977 to December 2015 – exposed the hidden underground of the world economy, a network of banks, law firms and other middlemen that utilize shell companies, sometimes using them to hide illegal wealth.

The 2.6 TB files, involving 214,488 entities, also revealed hundreds of details about how former gun-runners, contractors and other members of the spy world use offshore companies for personal and private gain.

The investigation unveiled the cloak of secrecy provided by Mossack Fonseca, a law firm that specializes in creating offshore companies, some of which have been used by con men and women to hide Ponzi schemes, predatory lending scams, and other financial frauds from their victims and from the authorities.

Many people using offshore companies do so legally and offshore companies indeed have many legal purposes.

But shell companies like Mr. Joshua’s, experts say, are entities that have no active businesses and usually exist only in names as vehicles for another company’s business operations. In essence, they are corporations that exist mainly on paper, have no physical presence, employ no one and produce nothing. They are frequently used to shield the identities of owners and/or to hide money.

Because shell companies are at times associated with fraud, their activities are of big concerns to international bodies such as the Organisation for Economic Co-operation and Development (OECD).

Money laundering, billing schemes, fictitious service schemes, bankruptcy fraud, tax evasion, and market manipulation are some of the fraudulent activities facilitated by shell companies, several past investigations by ICIJ and this newspaper have shown.

END

Be the first to comment