Nigeria’s economic diversification initiative has been more about political pronouncements than real efforts to not only broaden the base of the country’s resources, but raise the volume of output and revenue. of course, diversification has become imperative, given that the nation’s offerings at the international market are commodity-based, without significant value addition and subject to several shocks.

An economist and Head of the International Trade Centre, Arancha Gonzalez, observed that “growth without diversification, technological improvement and increased productivity is easily reversed. All it takes is a dip in commodity prices.”

True to this sentiment, Nigeria has severally experienced the rampaging economic consequences of ignoring the importance of diversification. In the last two years, it has not been the same compared to nearly three decades, as commodity crisis-induced recession brought the economy to standstill. Till date, it is still “fragile”.

The age-long diversification mantra has become indelible in the vocabulary of any existing government, with officials making it a daily discourse, once the fortunes of the major foreign exchange earner- crude oil, begin to totter. Fortunately or not, the commodity has always been the rescuer, but government will again relax and relapse to the “usual.”

The renewed campaign for economic diversification started with the former Minister of Finance, Dr. Ngozi Okonjo-Iweala, as she read the signs of dwindling crude oil fortunes towards the end of 2014. She quickly declared the country austere, but scripted set of tax opportunities inherent in luxury items as part of palliatives for government’s budding fiscal crisis. Unfortunately, she did not pursue the plan to logical conclusion, as it would require legislative pronouncements.

Nigerian-born Dr. Philip Emeagwali, according BrainyQuote, once said that “Nigeria is a West African nation of over 100 million energetic people. It is endowed with lots of natural resources, but lacks human resources.”

Indeed, the observed lack of human resources is not about certificates and exposure, but may well include the obvious dearth of self and political will and ingenuity, needed to transcend any seeming impossibility.

A politically exposed person and economist confided in The Guardian that the lack of real diversification in the country has only revolved around evolving efficient strategy, commitment and implementation. “It is the mediocrity seen around the corridors of power overtime, that has no ground, much-less of standing the ground, and has nothing to offer, but would not quit for anything, including obvious incompetence. That is the setback of Nigeria’s diversification and it is far from over.”

Complicating efforts

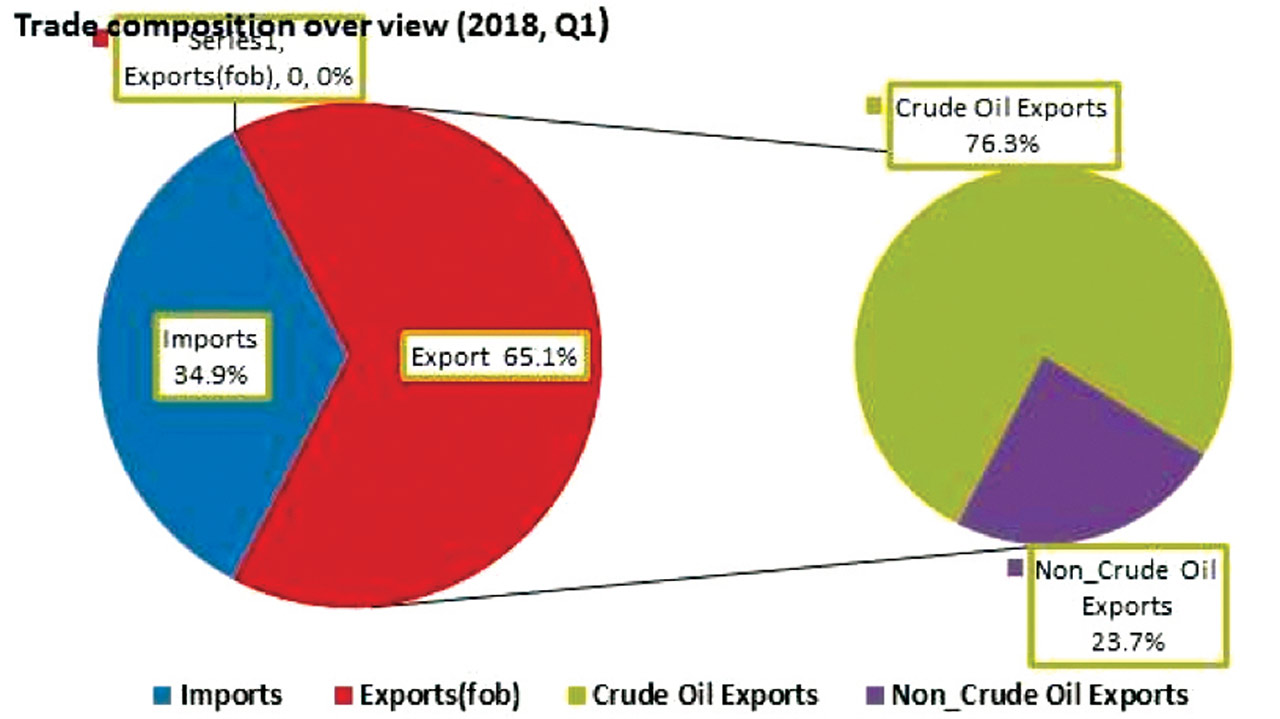

Granted, Nigeria’s Balance of Payments (BOP) position as at first quarter of 2018, showed strong external position, with a surplus of $7.3 billion, but the inflows were dominated by the crude oil and gas market, a clear vulnerability to external shock and a confirmation of the country’s shallow status in the diversification scheme, despite the campaign.

Specifically, the country’s inflows into the current account in the period under review were dominated by crude oil and gas exports, accounting for 93.28 per cent of total exports and 64.46 per cent of total inflows. It would be regrettable to know that right in front of the nation’s major gateway- Apapa ports, export-bound non-oil commodities lose value due to unending gridlock, caused by combined lame strategy, non-prioritisation of projects, poor enforcement of rules and lack of effective implementation of policies.

The continued siege by the drivers of articulated vehicles to one of the most important road networks in the country’s economic nerve center- Lagos State, is nothing short of dearth of ideas and tacit admittance by the country’s leadership at all levels. It betrays the acclaimed successes in the ease of doing business.

A motorist, who identified himself as Mr. Otalor, described the long years of Apapa gridlock as a show of shame, especially as billions of naira, “including the possible over invoicing,” were spent on the construction of the highway few years ago, but now surrendered to “illiterate” tanker drivers, by “weak and selfish leaders.”

“We only have leaders who do not think about the link between gridlock and man-hour losses and cannot correlate it in terms of naira and kobo. They only count money when they want to embezzle it, not for development. Nigeria’s diversification is only a story,” he said.

But the Executive Secretary of the Nigeria Investment Promotion Commission, Yewande Sadiku, in an exclusive chat with The Guardian, admitted that the pace of the diversification remains hampered by may challenges, explained that the level of commitment by the present administration would have been felt better if the previous ones had laid a palpable foundation.

“This government has not entertained the idea of relying on oil any more. But diversification does not mean that we don’t need the oil. In fact, we need the oil to achieve the diversification because that is where the bulk of the revenue comes.

“For now, the government has shown interest in diversifying by using the gas for electricity generation and building infrastructure. The efforts to fix the cause of the gridlock should have happened before now. This government has chosen to be part of the solution to that crisis.

“But I think it is more important to try to attract investor attention to other avenues that can be used for entry and exit in Nigeria. This means, ensuring that other ports actually develop and not concentrate only on one point of entry. Take note that this cannot be done overnight,” she said.

There is also observed bureaucratic bottlenecks in the registration of products under the ECOWAS Trade Liberation Scheme (ETLS), currently being managed by the Foreign Affairs Ministry, as it is now impeding export of goods from Nigeria to other West African countries.

The Lagos Chamber of Commerce and Industry (LCCI) has raised concerns that the fusion of the Ministry of Integration and Economic Cooperation, which had responsibility for facilitating trade with other African countries, into the Ministry of Foreign Affairs, has further increased the officialdom in the region.

The chamber’s President, Babatunde Ruwase, suggested that the administration of ETLS should be moved from Ministry of Foreign Affairs to the Ministry of Industry, Trade and Investment, specifically, the Nigeria Investment Promotion Commission (NIPC), to improve the administration of trade protocol and serve exporters better.

The International Monetary Fund (IMF), on economic assessment of the country, led by the Senior Resident Representative and Mission Chief for Nigeria, Amine Mati, affirmed that the relative stability in the economy is driven mainly by higher oil prices and portfolio flows, which have helped strengthen fiscal and external buffers and not non-oil exports. So, where is the diversification?

“Higher oil prices and short-term portfolio inflows have provided relief from external and fiscal pressures but the recovery remains challenging…activity in the non-oil non-agricultural sector remains weak as lower purchasing power weighs on consumer demand and as credit risk continues to limit bank lending,” he said.

According to him, revenue from higher oil prices is limited by net losses from retail fuel sales, while non-oil revenue remains below expectations, with yields from tax administration measures—including the Voluntary Asset Income Declaration Scheme (VAID) and increased tax audits—yet to fully materialise.

Mati said that a coherent set of policies to reduce vulnerabilities and increase growth, there is urgent need for specific and sustainable measures to increase the currently low tax revenue, avoid new tax exemptions and ensure that budget targets are adhered to even in an election year.

Budget tardiness

Although various administrations have always been reactive to observed yearly budget irregularities, particularly the recurring repetition of items, ambiguous terms, fictitious project items and the associated bogus allocations, the outcome of the implementations have always justified the allegations.

But the failure to implement capital projects has raised more concerns, especially as the budget component has in the last three years been financed by borrowing, which attracts huge costs running into trillions of naira and calling to question the claims on economic diversification.

The development, which has been described as flagrant display of incompetence, indolence and unending tardiness, caused by late preparation and passage of the yearly budgets, as well as unnecessary lengthy procurement processes, has resulted to incomplete implementation of capital budget. The latest is that N118 billion meant for capital projects for 2017 fiscal plan was returned.

Fiscal governance campaigners, in a chat with The Guardian, said it is a show of irresponsibility for the country to borrow huge funds in the name of capital expenditure items, with associated interest rates, only for the government to keep the fund idle, when the country is littered with parlous infrastructure.

The country’s first Professor of Finance and Capital Markets and Chair, Banking and Finance Department, Nasarawa State University Keffi, Uche Joe Uwaleke, said it is ridiculous that the problem is not usually associated with recurrent spending, as agencies strive to exhaust whatever is allocated to them.

There is observed lengthy procurement process that takes up to six months, in some cases, before a contract can be awarded, causing a snag in the ease of doing business as regards the facilitation of diversification efforts. If the government is serious, this has to be looked into to reduce the chances of having unspent funds by critical agencies of government that require them.

But Uwaleke warned that the late release of funds for implementation of capital projects would also continue to hold the economy down. “The way forward requires amendment of the procurement Act, timely passage of the appropriation bill and release of funds. This also speaks to the need to diversify the revenue base of the government, especially ramping up tax revenue.”

The Executive Director of Abuja-based OJA Development Consult, Jide Ojo, said it is ironical that the little money earmarked for capital projects is not expended in a 12 calendar month budget cycle, necessitating the ugly scenario where the money, which, in the first place, is inadequate to fix infrastructure, is returned to the treasury as unspent funds., querying the claims of infrastructure development for diversification.

“This smacks of incompetence, indolence and incapacity. Imagine Ministry of Works, Power and Housing returning a whooping N66bn when there is yawning infrastructural needs. In fact, many contractors are being owed huge sums of money. This is incredulous,” he said.

A lawyer and fiscal governance campaigner, Eze Onyekpere, was concerned about if such money was actually returned, as a return of unspent fund would actually follow a proper channel, which is an official quarterly or yearly budget implementation reports. Noting that the trend is not the way diversify and stabilize economy.

“The fact that money was available, but had to be returned, tells a lot of story about capacity and management issues. Coming at a time the government complains of lack of resources to implement the budget, it is an unfortunate development which needs to be investigated, especially to confirm the reason(s) for the return of the monies.

“I agree that money must not be spent simply because it was budgeted. I also that procurement challenges may also hamper financial expenditure, particularly if the background technical studies and assessments have not been done before appropriation. But these happen when there are fundamental challenges with the budgeting process,” he said.

END

Be the first to comment