Nigeria’s economy is still Africa’s number one, notwithstanding the 30 per cent drop in the currency last month knocked almost $150 billion off its Gross Domestic Product (GDP).

South Africa, which has regained second place after overtaking Egypt, is closing the gap, although its economy also shrank with the weakening of the rand. The gap between both economies has narrowed to $60 billion from $170 billion at the end of last year.

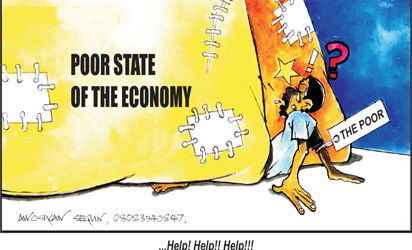

The International body said the economy could contract, even as Renaissance Capital Limited’s analyst, Yvonne Mhango urged the government to address the sundry economic issues facing the country.

Last month, with the CBN’s forex policy, the naira depreciated after a 15-month currency peg curbed investment and contributed to a 0.4 percent contraction in the economy in the three months through March.

According to the IMF, the four-month delay in passing the record N6.1 trillion ($21.6 billion) budget, meant to stimulate growth by spending on roads, ports and electricity generation, will reduce its efficiency.

The administration’s vision to diversify the economy which relies on oil for more than 70 percent of revenue, has not translated into big investments, and infrastructure to support local manufacturers doesn’t exist yet, according to Mhango.

She regretted that not much has been heard enough on how the government planned to improve and make the business environment more conducive. She added in a statement that there has been little color on fiscal policies to drive the growth agenda.

Nigeria is facing a revenue squeeze as oil earnings fail as a result of militancy. The naira peg at 197-199 per dollar, compared with an unofficial exchange rate of 340 per dollar just before the currency was allowed to float, caused fuel shortages for months as businesses struggled to access foreign currency to place orders.

“It is not sufficient to focus on going from a de facto peg to a flexible regime,” IMF’s Resident Representative in Nigeria, Gene Leon, said.

“The authorities need to be announcing at the same time how the change affects fiscal policy, how is it impacting inflation, balance sheets of corporates, balance sheets of the banks, and how the increased fiscal receipts allows the undertaking of development,” he stated in a statement.

END

Be the first to comment