“By advancing new measures, pushing banks to extend their lending activities, the CBN is filling the policy void in the prolonged absence of a new cabinet. Unfortunately, neither the new minimum loan-to-deposit ratio nor the reduced maximum amount for which banks will receive interest on their deposits with the CBN change the underlying conditions…”

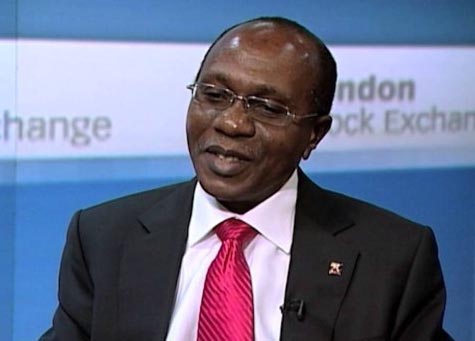

In late June, Godwin Emefiele, governor of Nigeria’s central bank, unveiled a five-year policy roadmap to guide his second five-year term. Mr. Emefiele desires faster economic growth, slower inflation, more non-oil sector output, greater financial inclusion, ample jobs, stronger banks and more private sector credit extension. To these ends, he announced a raft of new regulatory measures in early July.

Nigerian banks would be required to maintain a minimum loan-to-deposit ratio (LDR) of 60 per cent by end-September. The LDRs would be reviewed quarterly afterwards. In the computation of the LDR, a greater weighting of 150 per cent would also now be assigned to lending to small and medium-sized firms, and for retail, mortgage and consumption purposes. Should a bank not meet these new criteria, half of the shortfall would be parked at the central bank by way of an additional cash reserve requirement.

The central bank also announced modalities for a single-digit long-term financing initiative for the information technology, movie, and fashion sectors. To engender greater financial inclusion and meet its 80 per cent target by 2020, banks are also now not required to seek prior regulatory approval to offer mobile money services.

“Bold and ambitious about his desires but without the recommended dose of realism that Nigeria’s increased vulnerability to external shocks require. The plan seeks to pursue single digit inflation, high growth and increased banking sector involvement with the economy but makes little mention as to likely trajectory of the key policy anchor (the exchange rate).”

Of much interest is the CBN’s recapitalisation drive for banks. While the new minimum capital threshold is yet to be announced, Mr. Emefiele’s ambition of having Nigerian banks amongst the top 500 global banks suggests it might be high indeed. What do analysts and portfolio investors think? I asked Malte Liewerscheidt of Teneo, a consultancy in London and Wale Okunrinboye, head of investment research at Sigma Pensions in Lagos.

Malte Liewerscheidt, vice president at Teneo

By advancing new measures, pushing banks to extend their lending activities, the CBN is filling the policy void in the prolonged absence of a new cabinet. Unfortunately, neither the new minimum loan-to-deposit ratio nor the reduced maximum amount for which banks will receive interest on their deposits with the CBN change the underlying conditions that make it unattractive for banks to lend in the first place. In fact, the CBN’s obsession with the exchange rate has led the apex bank to sell more and more open market operations (OMO) securities that offer a high-yield, risk-free alternative for banks, effectively preventing them from handing out more loans to the real economy.

Wale Okunrinboye, CFA, head of investment research at Sigma Pensions

I found the substance of the plan a little unchanged from his inaugural statement in 2014: Bold and ambitious about his desires but without the recommended dose of realism that Nigeria’s increased vulnerability to external shocks require. The plan seeks to pursue single digit inflation, high growth and increased banking sector involvement with the economy but makes little mention as to likely trajectory of the key policy anchor (the exchange rate). In line with historical trends, the exchange rate is the eternal obsession of the CBN and one which assumed a larger-than-life status under his first term.

“On growth and inflation, to drive a large expansion in the former, we need to see some sizable fiscal policy adjustments which may be potentially inflationary (flexibility around fuel and electricity prices) and will work to limit the scale of any dovish monetary policy aspirations. Not doing them means economic growth remains at this ‘Ijebu’ two per cent level.”

At the heart of the present FX strategy is a play on offering a high interest rate differential on OMO bills to foreign portfolio investors to shore up the Nigerian naira at its increasingly over-valued level. This tactic, which is not a radical departure from policy under Sanusi, is essentially an enlarged bet that external conditions remain benign (dovish Fed + above $60/bbl oil price) over the medium term. That said, the quantum of these FPI inflows into short-dated CBN T-bills ($16 billion) have become significant, relative to FX reserve levels ($45 billion), which means that any adverse change on the external front would easily derail the plan.

On growth and inflation, to drive a large expansion in the former, we need to see some sizable fiscal policy adjustments which may be potentially inflationary (flexibility around fuel and electricity prices) and will work to limit the scale of any dovish monetary policy aspirations. Not doing them means economic growth remains at this ‘Ijebu’ two per cent level.

Lastly, just as we are now used to multiple exchange rates, I think we are likely to increasingly see multiple interest rates (one based on CBN intervention funds and another based on market conditions). In all, my thoughts are we are likely to see greater unorthodoxy in the event of an unfriendly external environment: Not that orthodox solutions offer much hope when fiscal policy makers are not sincere about reforms but an orthodox approach assures on the credibility of CBN’s forward guidance, which markets require.

Rafiq Raji, a writer and researcher, is based in Lagos, Nigeria. Twitter: @DrRafiqRaji

END

Be the first to comment