I welcome the House of Representatives decision to probe the $400 million Chinese loan. But the probe appears to primarily focus on the sovereign clause in the loan agreement. Indeed, this was what triggered the alarm about the loan because those of us not tutored in the intricacies of international law fear that the said clause would amount to China legitimately annexing Nigeria as its new province if it defaults in the loan repayment agreement. We would become black Chinese.

The possible loss of our sovereignty as a debtor nation naturally offends the foot soldiers of patriotism. You cannot blame them. But the possibility of a creditor-nation annexing a debtor-nation is so remote that pushing that line of argument would only give ignorance some credit. The probe must not be allowed to fall on its face because of this.

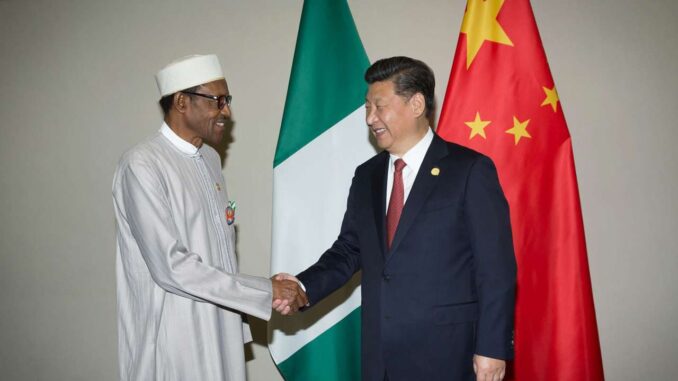

There are more fundamental issues here that must be dealt with by the probe as we watch the Buhari administration piling up debts from all willing do-gooders ready to bail out a nation in desperate financial straits. The government reasoning that it needs the loans to fix our dilapidated infrastructures is not without its merits. These dilapidated infrastructures are a sure drag on our national development. Progress must follow the infrastructures. So, it first embarked on its loan shopping spree with the $30 billion jumbo loan from the World Bank/IMF, the same Bretton Woods Institutions whose conditionalities attached to its loans generated howls of national protests in the eighties, to fix our infrastructures. Since then the Buhari administration has borrowed more and more money from China and elsewhere for the same purpose.

Borrowing per se is not the problem. It is inevitable in the public as well as the private sectors. No country can earn all the money it needs from its internal sources. Nor is the country strange to borrowing. After all, the banking system was created for lenders and borrowers to survive. Still, the possibility of debts morphing into a burden waves the red flag in the face of all nations.

The Obasanjo administration freed us from the debt burden when it successfully negotiated debt forgiveness from the Paris Club and other creditors. If that did not happen this country would be flat on its back by now. We thought that that hole from which the country was dug out taught us some important lessons in the management of the national economy. Apparently not. The current debt burden is put at some N10 trillion. When the $400 million Chinese enters the picture, it would get uglier and the future grimmer.

The problem is that borrowing does not represent a skilful management of the national economy. But a skilful management of the economy is what we need now. The days of easy options through external loans should be over by now. The national economy faces existential threats. It bleeds from low earnings from its main source, crude oil. It bleeds from the security challenges on which the government spends millions of Naira in the war against Boko Haram and bandits. It bleeds from the COVID-19 health challenges. And of course, it bleeds from the broken down infrastructures. These challenges cannot be met with the easy of option of going out, a begging bowl in hand, seeking do-gooders with some money to spare. They require creative thinking outside the box.

I am not saying anything new in pointing out that if we do not get the economy right we cannot get anything right. The economy is about money; money is the instrument for development. The love of money may be the root of all evil but the lack of it is the evil itself for nations and individuals. When the country takes a loan to fix a road, for instance, the primary beneficiary is the road contractor. You take the money and pass it on to the contractor. It does nothing for the economy by way of its husbandry, even if the road is built.

By the way, the dilapidation of the infrastructures did not happen overnight. It crept up on us because our maintenance culture has become anathema to our national development. We would rather watch a federal government road deteriorate until it becomes impassable in order to award a jumbo contract to rebuild it, often at more than four or five times the original cost of building the road. It is not a mark of progress; it is rather evidence of a country that feeds contractors and consultants and matches on one spot.

Do what we may, we cannot hide the truth that the times are getting harder for both our national economy and the global economy. The twin evils of debt trap and debt burden cast a looming shadow on the future solvency of our country. It should matter more deeply to us than it appears to do at the moment. Our national economy would take a big hit in the post COVID-19 pandemic world economy. The government should begin to show some evidence that we are preparing for those difficult times ahead. Loans from China and other lenders would avail the nation almost nothing if we insist on maintaining the status quo in the management of our national economy.

The first step is to end the borrowing spree, look inward and see if there are not more viable domestic options to the external loans. On Wednesday this week the House of Representatives, in the course of its current investigation of the $400 loan from China, said that “Nigeria does not need to seek external borrowing especially from China if the MDAs properly remit their internally generated revenues.” The chairman of the house committee on finance, James Faleke, put it rather nicely when he said “in the past few weeks, we have been talking about Chinese loans when the money is there in the system. We have the money in Nigeria but we are not doing the needful.” As we like to say, what we are looking for in Sokoto is right there in our sokoto.

Secondly, it should be clear to us that if the managers of our national economy continue to manage it the way they have always done, the economy would continue to be a major problem, able and willing to bring every administration to its knees. No national economy manages itself. If we squandered riches in the past, we need not squander opportunities for a more creative and pragmatic management of our economy in the present.

We may not go the way of President Ibrahim Babangida’s structural adjustment programme, but SAP remains, in my view, a sensible and creative policy intended to deal with the fundamentals of our national economy, to wit, the restructuring of its base to put the nation in command of its own economy. Solutions are lacking only when ideas are lacking. This seems to be the problem of the present administration. Human progress is driven by ideas and it is killed by lack of ideas.

It is not the business of the Buhari administration to burden the national economy beyond what it is carrying at the moment. If the administration is looking for a legacy, then it should think of leaving the legacy of a sound national economy such that our dear country moves from being perpetually potential to fully realise its potentials – and we can offer the crown as the poverty capital of the world to a more deserving country. I am sure that if the managers of our national economy think hard enough they would likely come up with something to make the management of the economy more effective and thus prepare the country for the greater challenges, the challenges of the post pandemic national economy.

I hope the probe of the Chinese loan by the House of Representatives would reach that conclusion so that our children and grandchildren are not burdened with paying for what their papa chopped

END

Be the first to comment