MTN has agreed on a deal to sell a stake in its fintech business to Mastercard for an undisclosed sum, in line with the operator’s long-term goal of raising cash from asset sales and its financial services platform.

In its H1 earnings announcement, the South Africa-based company said it signed a memorandum of understanding (MoU) with Mastercard for the latter to make a minority investment into its fintech business, based on an enterprise valuation of around $5.2 billion.

MTN previously targeted a valuation of between $5 billion and $6 billion for the unit.

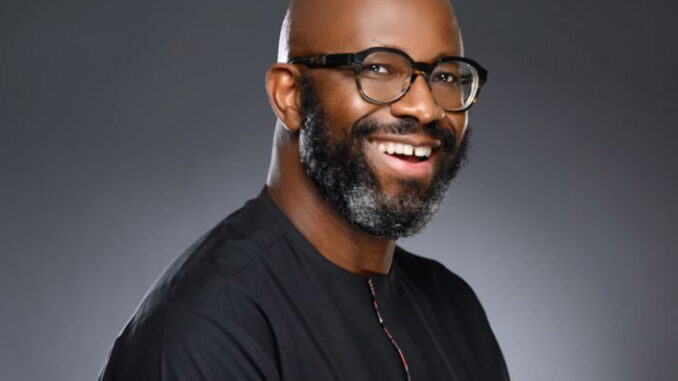

Chief Executive Officer of MTN, Ralph Mupita, said it chose MasterCard following a bespoke process to identify potential minority investors for the unit and it expects to sign a definitive agreement in the very near term, following customary due diligence.

According to Mupita, the commercial agreements executed with Mastercard will support the growth and profitability of MTN’s fintech services, such as payments, remittances, and the development of technology infrastructure

He said: “As a globally recognised brand and a leading international payment systems company, Mastercard will enable Mobile Money (MoMo) consumers to pay globally and MoMo businesses to digitise their payments and accept payments beyond MoMo users. This will enable Group Fintech customers to participate in the global economy.”

According to Mupita, MTN’s active MoMo users were flat in the current reporting period at 60.5 million, due to the effects of the cash shortages in the first quarter and a strategic shift in focus to wallet consumers in Nigeria; as well as a user base clean up in Côte d’Ivoire.

The transaction comes as MTN Group is expanding its fintech business, putting the telecoms company on a solid footing, as it prepares to separate its financial services division.

Mastercard has also invested $100 million in MTN rival Airtel Africa’s mobile money unit.

For MTN, the sale complements its Ambition 2025 project unveiled two years ago, which outlined a strategic repositioning to separate infrastructure assets and platforms like fintech to attract third-party capital, investments and partnerships.

In H1, the company booked service revenue of ZAR107.7 billion ($5.7 billion), 16.5 per cent increase year-on-year, fuelled by gains in data and its fintech business Nigeria was a strong performer, with service revenue up 24 per cent to ZAR43.6 billion.

Growth in South Africa was more modest, up 1.9 per cent to ZAR20.4 billion.

Subscribers increased 3.6 per cent to 291.7 million, although mobile money customers remained at 60.5 million. Mobile money transactions increased 61.6 per cent to $135.2 billion.

END

Be the first to comment