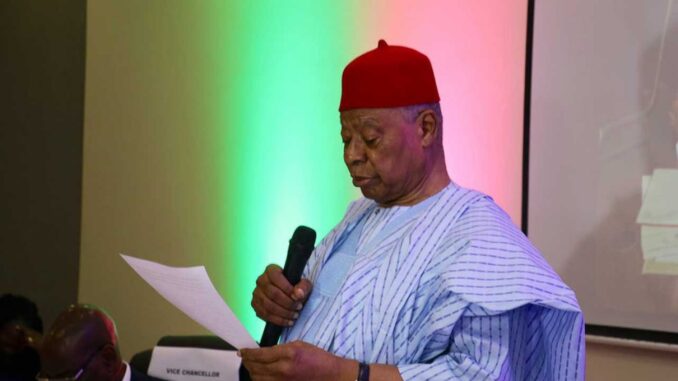

The Director of Arthur Mbanefo Digital Research Centre (AMDRC), Dr Taiwo Ipaye and The Deputy Vice Chancellor (DS) of University of Lagos Prof. Ayo Atsenuwa welcomed guests and invitees to the 4th lecture entitled: Impact Investing – The Way Of The Future in Nigeria. The Guest Lecturer Dr. Yemi Cardoso took over the stand and gave his lecture which, basically, related to how strange it is to him that so much funding outlets all over the world, waiting for Nigeria as the largest market in Africa to access it, especially impact investment funding, and yet Nigeria has no appetite for it. According to him, seemingly, nine quadrants and their matrix determinant could help interested fund managers access the over $1trillion available in the market.

That is, package a project that could have a reasonable mix of: care for the environment; humanistic corporate social responsibility; investing to care for a given religious belief group; carving a niche that makes for a change in the world; creating industries that are mission-related like solving the United Nations’ Sustainable Development Goals in which no fewer than 130 million Nigerians, living below poverty level, could find new lease of life; bottom of the pyramid investing to help the rural people have a sense of belonging; creative capitalism which blockchain technology proposes; social business investing; inclusive business investing in which the poor and women in the rural areas participate effectively; and, finally, organising the weak in corporative manner so as to create solidarity among them for ventures that bring them together in non competitive way.

Netherland, for example with about 17 million people living on 41,543km2 has a great deal of the Dutch Butchers Pension Fund participating in Impact investing and it goes into, indirectly, affecting ventures in Kenya like the Ecotact Waterless Toilets.

Small entrepreneurs in Kenya access such funds and live on it Just like Odu, Arthur Mbanefo expresses his surprise about Nigeria: over N100 trillion exist in Pension Fund in Nigeria, and unlike Netherland that has just about the population of Lagos State alone, their investments in Pension Fund fetch them what it takes to keep Netherland population very comfortable whether at work or in retirement for over six decades after exiting colonial exploitation. As at today, it stands over $2 trillion, and it is being pumped further into impact investing. Cocoa or coffee producers in Africa cannot boast of such; and it is also unlikely that most Nigerian pensioners could find comfort in their retirement; instead hardship is their fate.

The Butchers know where their money is invested and they also send their likes to monitor the end result of such investment so as to remain at alert in recouping from their investment, instead of waiting to allow it wipped off. Just like another surprise of Odu relates, he was involved in organizing Nigeria Airways and other Public Enterprises after the Nigerian Civil War and the parameters he put in place to attract investment and make the enterprises sustainable were not followed up, as the Military in power rubbished all plans to keep the enterprises sustainable, hence it resulted in some cases having investors come into Nigerian space with a known rate of return on investment and no sooner they are in than unexpected events from the government get their investment wipped off.

That lack of trust by investors persist up to today, about investment ecosystem in Nigeria, to an extent that hedge funds and portfolio investments dominate to the detriment of impact investment. In effect, a fund manager is not expected to take any allowance if workers in the venture it is overseeing are not paid salary. In the same manner State Governors are not expected to earn salary or allowance if they are not paying the salaries of their civil servants. According to Odu, taking allowance amounts to pick-pocket governance. Even the Apex Finance Regulator, CBN is not absolved in that, as it has not presented its balance sheet for over five years and they take allowance. Losses could have been noticed to call to caution its board, and for Nigerians to notice that the government of Buhari has taken away over N23 trillion from it, undermining Fiscal Responsibility Act.

To avoid pick-pocket governance in Nigeria, Nigerians should pay more attention to what loans and internal generated revenues (IGR) are ploughed back into for the sustainability of the States and as well the Federal Government. That is what Impact Investing is all about, and it is expected that governments – Local, State and Federal – buy into it.

Odu was once the Pro-Chancellor of University of Lagos, University of Ife and Ahmadu Bello University. The investment patterns during his tenure in those institutions reflected significantly impact investment approach as each of them could lay hand to his legacy and point out how such investment is working till today. Finally, he advises that Nigeria’s presidential system be modified to some extent to avoid giving too much power to someone who knows nothing about impact investing taking over power and ruining the prospect of investors’ trust in Nigeria like Nigerians are witnessing after eight years of Buhari’s governance. As well, he expects Nigerian Universities to lead in making impact investment a reality in Nigeria by incubating any aspect of its determinant matrix and selling it to the populace.

Ariole, Ph.D is Professor of French and Francophone Studies, University of Lagos.

Be the first to comment