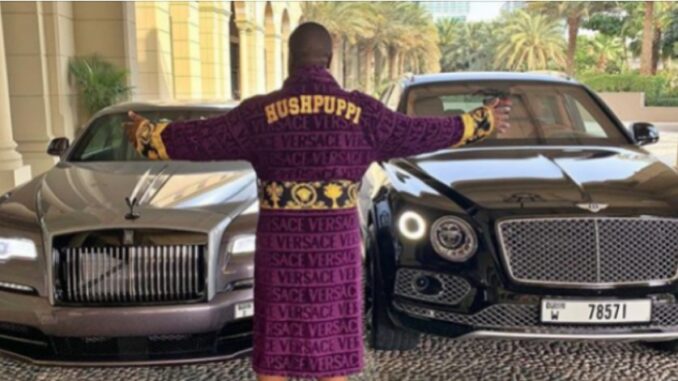

Hushpuppi, an internet celebrity, has been charged with the conspiracy to commit money laundering before a United States court, one for which he could get a maximum jail term of 20 years if convicted.

The United Arab Emirates (UAE) authorities had earlier shared footage of how Hushpuppi was busted in a special operation dubbed ‘Fox Hunt 2’ over cyber-fraud involving 1.9 million victims to the tune of N168 billion.

The self-acclaimed influencer was arrested on June 10, with 11 of his associates after he was said to have committed crimes including money laundering, hacking, impersonation, scamming, banking fraud, and identity theft.

After his extradition to the United States, the US Department of Justice, in a website publication, revealed details of his first court appearance, which saw him face the money laundering charge.

It is understood that the alleged fraudster faces criminal charges bordering on conspiracy to launder hundreds of millions of dollars from business email compromise (BEC) frauds and other scams.

Among these are schemes that allegedly saw him and his cronies target a law firm in the United States, a foreign financial institution, and an English Premier League soccer club.

According to the affidavit filed with the complaint during the court session on Friday, Hushpuppi, whose real name is Raymond Abass, is also one of the leaders of a transnational criminal network.

“The FBI’s investigation has revealed that Abbas finances this opulent lifestyle through crime and that he is one of the leaders of a transnational network that facilitates computer intrusions,” it read.

“…fraudulent schemes (including BEC schemes), and money laundering, targeting victims around the world in schemes designed to steal hundreds of millions of dollars.”

The affidavit described BEC schemes as involving a computer hacker gaining unauthorised access to a business’ email, blocking or redirecting communications to and/or from that email account.

This, it said, uses the compromised email account or a separate fraudulent one to communicate with personnel from a victim company, tricking them into making an unauthorised wire transfer.

In the scam involving a New York-based law firm, Hushpuppi and his crew were alleged to have undertaken a scheme that defrauded a client out of approximately $922,857 in October 2019.

He was also said to have conspired to launder funds stolen in a $14.7 million cyber-heist from a foreign financial institution in February 2019, sending the loot to bank accounts around the world.

The affidavit also alleged that they conspired to launder hundreds of millions of dollars from other intrusions, including one scheme to steal £100 million from an English Premier League soccer club.

With respect to Hushpuppi’s case, Nick Hanna, a United States attorney, described BEC schemes as one of the most difficult cybercrimes that the Federal Bureau of Investigations (FBI) encounters.

“They typically involve a coordinated group of con artists scattered around the world who have experience with computer hacking and exploiting the international financial system,” he said.

“This case targets a key player in a transnational conspiracy who was living an opulent lifestyle in another country while allegedly providing safe havens for stolen money around the world.”

Paul Delacourt, the assistant director of FBI’s Los Angeles field office, compared Hishpuppi’s case to one that cost US victims, including individuals and firms, a $1.7 billion loss back in 2017.

“This arrest has effectively taken a major alleged BEC player offline. BEC scams represent the most financially costly type of scheme reported to the FBI,” the director explained.

“I urge anyone who transfers funds personally or on behalf of a company to educate themselves about BEC so they can identify this insidious scheme before losing sizable amounts of money.”

Be the first to comment