Ashburton Investments, the money-managing unit of Africa’s biggest bank by value, said Nigerian curbs on foreign exchange trading are limiting its ability to increase its holdings of stocks in the West African nation.

Ashburton Investments, the money-managing unit of Africa’s biggest bank by value, said Nigerian curbs on foreign exchange trading are limiting its ability to increase its holdings of stocks in the West African nation.

“The foreign-currency situation has made it difficult to add more exposure to Nigeria,’’ Paul Clark, head of African equities at the unit of Johannesburg-based FirstRand Ltd., said Wednesday in an interview. “At the moment, there are no obvious buyers of equities in Nigeria.’’

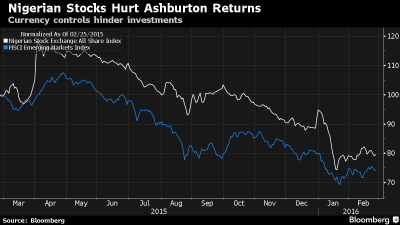

Ashburton, which holds Nigerian banking and oil stocks including Seplat Petroleum Development Co., has seen the valuation on its investments in Africa’s largest economy slump by half to $5 million, from more than $10 million in 2014, Clark said. That’s in the wake of a plunge in crude oil prices and foreign currency restrictions imposed by the government.

The situation looks unlikely to change “until we see more foreign currency availability or an exchange rate at the level where the market wants to clear,’’ he said in Lagos, Nigeria’s commercial capital.

Africa’s largest oil producer is struggling to cope with a 70 percent-slump in crude prices since mid-2014 to below $30 a barrel. The Central Bank of Nigeria has restricted supplies of foreign currency and pegged the naira at 197-199 to the dollar since March as it seeks to conserve reserves and stem a rout of the local unit. The black market rate is about 34 percent weaker.

Some investors are holding back on deals until there is more flexibility in the foreign-exchange regime and the value of the currency is reduced to compensate for the drop in oil revenue. This is a year “of pause” for foreign investors buying Nigerian assets as they wait for a potential naira devaluation, Citigroup Inc.’s African investment banking head, Miguel Melo Azevedo, said in an interview Wednesday in Cape Town.

“To be honest, I don’t see how it cannot happen, but right now it’s extremely difficult,” Azevedo said of a move to lower the naira.

The Nigerian Stock Exchange All Share Index, which has dropped 16 percent this year compared with the 7 percent retreat in the MSCI Emerging Markets Index, “has been a drag on our performance for Africa,’’ Clark said. Investors with a longer-term view could still see opportunities in Nigerian assets such as real estate, he said.

Ashburton invests in African equities in countries beyond South Africa including Ghana, Senegal and Ivory Coast and has increased its holdings in Kenya “because we think the market now offers more value,’’ Clark said. “East Africa is looking good at the moment.’’

BLOOMBERG

END

Be the first to comment