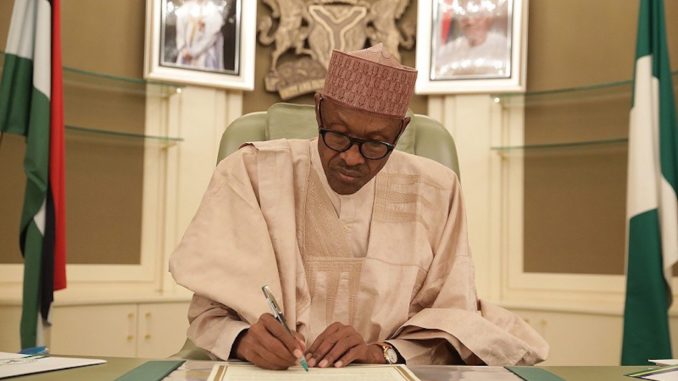

THE recent Senate intervention in the excise duty hikes on alcoholic beverages and tobacco products reignites the debate on the best strategy to improve public revenues and reboot the economy. For the Muhammadu Buhari administration, a phased increase in excise duties on selected products, among other measures, is one way to lift its declining income, a move that, however, dismays producers. There should be a middle ground that will meet the objectives of fiscal enhancement, health concerns and promotion of domestic investment.

Most importantly, the beverages sub-sector is hanging in there, deploying resources and investing in Nigeria at a time many other investors are taking flight. Government should, therefore, tread carefully to ensure it does not trigger more job losses and factory closures.

The legislature rightly also struck a middle ground when it passed a resolution calling on the government to suspend the implementation of the new excise rates to give more time to sensitise all stakeholders. While acknowledging the imperative of higher tariffs, the Senate suggested no more than 50 per cent increase, but wanted higher rates on imported alcoholic beverages and tobacco. The organised private sector, on its part, argues that, in the face of flat growth and adverse conditions, taxes should generally be lowered for local producers to safeguard jobs and keep factories running.

It was in March this year that the then Finance Minister, Kemi Adeosun, rolled out new excise duties on alcoholic beverages and tobacco products to take effect from June 4. Under the new regime, there will be graduated increases in the excise duly rate per litre of beer, wines and spirits produced in Nigeria, as well as similar, but steeper, increments in the duty per stick of cigarette over the next three years.

It is clear that incremental rises in these products align with global best practices as governments generally tax alcoholic drinks and tobacco for the dual purpose of filling the treasury and discouraging the harmful effects of their abuse. However, with recession still biting and this subsector braving the odds to invest in our turbulent operating environment, keeping factories running and maintaining jobs are as important as plugging the revenue hole.

A more appropriate course might be a minor adjustment downwards: the tariff on tobacco should remain to meet standards set by the World Health Organisation. In this, health concerns must trump economics. The Manufacturers Association of Nigeria says as the new rates are an addition to the existing ad valorem duty, the cost is prohibitive to producers. Ad valorem rate is paid on the value of a product and the 20 per cent applied to tobacco will raise taxes on each stick of cigarette to over 30 per cent, still less than the 38.14 per cent in Algeria and 36.52 per cent in South Africa. A global pact prescribes 65 per cent minimum as total taxes on the price of cigarettes. Beer attracts 47.5 per cent excise duty in Ghana and tobacco 150 per cent; in Senegal, these are 40 per cent and 45 per cent respectively. In Europe, total taxes as a share of the retail price of popular cigarette brands range from 70 per cent to 85 per cent, with Bulgaria implementing 83.24 per cent, Sweden 80.6 per cent and Finland 84.9 per cent.

But beer, wines and spirits are a bit different. AB InBev Group, the Belgium-based world’s largest brewer, has invested $250 million in a new factory in Sagamu, Ogun State, its fourth in Nigeria at a time Foreign Direct Investment is dwindling. Nigerian Breweries Plc, a subsidiary of Heineken NV, has continued to invest in new plants with five new acquisitions since 2011, now having 11 breweries, two malting plants and depots. A similar faith in Nigeria has seen Guinness continuously expand its four local breweries. The Distillers and Blenders Association of Nigeria has warned that N420 billion investments and 20,000 jobs are at risk if the tariffs force down consumer demand.

BMI Research, a subsidiary of the Fitch Group, has in response to the excise duty raise revised downwards its annual growth forecast for Nigeria’s alcoholic drinks sector from 6.9 per cent to 6.4 per cent through to 2022. We agree with BMI that the rate increase is a risky move in the tentative stages of recovery from a recession as it targets “one of the most resilient and strongest growing industries.” Analysts, however, suggest that the increases are nowhere near the 500 per cent MAN has claimed.

However, the resilience of the domestic beverages sector strongly lends itself to deserving of government support, not constraints. The recommendation of even higher taxes to raise revenue by the International Monetary Fund ignores the current 18.8 per cent unemployment rate and over 50 per cent youth unemployment in the country. Government should rather expand and deepen the tax net: enforce tax laws ruthlessly and adopt a zero tolerance policy for tax dodgers.

Stakeholders should work towards a compromise between what government wants and the 35 per cent cumulative duty suggested by MAN. The government believes it has taken care of MAN’s concerns by graduating the increases, limiting them to beer, wines, spirits and tobacco and by giving three months or more grace periods before full implementation.

Both government and the private sector should separately commission independent research to study their likely impact on public revenues, investment and job creation, the result of which will help chart the best course. The overriding objective should be preserving and creating more jobs, attracting FDI and boosting exports.

END

Be the first to comment