President Muhammadu Buhari has approved the extension of the Voluntary Assets and Income Declaration Scheme (VAIDS) to June 30, 2018.

The short extension after the original March 31 date is based on the appeals of professional bodies and individual taxpayers, Femi Adesina, spokesman of the president, said in a statement.

Adesina added that no further extension of time will be approved after June 30.

He statement said the new date was given based on the conviction of the ministry of finance that the overall objective to increase compliance will be attained, and additional revenue will accrue.

“A fresh executive order will be made to give legal backing to the new timeline,” the statement read.

“For a nation of people who are competitive and driven, it is not a pride that we are the lowest performer in tax to GDP, not just in Africa, but in the world.

“Nigeria’s growth needs are such that every Nigerian must do his duty to his nation, to his neighbour, and to himself.

“Hiding monies overseas, evading taxes by manipulation, and other unwholesome practices, have never developed a country, and for Nigeria to attain her true potential, these must stop.”

The president urged Nigerian companies and individuals to join government in the rebuilding mission, “and do the right thing by taking this window of extension to regularise.”

He added that the right thing may not be convenient or comfortable, “but in the long run, we will all have a nation we can be proud of.”

Buhari urged tax authorities to use the extension window to perfect plans to prosecute those who fail to regularise their tax status.

The government says VAIDS is one of the key policies used to reposition the economy and correct inherited underdevelopment.

Nigeria has one of the lowest tax collection rates in the world at just 6% of GDP.

This was partially a function of the reliance on oil that saw us abandon the historical revenue collection systems and switch to a culture of sharing resources, rather than generating them.

Last year, Buhari launched the economic recovery and growth plan (ERGP), and the VAIDS tax amnesty is first in the series of reforms by the current administration.

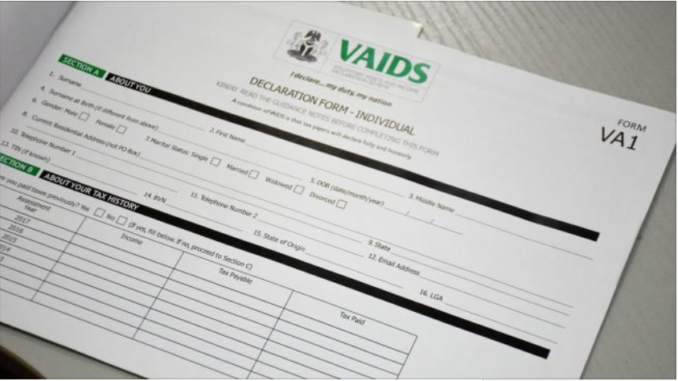

VAIDS provides a window of opportunity, an amnesty of sorts, for taxpayers — both individual and corporate — to be honest with what they earn and own, and voluntarily pay up on their tax arrears between 2010 and 2015.

With a target of raising at least $1 billion from undeclared liabilities, VAIDS applies to all tax-paying individuals, companies, executors and trusts, and covers all taxes collectible by federal and state tax authorities.

The goal is to raise the percentage of non-oil tax revenue from the current 6 percent to 15 percent by 2020.

END

Be the first to comment