The country earned a total sum of N980.48bn from taxes between July and September this, figures obtained from the Federal Inland Revenue Service have revealed.

The tax figures for the third quarter obtained by our correspondent on Friday in Abuja were prepared by the Planning, Reporting and Statistics Department of the FIRS.

According to the document, the N980.48bn tax collected for the three months showed that N654.61bn, representing 66.76 per cent, was generated from non-oil taxes while the balance of N325.86bn or 33.24 per cent was earned through the Petroleum Profit Tax.

A breakdown of the tax revenue showed that the sum of N250.25bn was earned in September.

This shows a decline of N130.76bn when compared to the monthly target of N381.01bn for 2015.

In terms of tax collection according to types, the document said that in the month of September, the country earned N111.96bn from the PPT, representing 44.74 per cent of the entire collection for the month.

Others are Company Income Tax, N65.28bn representing 26.09 per cent; gas income, N826m or 0.33 per cent; capital gains tax, N263m or 0.11 per cent; and stamp duty, N766m or 0.31 per cent.

Similarly, the Value Added Tax generated N56.39bn or 22.54 per cent; education tax, N10.26bn or 4.1 per cent and Nigerian Information Technology Development Fund, N84m or 0.03 per cent.

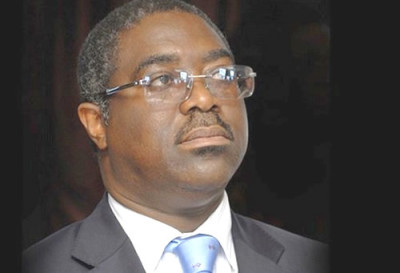

The Acting FIRS Executive Chairman, Mr. Babatunde Fowler, had said the agency would soon carry out a special audit of all companies operating in the country in order to increase the level of compliance with the relevant tax law.

The audit exercise, according to him, will be carried out within 30 days and will take into consideration the various year ends and peak points of activities of the various companies.

Fowler said the FIRS had entered into collaboration with the professional service providers, states board of internal revenue, noting that this would mark a turning point for taxation as well as reduce the country’s reliance on oil

He said the focus of the service now was to expand the nation’s tax net, build capacity of tax administration and share information that would promote voluntary compliance.

He said, “We have a duty to advise taxpayers; we equally have an obligation to government in ensuring an increase in revenue collection.

“It’s time to stop all forms of unwholesome practices in tax-related issues because Nigerians need us at this critical time to reposition the country for more resources.

“We don’t have all the answers; we need to reposition the entire process. All we are asking for is cooperation to move the nation’s tax system to another level.”

In the area of tax evasion, he said the FIRS would go after multinational companies, individuals and other corporate organisations that were evading the payment of taxes in the country.

Statistics obtained from the service revealed that out of the 450,000 companies in Nigeria, only 125,000 representing 27.7 per cent pay taxes.

Going by this figure, it implies that about 325,000 companies are evading tax, thus denying the government of huge revenue annually.

Fowler said his administration would not take the issue of tax evasion lightly as he was aware that some foreign companies operating in Nigeria were being investigated in England for evading taxes.

He said with the renewed effort to strengthen tax administration, the era where companies kept three types of accounts – one for the banks, one for shareholders and another for tax administrators – was over.

END

Be the first to comment