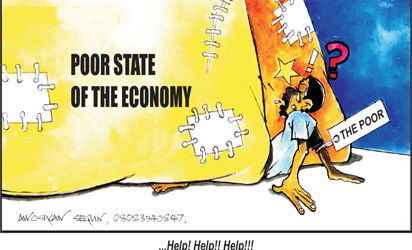

THE Nigerian president, like any other president, has two major tasks; provision of security for all citizens and managing the economy for the benefit of the citizenry. On the first count, the current administration of President Muhammadu Buhari has a few things to point to as its accomplishments. But on the second, the administration has a long distance to travel. The economy is in tatters and has slid into recession after recording negative growths in two consecutive quarters.

The economy has contracted and the GDP has plummeted from $578 billion to $290 billion, forcing the country to yield its position as Africa’s largest economy to South Africa. Similarly, the per capita income has dropped from $3,100 to $1,500. Inflation is galloping, the value of the currency keeps worsening, unemployment is on the increase and manufacturing companies are closing down in droves due to the escalating cost of doing business. These are consequences of the policy decisions of the administration, especially the currency management.

Being an import-dependent country, currency management is a gauge for measuring the economy’s well being because it affects virtually every sector. For over a year, the government, through the Central Bank of Nigeria, put a lid on the exchange rate by not allowing the true value of the currency to be determined by the forces of demand and supply. The government had deployed the nation’s dwindling foreign reserves in the defence of the embattled currency. This put a gulf between the real and official values of the currency, thus forcing many foreign investors to exit the country. It also pushed JP Morgan Chase, whose bond index is tracked by over $200 billion funds, to de-list Nigeria from its Emerging Market Bond Index.

By the time the government had a rethink two months ago and decided to tread the path of economic wisdom by allowing market forces to be the determinant of the exchange rate of naira to other currencies, the economy had almost become prostrate. Even then, the CBN has not completely freed up the currency as it keeps intervening in the market to the extent that the gap between the interbank and parallel market is at least 25 per cent. Ordinarily, the disparity between the interbank and parallel market rates should not be more than 1 per cent. There was a time when the dollar was sold at N158 in the bank and N160 at the black market.

But the situation has since changed with almost N100 gap between the two rates. This has created opportunities for arbitrage which resulted in the emergence of the noveau riche who make billions by getting foreign currency at the official rate only to sell at the parallel market rates. Even banks are not exempted from this as their customers do not get dollars at the interbank rate, rather bank customers, especially those who use their cards to pay for goods and services in foreign exchange, are billed the prevailing parallel market rate.

The point was indeed well elucidated last week by the immediate past CBN governor and the Emir of Kano, Alhaji Muhammadu Sanusi II, that the non-floating of the currency encourages arbitrage and round tripping. The Emir said, and rightly so, that there are people who make billions by doing nothing other than buying dollars at the official rates and selling at the parallel market rates. This is a disincentive to manufacturing. If people can make easy money by selling dollars, why should they bother about manufacturing where they have to contend with epileptic power supply, expensive diesel, dilapidated infrastructure and labour matters, among other issues?

The president has repeatedly expressed the hope that the economic situation will soon change. We share his optimism but we are constrained to state that the hope may remain forlorn for long until there is a shift from a policy which enriches a few and pauperizes the majority. The government really must give the foreign exchange policy another look and fine tune it to make it work in the interest of the millions of Nigerians who are daily pushed further into the hostile embrace of excruciating deprivations and dehumanizing hunger.

It is our considered opinion that for the country to escape the current economic doldrums in which it has found itself, the government must come up with well thought out, coherent and cohesive economic policies that leave no room for manipulation by some of Nigeria’s nationals, goaded by unpatriotic intentions. The government must come up with a sound economic blueprint that would serve as a compass to the economic prosperity promised by the current administration. Doing that will save the nation from the fits-and-starts management style that it currently has. A national economy cannot be run by whims and caprices.

END

Be the first to comment