Confusion reigned in the banking industry yesterday as some banks restricted access to bank accounts not linked to the National Identity Number, as directed by the Central Bank of Nigeria, CBN.

The CBN had in a circular on December 1st 2023, directed that banks should place restrictions on all Tier 1 bank accounts without BVN.

Tier 1 accounts are accounts that can be opened with a valid identity or proof of address.

The maximum daily transaction limit for a Tier account is N50,000 while the maximum account balance is N300,000.

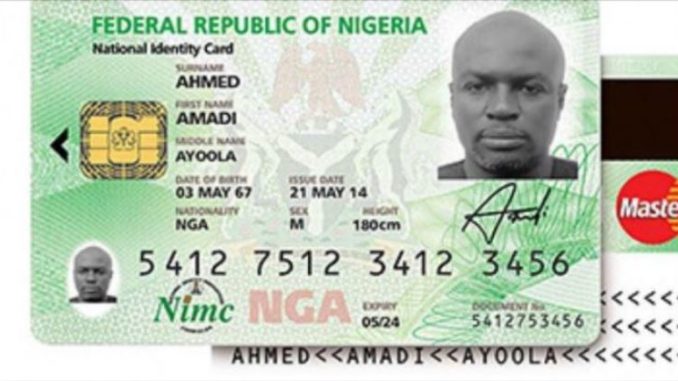

According to the circular, titled, ‘TIER-1 WALLETS AND ACCOUNTS: MANDATORY USE OF BANK VERIFICATION NUMBER (BVN) OR NATIONAL IDENTIFICATION NUMBER (NIN), the CBN said: “As part of its effort in promoting financial system stability, it becomes necessary to strengthen the Know Your Customer (KYC) procedures in financial institutions under the purview of the Central Bank of Nigeria (CBN).

“Accordingly, the CBN hereby issues an amendment to Section 1.5.3 of the Regulatory Framework for Bank Verification Number (BVN) Operations and Watch-List for the Nigerian Banking Industry (The Guidelines).

In this regard: It is mandatory for ALL Tier-1 bank accounts and wallets for individuals to have BVN and/or NIN

“It remains mandatory for Tiers 2 & 3 accounts and wallets for Individual accounts to have BVN and NIN;

“The process for account opening shall commence by electronically retrieving BVN or NIN related information from the NIBSS’ BVN or NIMC’s NIN databases and for same to become the primary information for onboarding of new customers, and all existing customer accounts/wallets for individuals with validated BVN shall be profiled in the NIBSS’’ ICAD immediately and within 24hrs of opening accounts/wallets.

“Effective immediately, no new Tier 1 accounts and wallets should be opened without BVN or NIN,

“For ALL existing Tier 1 accounts/wallets without BVN or NIN:

“Effective immediately, any unfunded account/wallet shall be placed on “Post No Debit or Credit” until the new process is satisfied.

“Effective March 1, 2024, all funded accounts or wallets shall be placed on “Post No Debit or Credit” and no further transactions permitted.

“The BVN or NIN attached to and/or associated with ALL accounts/wallets must be electronically revalidated by January 31, 2024.”

Vanguard checks revealed that customers of a Tier 1 bank who have not linked their NIN to their account were not allowed access to the account.

A staff of the bank, who spoke on condition of anonymity confirmed to Vanguard, that the bank had started implementing the directive of the CBN that all bank accounts must be linked to NIN and BVN before February 29.

‘It is true that we have started implementing the directive. We have begun to place restrictions on accounts not linked to NIN. Today a customer called for my intervention because he could not access his account via internet banking.

A customer of the bank who also spoke anonymously shared his experience at the Berger Branch of the bank in Apapa. He said: “The bank staff told me I cannot access it because it has not been linked to my NIN. I had to show them a copy of my NIN slip before I was allowed to access the account.”

Vanguard checks however reveal a different story in most of the banks. Besides sending email and SMS messages to their customers, most of the banks have yet to place restrictions on accounts not linked to NIN.

Speaking on condition of anonymity, the branch manager of another Tier 1 bank, said: “The only thing that is mandatory for now is BVN. In as much as the account is linked to a BVN, we allow access for customers. That is the latest communication received from our Head Office.”

Adding to the confusion is the divergent messages from the banks to customers over the deadline for the CBN directive.

While some banks indicated February 29, 2024, as the deadline, some banks were silent about any deadline.

For example, a Tier 1 bank in an SMS to its customers said: “Dear Customer, you must link both BVN and NIN to your account. Visit www.gtbank.com to link your BVN and NIN.”

But another Tier 1 bank, in an email message to its customers, said:

“Please ensure that your Biometric Verification Number (BVN) and National Identification Number (NIN) are linked to your account number on or before 29 February 2024.

“You can seamlessly update your account information with your BVN and NIN by visiting any FirstBank branch close to you.

“Please note that Central Bank of Nigeria (CBN) through its circular: PSM/DIR/PUB/CIR/001/053 dated 01 December 2023, has directed that effective, 01 March 2024, all funded accounts without BVN shall be placed on ‘Post No Debit or Credit’ and no further transactions permitted.”

However, efforts to get the CBN to clarify the implementation of the directive prove abortive. A top official who spoke on condition of anonymity told Vanguard, “What I can tell you for now is that we have not issued any fresh directive to the banks on the issue.”

Similarly, subscribers in the country are going through harrowing times at the moment as operators’ networks are failing spectacularly.

Since the yuletide, subscribers have had to struggle to complete calls when they manage to achieve connection.

Businesses that largely depend on telecom networks have also suffered massively as voice calls and data services have recorded annoying glitches.

This is compounded by a directive by the Nigerian Communications Commission, instructing jamor telecommunications operators in Nigeria, such as MTN, Airtel, Globacom and 9Mobile to implement comprehensive network barring all phone lines without a link to National Identification Numbers, NIN on Wednesday, February 24, 2024.

Some of the major operators who spoke to Vanguard in confidence confirmed that they had commenced disconnection of all unregistered SIM cards as well as SIM cards not properly registered and linked to NIN, based on the NCC directive.

END

Be the first to comment