The world’s largest company could owe more than $8 billion in back taxes as a result of a European Commission investigation into its tax policies, according to an analysis by Bloomberg Intelligence. Apple, which has said it will appeal an adverse ruling, is being scrutinized by regulators who have accused the iPhone maker of using subsidiaries in Ireland to avoid paying taxes on revenue generated outside the U.S.

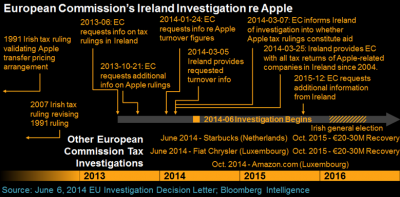

The probe dates back to 2014 and a decision could come as soon as March.

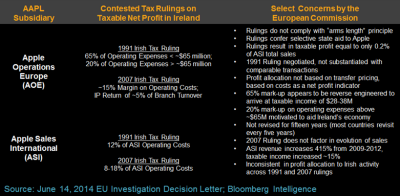

The European Commission contends that Apple’s corporate arrangement in Ireland allows it to calculate profits using more favorable accounting methods. Apple calculates its tax bill using low operating costs, a move that dramatically decreases what the company pays to the Irish government. While Apple generates about 55 percent of its revenue outside the U.S., its foreign tax rate is about 1.8 percent, according to the analysis. If the Commission decides to enforce a tougher accounting standard, Apple may owe taxes at a 12.5 percent rate, on $64.1 billion in profit generated from 2004 to 2012.

Tax Bills

Apple is perhaps the highest-profile case of U.S. companies facing scrutiny from officials in Europe. Starbucks Corp., Amazon.com Inc. and McDonalds Corp. also have had its tax policies questioned.

In October, Apple listed scrutiny of its taxes as a risk factor to investors. In addition to European regulators, the U.S. Internal Revenue Service has also examined the company’s tax returns, Apple said. Were the tax rates to change, Apple’s “financial condition, operating results and cash flows could be adversely affected,” the company said in its financial statement for fiscal 2015.

Apple Chief Executive Officer Tim Cook has denied that the company uses tricks to avoid paying taxes. In a recent interview on CBS Corp.’s “60 Minutes,” he called the criticism the company has faced from U.S. lawmakers “political crap.” He said the tax system is outdated and needs to be updated for a digital economy.

Kristin Huguet, a spokeswoman for Apple, didn’t return a call seeking comment.

END

Be the first to comment