The Central Bank of Nigeria on Tuesday wielded the big stick as it barred nine Deposit Money Banks from the nation’s foreign exchange market for failing to remit the sum of $2.334bn belonging to the Nigerian National Petroleum Corporation to the Treasury Single Account.

President Muhammad Buhari had last September ordered all the DMBs in the country to remit all Federal Government funds to the TSA.

The banks are: First Bank of Nigeria Limited ($469m); Diamond Bank Plc ($287m); Sterling Bank Plc ($269m); Skye Bank Plc ($221m); Fidelity Bank ($209m); United Bank for Africa ($530m); Keystone Bank ($139); First City Monument Bank (FCMB) $125m; and Heritage Bank ($85m).

Officials of the CBN officials told our correspondent that the sanction would remain until the DMBs could remit the funds to the CBN.

The officials further said the further disciplinary actions awaited the errant banks after remitting the funds in full to the Federal Government’s coffers.

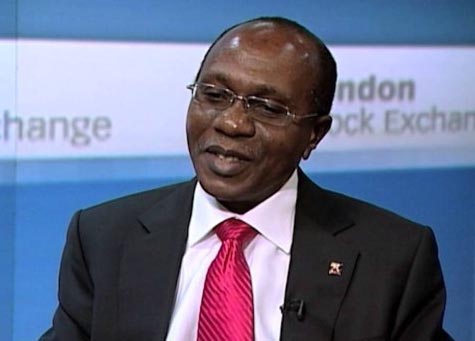

As of time of filing this report, it was learnt that some bank executives were meeting with the CBN Governor, Mr. Godwin Emefiele, over the development.

However, the Head, Corporate Communications, UBA, Mr. Charles Aigbe, said the bank was not among the banks sanctioned by the CBN.

In a statement issued on Tuesday, Aigbe said, “Our attention has been drawn to report of the ban of UBA from the foreign exchange market by the CBN over the non-remittance of the NNPC/NLNG dollar deposits.

“We wish to state very categorically that UBA has completely remitted all the NNPC/NLNG dollar deposits. We thank all our numerous customers, business partners and other. stakeholders who have reached out to us on account of this report.”

The spokespersons for First Bank, Mr. Babatunde Lasaki, said the lender would issue a statement on the development.

But as of the time of filing this report, he had yet to do so.

Spokesperson for FCMC, Mr. Diran Olojo, in a terse response, said, “We are working with the CBN on an amicable resolution. This is really a function of the dire macroeconomic situation and illiquidity in the FX markets, rather than concealment or wilful non-compliance by banks.”

Spokesperson for Diamond Bank, Mr. Mike Omeife, did not respond to telephone calls and text messages seeking their reaction on the development.

The Skye Bank spokesperson, Mr. Ndumechi Ezurike, could not be reached for comments.

Spokespersons for Fidelity Bank, Sterling Bank and Heritage Bank could not comment immediately.

However, sources in the banks said their managements were working with the CBN to resolve the matter.

It was learnt that Fidelity Bank had been following a payment plan agreed with the CBN on the funds.

Following the President’s directive on the TSA last September, majority of the banks had complied by remitting all the Federal Government funds including that of the NNPC to the TSA.

However, the CBN reportedly fined First Bank, UBA and Skye Bank for failing some billions of naira to the Federal Government coffers in line with the TSA directive.

Further investigations by our correspondent revealed that following the presidential directive on the TSA, most of the DMBs remitted all naira-denominated funds in their possession including that of the NLNG/NNPC to the CBN.

However, the dollar components of the NLNG/NNPC funds in the banking system, estimated at about $5bn, could not be remitted immediately due to scarcity of forex in the country.

However, the banks reached an agreement with the CBN to start remitting the funds on monthly basis.

The monthly payment plan submitted by the banks to the CBN, it was learnt, was being followed by the some banks while other defaulted.

Following the compliance of some of the banks to the payment plan, the dollar component of the NLNG/NNPC funds was reduced to $2.3bn.

The failure of some banks to comply with the payment plans and the dire need for the CBN to shore up the nation’s fast-depleting external reserves, it was learnt, forced the regulator to adopt a measure.

This, findings revealed, forced the CBN to bar the banks from the forex market.

A top bank executive close to the development, who spoke under the condition of anonymity, said, “We need to admit we have a national problem. The NLNG deposit in the banking system was about $5bn. The banks have been paying and what is remaining now is just about $2bn. The banks have submitted a payment plan and they are following it. The banks have the naira equivalent of the outstanding amount. The challenge is that they cannot get dollar to buy to settle the money.”

Some top bankers said the approach the CBN was adopting was capable of compounding the problem.

“This could affect the banks image and their ability to get foreign investors; we need to admit we have a national problem and seek for ways to resolve it,” one of the bankers said.

The NLNG was paying dividends from the investment of the government in the company (NLNG) to the NNPC.

The dividends had accumulated to about $5bn; the

NNPC was investing this dividend payment in a dedicated account as fixed deposits with commercial banks.

It was learnt that when the Federal Government raised the issue that the dividends should have been paid into the Federation Account, the CBN governor invited the CEOs of all the banks that had the funds to Abuja for a reconciliation of the amount in each bank with the records of the CBN/NNPC, and agreed to a repayment time table of the funds with the banks

As of the time the TSA Implementation commenced in September 2015 some of the banks had paid back over 50 per cent of the funds based on the repayment timetable

This repayment by the banks was the bailout of $2.1bn (N414bn) that was shared by the FGN and state governments in July/August 2015.

When the TSA commenced, the banks reported these funds as part of government deposits they had but it was not remitted like other TSA funds because of the remittance timetable that had been agreed with the CBN.

The NNPC invited banks earlier this year to submit a revised repayment plan for the balance of the funds offers.

Punch

END

Be the first to comment