Activist Starboard Value LP is making good on its threats to unleash a proxy war with Yahoo! Inc., seeking full control of the Web portal’s boardroom.

Starboard said Thursday it is nominating nine directors to replace all of the board’s current members, including Chief Executive Officer Marissa Mayer, who has drawn increasing investor ire over her stalled turnaround strategy. The activist hedge fund, which has increased its Yahoo holdings to 1.7 percent, is seeking the director sweep after first raising concerns about how the company was being managed in September 2014.

Using a playbook that helped give it leverage over other, smaller companies, Starboard’s Jeffrey Smith is raising the stakes with Yahoo — even after the company said it would consider strategic alternatives such as a sale of the main Web operations. Smith is betting that other frustrated shareholders will support him in his bid to force change from management and boost pressure on Mayer, who has struggled for more than three years to revive sales and has so far failed to separate Yahoo from its multibillion-dollar stake in Alibaba Group Holding Ltd.

“It puts pressure on the board,” said Colin Gillis, an analyst at BGC Partners. “We have seen plenty of times where boards are less independent than they should be.”

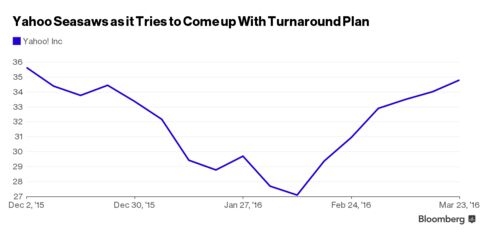

In a statement, Yahoo said it has “noted” Starboard’s announcement regarding the board nominations, and its nominating and governance committee will review the nominees and respond “in due course.” Yahoo shares fell less than 1 percent to $34.77 at 3:01 p.m. They had gained 4.6 percent this year through Wednesday.

‘Full and Fair’

The board needs credibility, Smith wrote in a letter to fellow shareholders, adding that Starboard’s nominees can deliver that. It’s important for the activist to be involved to ensure a “full and fair sale process,” according to the letter. “We believe this is crucial not only to reach the appropriate conclusion, but also to ensure that potential buyers believe the board will take their interest seriously and impartially.”

“We have been extremely disappointed with Yahoo’s dismal financial performance, poor management execution, egregious compensation and hiring practices, and general lack of accountability and oversight by the board,” Starboard said in the letter. “We believe the board clearly lacks the leadership, objectivity, and perspective needed to make decisions that are in the best interests of shareholders.”

While some analysts expressed surprise at the drastic move of seeking to oust the entire board, some investors have already signaled their support for Starboard. Ryan Jacob, who manages the Jacob Internet Fund, said he backs Starboard — and thinks the activist will succeed in persuading enough shareholders to get its slate of directors elected.

“At this point, it’s kind of, “Who are going to be the best stewards and make the right decisions?”’ said Jacob, whose fund owns Yahoo stock. “This board and this management team have made a lot of wrong decisions. So there’s just not a lot of trust or credibility there.”

If Yahoo were to announce a sale before the shareholders’ meeting, Jacob said, that may weigh in the company’s favor for keeping its board in place. Still, he said there’s value in getting a new slate of directors for handling the assets after any sale of the core business. Gene Munster, an analyst at Piper Jaffray Cos., said Starboard’s ultimate goal is more about ensuring that management pursues a deal for the company than it is about ousting directors.

“It’s not about getting a new board” and fixing Yahoo, Munster said. “Investors want the company to be sold.”

Nicholas Donatiello, a lecturer in management at the Stanford Graduate School of Business, said it isn’t entirely clear why the Web portal needs a new board while it’s already seeking strategic alternatives.

“In some ways, the question for Starboard is, ‘Why don’t they want to let that process work?”’ he said. “Activists have to be active or they don’t have a reason to exist.”

Difficult Step

For Mayer, it’s another difficult step in her tenure that began as a turnaround effort when she arrived in July 2012. In February, she rolled out her latest plan to overhaul the company, calling for employee cuts, product closures and other reductions to help drive efficiency and focus on growth opportunities.

Yahoo is likely to hold its annual meeting in June, though that could be delayed to July, according to a research note from Robert Peck, an analyst at Suntrust Robinson Humphrey Inc.

Earlier this month, Mayer said she would do what’s best for investors as Yahoo considers its strategic options and she would like to keep her job leading the company even if it changes hands.

“I certainly hope the strategic alternative has a place for me,” she said in an interview on the “Charlie Rose Show” television program. “But that said, we’ll obviously honor our commitments to our shareholders.”

Mayer stands to collect at least $12.4 million if she’s terminated, including $3 million cash severance, and about $9.34 million in equity vesting early and certain health and outplacement benefits, according to data compiled by Bloomberg.

Independent Directors

Earlier this month Yahoo added two new independent directors who have experience helping sell companies as it sought to bulk up the board to prepare for a proxy fight.

Starboard met with Yahoo on March 10, the same day Yahoo appointed Eric Brandt and Catherine Friedman to the board, according to a person familiar with the matter. Starboard, which wasn’t alerted about the new appointments prior to the meeting, has had contact with the Web portal since then, said the person, who asked not to be identified because the matter is private.

Starboard’s outreach to Yahoo shareholders through proxy advisers has indicated tremendous support for its efforts, which gave it confidence in initiating the proxy fight, according to the same person.

Darden Victory

Starboard is one of the most prolific U.S. activist investors and has a track record of pushing companies to heed its wishes. In 2014, Starboard persuaded investors to replace Darden Restaurants Inc.’s entire 12-member board after the unpopular sale of its Red Lobster chain to Golden Gate Capital. Starboard also recently helped pressure office-supply rivals Staples Inc. and Office Depot Inc. into a merger.

Starboard was founded in March 2011 through a spinoff from Cowen Group’s Ramius LLC. The New York-based firm continues the activist strategy developed by Smith and Mark Mitchell since 2002 and Peter Feld since 2005 — buying stakes in companies they call undervalued and pushing executives and directors for changes such as unit spinoffs and asset sales.

The fight with Starboard isn’t Yahoo’s first run-in with disgruntled activists. In 2012, Third Point LLC’s Dan Loeb succeeded in getting himself and two nominees on the Yahoo board after tangling with former CEO Scott Thompson, who stepped down after failing to correct errors in his credentials. Later that year, Loeb was instrumental in getting Mayer to lead the company.

END

Be the first to comment