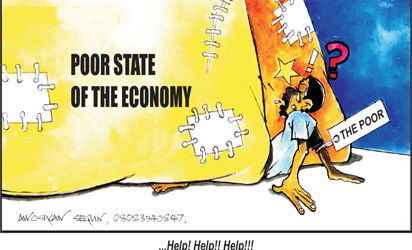

What can a President do in a troubled economy? Anything except work magic to revive it. Matters of ‘economics’ lend not to such supernatural sleight of hand. To exit the bad times, a President must work the numbers. He has to plan. And then pray. Because matters of ‘economics’ are not responsive only to the pragmatics of planning and the empirical realignment of numbers. Said Peter Middleton, a British banker: “It would be a dreadful mistake to equate economics with real life”.

A President –in addition to planning- must set out to reassure the people. To let them know they are in good hands. And that he is on top of the situation. Even if, in the meantime, he is not. It is sufficient merely that they do not know that he is not on top of the situation.

The President is like the paddler of a boat in troubled waters. He cannot afford ‘panic’ amidst the tempest of roaring waters. There is a fifty-fifty chance of surviving the elements of nature; but there is hardly any chance of surviving ‘panic’ on board a troubled ship. The ‘psychology’ of national survival is as important as the ‘economics’ of national survival.

If not more important. America’s Franklin Roosevelt during the Great Depression of the 1930s knew this the hard way. With panicky Americans huddled around their radios almost every day to hear from their President, Roosevelt knew better than to befuddle them with ‘economics’.

He reached instead the psyche of a despairing people in the language of ‘hope’ and not with the gibberish of micro economics. Roosevelt, even at the Depression’s bitterest point, assured a despondent America: ‘I got your back’. He told the Americans they had nothing to fear.

If anything, he said: “The only thing we have to fear is fear itself”. And although the Depression lingered six more biting years since Roosevelt spoke, plus the efficacy of his exit plans became even a subject of debate, Roosevelt’s success in restoring hope and confidence to a despairing nation, was never in dispute.

In 1992, the bad economic times visited America again. It was when Bill Clinton was angling to return the presidency back to the Democrats; and when incumbent President Bush Senior was battling to keep it for the Republicans.

Neither Bush nor Clinton had offered any credible ideas about how to get America out of the woods. In fact, Americans were faced with a dual Hobson’s choice.

Head or tail was still bad choice.

And as one of the many rights of a democratic electorate includes the liberty to elect even the wrong candidate, Americans, by fait accompli, ditched the ‘devil’ that they knew, Bush, and settled for the ‘saint’ they did not, Clinton. Bush’s undoing was that he missed the Roosevelt lesson in troubled economic times.

To connect to the ‘chests’ of the people, not their ‘heads’; to speak to their ‘hearts’, not their ‘brains’. Now –as the Bible would say- the wisdom of man is like filthy rags.

Be more ‘psychological’ than ‘economic’. Bush spoke to the people less with the language of ‘inspiration’ than he did with the dictate of economics.

He offered ‘information’ -by way of a 29-page economic jargon titled ‘Agenda for American Renewal’- when he should simply have given the people ‘inspiration’. Who feels it they say knows it all. Tell the people how bad the situation is. Tell them you know how much it hurts. And that in due course it may even hurt more. But tell them ‘we WILL make it’. Like the late Muhammad Ali would say, the word ‘impossible’ is merely an ‘opinion’.

We will make it! We cannot afford not to make it! But Bush immersed himself into the academics of ‘growth’ and ‘development’ -leaving existential economics all by itself.

And then he went around saying that the recession was over even when many believed that the bad times had just begun.

An upstart Clinton, not because he knew any better, turned Bush’s knife in the wound when he claimed that Bush had mid-wifed the worst economy “since Herbert Hoover” (the ill-fated President of the Great Depression). In addition to hitting a guy when he was already down, Clinton’s punch was way below the belt of a goofy Bush.

In truth Clinton lied. There were many real bad times since Herbert. Economic slumps have always been the veritable hallmark of all capitalist economies.

Even the world’s acclaimed quintessence of the ‘free market’ system, -the American ‘economy’-, is not entirely immune to the vagaries of the voodoos of capitalism. And so it has always been for other capitalist economies, of the West and of other climes; so much that it can safely be said that ‘periodic slumps’ have become the veritable hallmark especially of ‘vibrant’ ‘free market’ economies. Economists often warn that whenever an ‘economy’ beats all predictable odds to ‘bubble and bubble’, watch out soon for the ‘burst’! Meaning that no matter how well or poorly run, capitalist economies essentially are prone to ‘boom and bloom’ sometimes, even as they are at other times, inexplicably susceptible to sudden ‘doom and gloom’.

Sometimes even doing the ‘economically-needful’ may just be what it takes to achieve a ‘slump’. Or so said the U.S. economist Alan Greenspan: “Even (as) a moderate rate of ‘inflation’ can hamper economic performance, (so can) moderate rates of ‘deflation… most probably lead to similar problems”.

It is thus immaterial that the best brains are on top of it, any ‘capitalist economy’ -even with the cleanest ‘bill of health’- can still sooner be in the Intensive Care Unit, than a man with a ‘heart attack’. Said Frank Borman, U.S astronaut and business executive, “Capitalism without bankruptcy is like Christianity without hell”.

It is almost a given that capitalist economies are doomed to such a state of flux for the reason that selfish, conniving man will not allow the earthly affairs of man to take their natural course. Said E. F. Schumacher, an economist, “Modern economic thinking…is peculiarly unable to consider the long term and to appreciate man’s dependence on the natural world”.

Man has deliberately created a Frankenstein system of capitalistic economy and to whose unpredictable monstrosity even he, has become a perpetual victim. But these ‘unpredictable monstrosities’ he calls ‘market forces’ rather that what it truly is, ‘forcing the market’. ‘Market forces’ are the soulless factors that reward ‘opportunism’ and often punish ‘industry’.

Yet they are celebrated today as the defining criteria for ‘free trade’ -ironically in a fast globalizing world that is gradually but assuredly slipping into the command control of vested interests. And you think that ‘Free trade’ is actually ‘free’.

Such is the craze now about the dogma of ‘economics’ –like the self-harming creed called ‘rule of law’- that Schumacher, in lamentation of man’s naïve submission to the vicissitude of ‘economic’ forces, said: “Call a thing immoral or ugly, soul destroying or a degradation of man, a peril to the peace of our world or to the well-being of future generations; as long as you have not shown it to be ‘uneconomic’ you have not really questioned its right to exist, grow and prosper”.

Nor can the global media be said to be innocent –advertently or inadvertently- in this unfolding conspiracy to hand over the world’s resources to the command of vested interests. John Maynard Keynes, the British Economist, in his ‘Essays in Persuasion’ wrote: “editors all bloody and blindfolded, still piteously bow down before the free play of economic forces”.

Postscript

The undoing of modern democratic capitalism as a system of economy is traceable to its deviation from the path of its theocratic origin. When Jesus -in the Bible- stormed the synagogue to chase the money changers, he captured in one singular action the notion of a world economy envisioned by God which -of a necessity- must be nonusurious if it is to be free from the exploitation of the many by the few. Islamically, the object of theocratic economy has been to leave the windows of ‘profit’ and ‘loss’ widely open.

So that all who go into business transactions are exposed equidistantly to the possibilities of making ‘profit’ or registering ‘loss’.

Because in reality ‘business’ is one of few games of chance that religion can be said to have permitted. The undoing of global economies today is that democratic capitalism with its concept of so called ‘risk-free’ investment, insists on shutting the window of ‘loss’ -for good- and leaving e the window of ‘profit’ forever. And herein lies the venom of the capitalist system.

The very point at which man defied the transcendental order of ‘godly economics’ to supplant ‘usury’, was the tipping point that returned man from a path of bliss to the state of nature! So that naïve man for example now gleefully subscribes to life insurance policies, paying premiums all his life in the hope of making a ‘killing’ even after ‘death’.

Yogi Berra, the American base-baller known for his witty barbs mocks at this capitalist greed when he jived: “I took out a big life insurance policy because I want to be rich -when I die”. Now we believe that by ‘saving’ or ‘investing’ in a so called risk-free, interest-yielding, banking system today, we have outsmarted Jesus because we have covered the less than savory word ‘usury’ with the ‘pleasant’ word ‘interest’. Modern man believes that like the soulless money-merchants of Jesus’ time, he can multiply his estate without lifting a finger.

And yes, in reality we seem to make some fleeting gains in insurance, stocks, mortgages etc. But all of this gain inevitably aggregates to a national burden which the system –being risk-free- has to pass to the economy; and upon which in the long run, all our fates are hung. Because like the Americans would say, ‘there is no free meal’.

To the exclusion of existing goods and services, ‘money’ does not grow ‘money’ like democratic capitalism wants us to believe. We rejoice always at the prospect of reaping where we did not sow; but truth is, in no distant future the ‘curse’ of unearned ‘gains’ always awaits us all.

Because in reality interest-making upon which the free-market economy derives its oxygen bears a transcendental curse. By the way if you ask me, I would say that Jesus was quintessentially a better economist than Adam Smith; because even as far back as then he knew that if money was allowed to incubate money; and currencies to hatch their own kind -without a concomitant growth in goods and services- there would be as many false economies as he had warned that there would arise false christs and false prophets.

The irony is redolent with the tease of William Keagan, British author and journalist in The Specter of Capitalism where even as he insists “Communism has failed”; he also admits that “capitalism has not succeeded”. A United States economist, P.A. Samuelson said: “Man does not live by GNP alone”. Nor does he, I should add, live by GDP alone.

END

Be the first to comment