I have read with deep concern, the various accounts shared by many Nigerians on their sad experiences on the Mavrodi Mundial Moneybox Ponzi scheme that has created a lot of apprehension and uncertainty in the country. Because of this unfortunate development, millions of patrons of the Ponzi scheme have been thrown into confusion having placed a one-month ban on all withdrawals starting from December 13. The MMM has claimed that it had frozen the accounts to avoid preventable challenges during the Yuletide in the purported negative media reports given to the scheme.

The MMM is not new in the business world. It is on record that the organisation began as an office equipment company in Moscow, Union of Soviet Socialist Republics in the 1980s, before moving into the financial sector when the scheme collapsed and many investors lost their money. The MMM was able to win the hearts of many Nigerians with its ‘30 per cent per month’s return-on-investment in addition to other acquirable bonuses. But the hard truth is that despite the mouth-watering offer, the risks associated with the scheme seem to be more. No wonder, the company was “wise” enough to have advised customers to “use your #SpareMoney only (and) don’t be unnecessarily greedy.” What this expression tells me is that the operators of the scheme have cleverly and tactically insulated themselves from any undue liability and legal encumbrances. The scheme has since been declared illegal by the Federal Government.

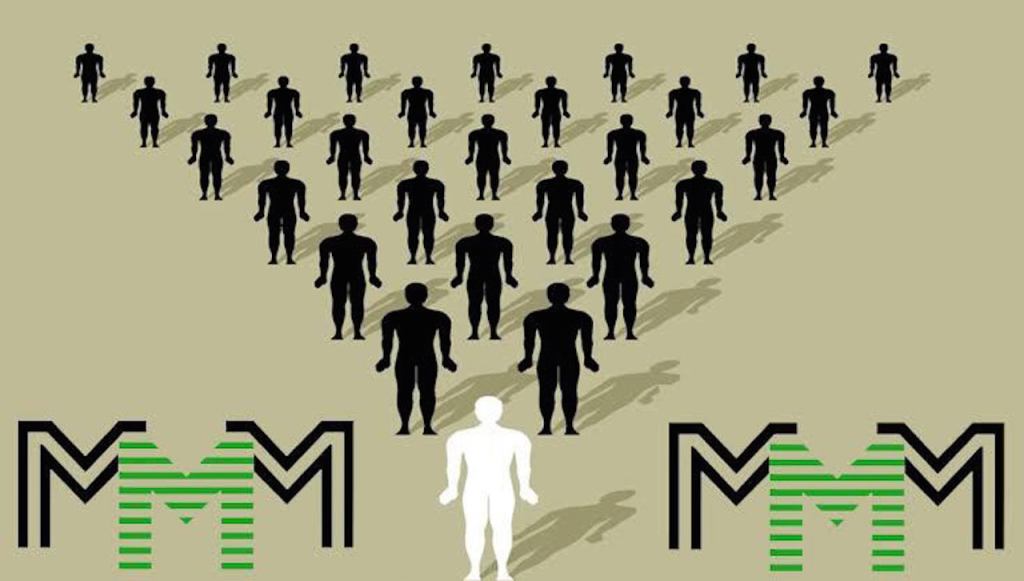

Before coming to Nigeria, the MMM had similarly operated in South Africa and Zimbabwe with the same business model, which claimed a 30 per cent per monthly return-on-investment through a ‘social financial network’ until the accounts of its clients were frozen. Similarly, in 2016, the Chinese government banned the scheme on the grounds that it was a Ponzi scheme, unregistered and hence, was tagged fraudulent. What the organisation does is to manage payments in such a way that quick returns to the first investors from money invested are given to later investors in a manner described as robbing Peter to pay Paul.

With the controversies surrounding the modus operandi of the MMM, Nigerians seem to have forgotten so fast the lessons learnt from the failed operations of “wonder banks” in which billions of naira went down the drain under similar circumstances, despite warnings by the National Assembly, the Central Bank of Nigeria, the Economic and Financial Crimes Commission as well as the Securities and Exchange Commission, suggesting that the scheme was fraudulent, but then, many Nigerians still patronised it. Three major reasons could be attributed to this doggedness. First is the current economic situation in the country that has brought about untold and high incidence of unemployment, inflation and poverty. Hence, people would want to do anything humanly possible to survive at a great risk.

Second is the secretive and greedy nature of many of the participants, who kept the offer to themselves, perhaps, to prevent others from benefitting, thus making them highly vulnerable in the process of secretly dealing with the MMM. Third is the weak regulatory framework that allows such a system to exist without having to pass through the necessary due diligence, checks and screening. No wonder, the MMM had the audacity to tell the Nigerian government to look at the benefits of the scheme to the over three million Nigerians within its one year of operation in the country, claiming that the scheme was the “only source of livelihood for many people”.

The ripple effects of the MMM invasion have begun telling on the people. Not a few “investors” were reported to have either committed suicide or attempted such. For instance, one is the story of a man from Benue State, who was found to have ingested insecticide, having invested N300,000 meant for his wedding in the dicey scheme! From the survey that I recently conducted, many people seem to be affected by the loss but would rather prefer to remain silent rather than lament their ordeals while many would rather prefer to keep mute for the fear of being stigmatised. After all, they never told anyone before going into the scheme! That is usually the problem with those who fall victims to fraudsters. They hardly inform others they are deeply engrossed in such a deal until everything crumbles and danger becomes the inevitable.

Despite the ordeal happening now, it must be appreciated that people should be free to invest in whatever business interest they so desire. That is why I won’t be surprised that the MMM may not be the only active Ponzi scheme around. There is the likelihood that many of such programmes exist under various names and brands. Whenever people are committing their resources into such deals, others hardly know of such until things begin to unfold and they cry out of the untold hardship and negative consequences that may arise. It is the secret nature of the patronage of the Ponzi schemes that makes many innocent people to lose their head earned resources and savings, thereby increasing the level of poverty in the land.

As a way forward, regulatory agencies should do more by helping the citizens in beaming their searchlights on other schemes to verify what is happening to them before they become another source of national problem, source of worry and tragedy. The whole scenario bordering on how the MMM has been managed has shown that the economic problems that encourage people to look for money at all cost, is not peculiar to Nigeria alone. Governments should come together to see how common problems could be discussed with a view to finding sustainable alternative to Ponzi schemes that would add value to the real sectors of the economy through spending.

It is only hoped that by January, the scheme would come alive again as it has planned to do by offering another opportunity for investors to access their funds. If this becomes a reality, they should pull out. I won’t be surprised that in order to sustain their interest in the scheme, an additional accrual of over 30 per cent could be dangled to lure participants into keeping their keeping funds in the scheme and even put in more resources after January. I really think they should not be lured again, in case the opportunity represents itself. They should look for other means of making money despite the economic recession currently facing the country.

a big lesson for all is that people should learn to be open, as much as possible, to those they could trust. I kept wondering why a very close friend of mine of many years should now be crying wolf now after the bitter experience when I was never consulted before deciding to join and invest in the scheme ab initio. Government should do more sensitisation of the citizens on the dangers that could befall them whenever they are confronted with issues that concern financial intelligence and breach of public trust. It is only hoped that the MMM would afford its depositors another opportunity to have a rethink. It’s just a matter of days for that to be or not to be!

Kupoluyi wrote in from Federal University of Agriculture, Abeokuta adewalekupoluyi@yahoo.co.uk,@AdewaleKupoluyi

Niyi Akinnaso returns next week

Be the first to comment