Muhammad Sanusi II, the emir of Kano and former governor of the Central Bank of Nigeria (CBN), recently claimed that the CBN has been illegally funding the Muhammadu Buhari-led administration.

In his claims, Sanusi said “the CBN-FGN relationship is no longer independent. In fact, one could argue their relationship has become unhealthy.

“CBN claims on the FGN now tops N4.7 trillion — equal to almost 50% of the FGN’s total domestic debt. This is a clear violation of the Central Bank Act of 2007 (Section 38.2) which caps advances to the FGN at 5% of last year’s revenues. Has CBN become the government’s lender of last or first resort?”

Sanusi also asked questions as to whether CBN is a lender of “last resort” or “first resort”, asking why the bank is lending money to a federal government that has trillions in its treasury single account (TSA).

Following Sanusi’s allegations, the CBN said “it is rather unfortunate that some people have chosen to play to the gallery and to make statements to disparage those in leadership at this time in total insensitivity to the larger interests of the Nigerian economy”.

The bank went on to say “the seed of our current economic crisis was planted by the failure of those who occupied public office in the past,” apparently referring to Sanusi, who led the bank for four years.

Garba Shehu, who speaks on behalf of the president, also said Sanusi “doesn’t have his facts as far as those issues are concerned”.

Shehu went on to make some claims on the emir’s speech at the Savannah Centre for Diplomacy, Democracy and Development.

TheCable has taken time to fact-check the categorical claims made by the emir and Shehu as regards government lending, and what the law stipulates.

CLAIM: HAS FG OVERDRAWN ITS LIMIT?

According to Shehu, “that government has overdrawn its Central Consolidated Account” but “the overdrawing is within limits”.

“The overdraw does not exceed 1.5 trillion. It is incorrect to say, as he (Sanusi) did, that the account was overdrawn by 4.5 trillion”.

Sanusi, on the other hand, said the government has overdrawn its limits, and has violated section 38.2 of the CBN Act of 2007.

FACT: SHEHU HAD NO FACTS ON THE LAW

According to section 38, sub-section 1 and 2, of the CBN Act, “the Bank may grant temporary advances to the Federal Government in respect of temporary deficiency of budget revenue” and “the total amount of such advances outstanding shall not at any time exceed five per cent of the previous year’s actual revenue of the Federal Government”.

By law, the federal government can only take an advance of five percent (of its previous year’s revenue) to fund budget deficiencies. This means the federal government can only borrow five percent of what it made as retained revenue in 2015 to fund 2016 budget. Anything above the five percent is illegal.

The questions to then ask are: How much did the federal government make in revenue in 2015? How much is five percent of the amount made? And how much has the CBN lent the federal government?

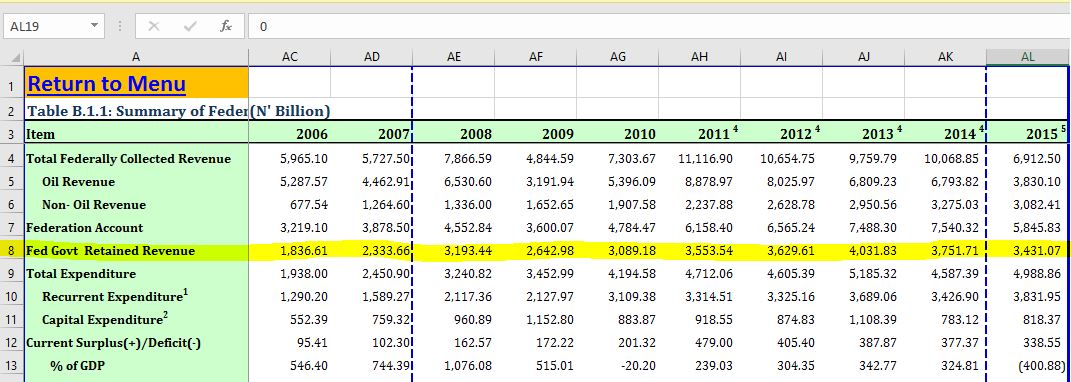

According to CBN statistical bulletin, available on the CBN website, the federal government retained revenue for 2015 was N3.431 trillion. Five percent of this is N171.55 billion.

This means that the government can only seek an advance of N171.55 billion from the CBN.

But according to CBN’s own data, mined from its statistical database, the CBN is seen to have lent as much as N4.7 trillion to the federal government in 2016.

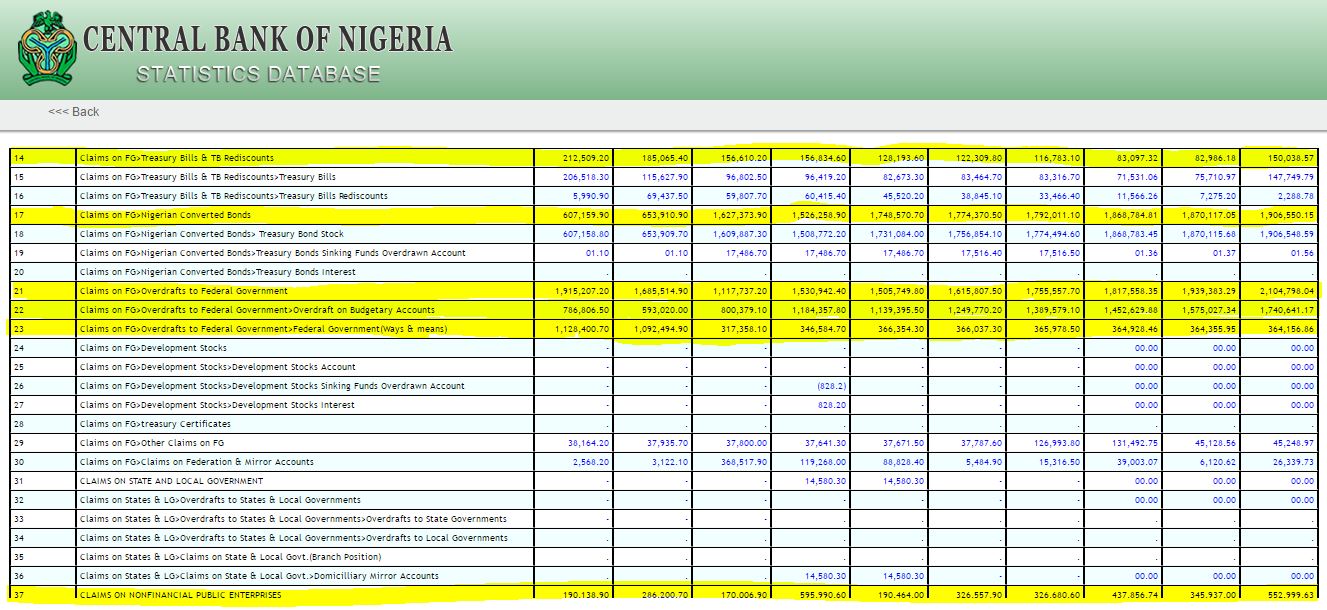

Sanusi’s presentation, as obtained from the Savannah Centre, highlighted government’s lending in terms “Treasury Bills & TB Rediscounts, Nigerian Converted Bonds, Overdrafts to Federal Government and Claims on Nonfinancial Public Enterprises”.

According to CBN’s data, the closing balance (lending) at the end of October 2016 amounts to N150 billion treasury bills, N1.906 trillion converted bonds, N2.104 trillion in overdrafts, and N553 billion to non-financial public enterprises (as highlighted above).

This brings government lending to N4.713 trillion, as against the N171.55 billion stipulated by law.

CONCLUSION

According to CBN revenue and lending data, and the CBN Act of 2007, the apex bank has actually been funding the Buhari administration above the legal limit.

END

As for something is wrong concerning

how this government is being run.

If this story is true, then there has to be a good reason why things have gone this way. Now the government have to explain their reasons to the people to avoid any misunderstanding with the public. They might feel they don’t need to explain anything but believe me they do.