The Central Bank of Nigeria (CBN) says it has provided additional forex to banks, as part of its efforts to alleviate the hardship experienced by Nigerians who need forex for school fees, medicals and personal travelling allowance.

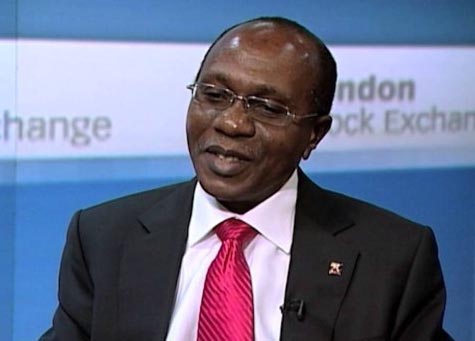

THISDAY reports that Isaac Okorafor, acting director, corporate communications of the apex bank, said this during a recent interview.

Okorafor also gave the assurance that the naira, which exchanges for N305 to a dollar at the interbank market and N517 at the parallel market, would regain its value as there have been improvement in local production.

The additional forex, the apex bank said, will be sold at 20 percent above the interbank rate.

“The Central Bank of Nigeria has taken a decision to directly fund banks with additional foreign exchange to be able to take care of some personal travel allowance, school fees and medical payments. With that, we have tried to set an exchange rate for those transactions at 20% above the interbank rate – that is, 20 per cent above the interbank rate that ranges between N305 and N315.

“The banks have been directed to sell to all the people that will come up for it and they actually have been directed to open up avenues at the airport so that they can deal with these demands.”

He gave the assurance that the naira would not plunge further adding that the shortage was due to reduced income for the country.

“The cause is obvious: we can’t earn enough again and we’re trying to rationalise and prioritise what we have at the moment so that it can meet the most basic needs of the country.”

Okorafor said that the rate of importation of goods and items that could be produced locally has reduced resulting in reduced pressure on the naira.

“Although people are trying to use all kinds of machinations and tricks to bring us to that (N1000/$1), it won’t happen because the economy itself, local production is picking up and the rate at which people import useless things is coming down.

I am very certain the naira is going to come back, gradually.”

END

Be the first to comment