…it appears that we are so obsessed with the top that we have lost sight of the bottom and possible lessons and opportunities that might be found there. We have taken so much risk with the top. Why not try something out with those at the bottom? The textbook does not say so?

Economics is no exact science, we are told. But it does appear that to a school of thought whose hands have been more evident in shaping the economic direction of Nigeria, over the years, managing the economy is one esoteric science that only a coterie of experts are supposed to have an understanding of. One over which they enjoy a monopoly of knowledge. Yet, in the hands of this school, there has only been more of movement with little motion. Yet, when things go wrong, as they have often done, they shift the blame and place it on the patient. They led us on to the path of devaluation, promised foreign direct investment in return. We opened the window and those with a pile of forex to ship out have simply done so leaving us empty-handed. They now say it is our fault – we didn’t do it early enough. They now remember that the fundamentals are not in place. As if we did not say so then, in calling for caution, in throwing the naira under the bus.

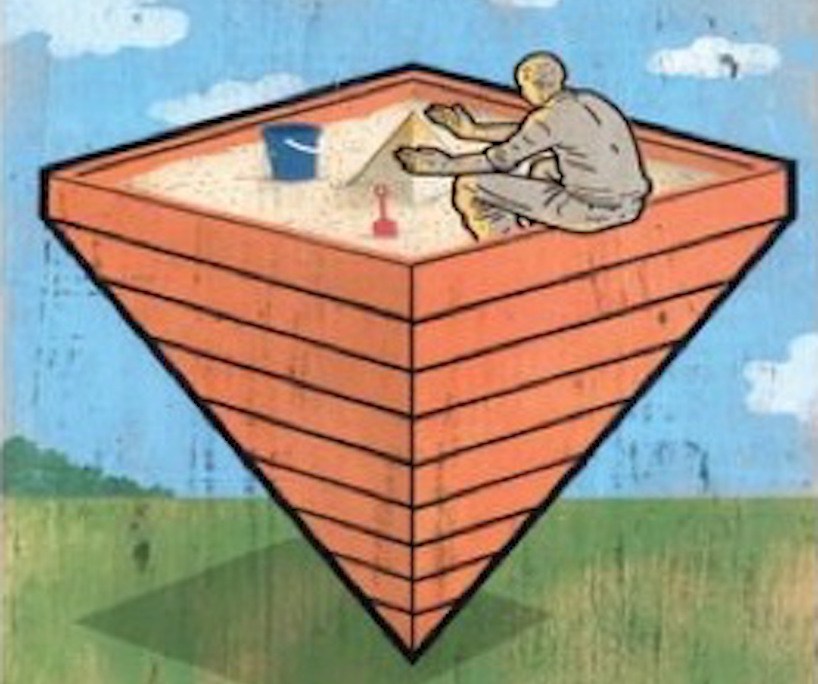

Could it be that, as some of us have argued, we do not really have the correct diagnosis of the problem? If we have the wrong diagnosis, how then can we have the right prescriptions? Is it not possible that what ails the system, in fact, lies beyond what some fiscal and monetary mumbo-jumbo fixes? I am only a road-side analyst, but I have long held that the under-belly of a lot of what is wrong with us bears little or no resemblance with the super-structure. If that is the case, we will realise that unless we dig deep to address the warped socio-psychological fundamentals aided and abetted by a dysfunctional legal and political framework, we might only be beating about the bush, seeking solutions in textbooks written for a scenario different from ours.

The challenge, over the years, has been that when the attention of our experts is drawn to the ontological peculiarities of life here, they seem to assume they do not matter. They shut other views up and simply open another page in their book of jaded concepts to try another trick on the guinea-pig. While there are out-of-the-box ideas out there requiring a bottom-up approach, they fastidiously hold on to different threads all built on the trickle-down philosophy, whose outcomes are already compromised by factors not envisaged by the textbook. They seem to think it is all about ramming down one policy down the throats, when in fact, some of those drafting policies are active participants in the sabotage to ensure they never work, as intended.

The manifestations of that disconnect between policy and outcomes are all over us, yet we refuse to learn from them. Even with the numerous interventions in the financial system, the rigging machinery embedded therein has been largely left intact. The k-leg in the system invariably finds its way to pollute the waters of programmes and policies that emanate from the public sector. The same elements who owe the banks, who occupy top places on the AMCON list of debtors, are the same ones who bought up public enterprises at give-away prices. They are the same ones who benefited from one intervention fund or the other. The same people who rigged the banks, as Directors and Borrowers, are active players in every other scheme. Some who got generous mentions in the subsidy scam are among those who received licences to generate or distribute electricity. The banks are exposed to these people on multiple fronts, hence the high ratio of non-performing loans. That is somehow linked to the problem we are faced with in the electricity sector. The banks, of course, know those behind the veil, and are finally holding back further funding of the new toys and acquisitions of the usual suspects, hence many of the DISCOs are dancing in one spot, shorn of wings to fly, as owners will not inject cash into the business. So, privatisation that was supposed to be one quick-fix has largely become a curse. The ruse it was from foundation has only become more evident with time.

Roll the dice several times, the same actors come on top. The game had been pre-rigged and programmed to throw up the same results. At the core of it all is a rotten banking system. It is the same banks that gave money out to mop up their own shares and artificially drive up prices that led to the crash of the capital market. The same ones where insider abuse reign and Director-related exposures are the norm. At the centre of all that is wrong with our system, you find the banks. So is it that whatever initiative or policy is pushed out is simply hijacked for compromise by the same elements, who connive with the top guys in banking, to ensure that it never achieves stated objectives. The level of bare-faced criminality undertaken by the banks on behalf of equally crooked clients is simply mind-boggling. The Money Laundering Act is there, the KYC requirements are there, observed by the banks for only for those who do not matter. If you ask me how the patient one was able to open and managed the dollar-denominated accounts with such volume of transaction without eyebrows raised by the banks and the NFIU, who do I ask? If you say such could not have been done without the active co-operation and supervision of the top guys in those banks, who am I to contest it? Many of the banks are actively working now to cover the tracks laid bare by the introduction of the BVN. The senior lawyers are busy seeking loopholes in the laws to help the rogues make away with the loot. They are looking at the judiciary seeking who and how to compromise the system to get away with the robbery on the public purse.

It is mostly those in the value-added ventures, those genuinely involved in manufacturing, professionals on the fringes of the service economy, the semi-formal world of entrepreneurs and the hoi-polloi in the informal sector that are feeling the pinch of a lack of liquidity in the right hands.

That is the reason why we are where we are. How do you frame whatever monetary and fiscal fixes when there are so many leaks in the system? So, when we argue that the problem is beyond some quick-fix policy and Midas touch of one Wizard, this is what we mean. You cannot even tell for sure what is where, who has what, and where it is. The books are so cooked up that they throw spanners in the plans even before they leave the desk. So much needs to be fixed in terms of regulation to force upon the system a hard reset. Fix banking and a lot of the other things will simply fall in place.

The popular sentiment out there, echoed by some highly cerebral and dutiful Senators, is that there is a squeeze in the system on account of the Treasury Single Account (TSA) policy implemented by the government. Some even go as far as citing the policy under which public funds were pooled into a basket to give managers of the economy a window to view and a platform to manage it as the cause of the recession. But you might ask: How much lending to the real sector did the banks do before the implementation of the TSA policy?

Banks might not be lending, but how much is that due to the TSA policy? When was it that our Banks ever supported the real sector? When they choose to look at the real sector, it is under conditions that defy logic. The bulk of their exposure is to the same elements whose names and aliases dot the list of chronic debtors to banks and AMCON. There is no liquidity, they say, yet the Central Bank has been battling for ages with excess liquidity in the system. Back in the day, the CBN’s weapon was the stabilisation security randomly issued to mop up excess liquidity in the system and keep the inflation rate under control. These days, the Treasury bills are routinely issued to raise funds for the public sector and mop up excess liquidity. The CBN is mopping up N952 billion from the system in the last quarter of this year. Yet, someone says there is no liquidity in the system.

The problem we have is not that of liquidity in the system but illiquidity in the sectors that really need the infusion of capital. And that has absolutely nothing to do with the TSA. It is mostly those in the value-added ventures, those genuinely involved in manufacturing, professionals on the fringes of the service economy, the semi-formal world of entrepreneurs and the hoi-polloi in the informal sector that are feeling the pinch of a lack of liquidity in the right hands. And that has little or nothing to do with the shenanigans in the banking industry, as the banks have hardly ever looked in their direction. There has never been any real lending to these ones who need it the most. And that is simply because the system was not configured to lend to the real sector.

Indeed, the squeeze on the corruption industry has its own consequences on cash-flow across many sectors, but that can hardly be helped as an economy built on the quicksand of proceeds of corruption is only a false one and is definitely not sustainable. Even in the face of much blackmail, it is suicidal to pull back on the squeeze on corruption. There are too many holes in the basket that many are exploring to rig they system. Fixing the economy cannot be done in isolation of a systemic overhaul, deeply rooted in our way of life, and the insatiable greed of the power elite.

…we need out-of-the-box-thinking around initiatives that can empower the most vulnerable who have learnt to survive without support from government to engender all-inclusive development. I have canvassed a link between the conditional cash-transfer scheme and the health insurance programme. I have also proposed an internship scheme linked to the country’s tax system…

The question is: Can we fix the economy simply by way of fiscal and monetary interventions without first fixing the fundamentals that shape the way we run the system? Is our economy in the state it is because of our mind-set or is our mind-set the way it is because of the state of the economy? Is our problem that of expertise and policy or one founded on the wrong value system making nonsense of even the best of policies? Are we where we are simply on account of wrong-headed policies or is it more to do with our hard-headed thinking and penchant for poor choices, even in the little things?

Our choices are not inspiring. We are held back by the same tired principles that place premium on free-wheeling in a system already rigged, expecting the market to fix what is being controlled by deliberate, yet unseen hands. Even this government has become shy with the N500 billion social investment programmes it had boldly rolled out as part of the 2016 budget. A first tranche of N420 billion was said to have been released as capital vote, with another N350 billion only recently released, with N60 billion said to have cash-backed for the social investment programmes. It takes adversity to know what we consider our priority. It is easy to release N350 billion to a few contractors, expecting the elusive trickle-down effect to kick in, and when the projection falls flat, approve a second tranche of N350 billion. Yet, it is difficult to trust the bottom of the pyramid with a substantial injection of the N500 billion that had been projected to generate one million jobs this year, provide financial support for up to one million vulnerable beneficiaries, and complement the enterprise programme – which will target up to one million market women; 400,000 artisans; and 200,000 agricultural workers, nationwide and create job opportunities for 500,000 teachers and 100,000 artisans across the nation.

We are not bold to proceed with the Conditional Cash transfer scheme, even when it has been tested with remarkable success across countries in Europe, Latin America and the USA, simply because the textbook we are condemned to reading, is not a believer in the wisdom of catalysing economic activities from the bottom. We are holding back from the one-meal-a-day scheme, in spite of the benefits outlined, because the dominant school of thought has been reluctant about it and cannot reconcile it with what it believes should be the priority of government. So, it is easy push it down the priority list in the face of ‘dwindling’ revenue.

Yet, we need out-of-the-box-thinking around initiatives that can empower the most vulnerable who have learnt to survive without support from government to engender all-inclusive development. I have canvassed a link between the conditional cash-transfer scheme and the health insurance programme. I have also proposed an internship scheme linked to the country’s tax system that, at once, pulls in the youth segment into the workforce, draws in the semi-formal sector into the tax net, while promoting entrepreneurship, innovation and greater productivity in the private sector.

Can you imagine what N70 billion (N10 billion for Lagos and N6 billion for each of the 6 geo-political zones) put in the hands of select Micro-Finance Banks for the purpose of administering to the unbanked/underbanked segment under a CCT scheme, would do for the system? One of these MFBs I know has a working template that guarantees over 90 percent recovery of what is advanced to its customers. Can we not work with the template being used? But it appears that we are so obsessed with the top that we have lost sight of the bottom and possible lessons and opportunities that might be found there. We have taken so much risk with the top. Why not try something out with those at the bottom? The textbook does not say so? Well.

Simbo Olorunfemi works for Hoofbeatdotcom, a Nigerian Communications Consultancy. Twitter: @simboolorunfemi

END

Be the first to comment