The Bank of Industry (BoI) has announced a profit after tax of N12 billion and an exceptional income of N37 billion from the disposal of WAMCO shares for the financial year The bank, which hinged its improved profitability on operational efficiency during the financial year, also disbursed loans worth N83.5 billion to 776 enterprises (47 Large Enterprises and 729 (SMEs), during the year under review.

A breakdown of the bank’s earnings for the year showed that the bank also recorded an unaudited Profit Before Tax of N50.4billion for the year ended December 31, 2015, representing an operating profit of N12 billion up by 100 per cent from N6 billion achieved in 2014.

The bank explained that loans to large enterprises went to companies in Nigeria’s real sectors such as agro-processing, food processing, solid minerals, gas value-chain, engineering & technology and light manufacturing.

According to the bank, the loans for small and medium enterprises were disbursed to companies in the various SME clusters such as fruit juice, cassava processing, fish farming, bakery, furniture, among others, adding that the loans resulted in the creation of over 90,000 jobs in 2015.

“The bank’s operating results are underpinned by strong growth in the bank’s balance sheet, improvement in the bank’s non-performing loan ratio from 18 per cent in May 2014 to four per cent in December 2015, and efficient cost management which saw the growth in operating expenses limited to only 12 per cent in 2015”, a statement from the bank read.

“I feel very proud of what we achieved in 2015. We made significant developmental impact through the disbursement of over N83 billion to nearly one thousand enterprises. We commissioned two of the six rural solar micro grid projects we financed. We introduced many products and programmes to support the SME Ecosystem.

“We obtained our ISO 9001:2008 Quality Management System Certification. We also secured our first ever international rating from Fitch Ratings (BB-) and Moody’s (Ba3), moving the Bank closer to global best practices.

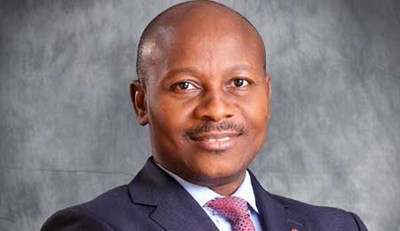

“We are grateful to all our development stakeholders for their continuing support especially the Central Bank of Nigeria and our 200 Business Development Service Providers (BDSPs)”, the statement quoted BoI’s outgone Managing Director, Rasheed Olaoluwa to have said.

Be the first to comment